Robust Holiday For The Nimble

Consumer spending is in large part fueling growth in the U.S. economy.

The National Retail Federation (NRF), in its annual holiday forecast conducted by Prosper Insights & Analytics, estimates that retail sales overall, from November through December will be up about 3.8 to 4.2 percent over 2018, totaling between $727.9 and $730.7 billion.

In fact, Deloitte, the London-based financial advisor is more bullish in its forecast predicting U.S. holiday retail sales will likely rise 4.5 to 5 percent in 2019, exceeding $1 trillion in sales from November to January. Even Kiplinger, publisher of business forecasts, calls for a 5.4 percent growth prediction.

Consumers are “in good financial shape and willing to spend a little more on gifts for the special people in their lives”, describes Matthew Shay, NRF President and CEO. He underscores that consumer spending is in large part fueling growth in the U.S. economy.

Consumers are “in good financial shape and willing to spend a little more on gifts for the special people in their lives”, describes Matthew Shay, NRF President and CEO. He underscores that consumer spending is in large part fueling growth in the U.S. economy.

Daniel Bachman, Deloitte’s U.S. economic forecaster, cites a healthy labor market — with near record-low unemployment rates and continued monthly job creation — as encouraging people to spend more during the holiday season. “The economy is still growing, albeit at a slower rate,” he says. “We continue to see consumer confidence elevated, which helps boost holiday spending.”

Despite the Thanksgiving to Christmas shopping period down by six days, with 26 days the shortest number for the season, the NRF does not expect a decline in total spending. The majority of consumers, it finds consistently in recent years, are shopping before and throughout the month of November.

Convenient & Across Channel

Paramount for shoppers is convenience, which Rod Sides, vice chairman, Deloitte LLP and US calls the new retail currency. “Retailers who offer seamless experiences, have products available, and can deliver items more quickly than ever are most likely to win this holiday season.”

Important to shoppers are options like free shipping, same-day delivery, and buy online pick up in store, finds NRF research, as consumers plan to shop across channels, with more than half doing so online.

The NRF expects online and other non-store sales included in the total, to grow 11 to 14 percent, yielding between  $162.6 and $166.9 billion, up from $146.5 billion in 2018. Even more optimistic, Deloitte forecasts e-commerce sales will grow 14 to 18 percent year-over-year, compared to sales increasing by just over 11 percent in 2018. This robust growth will likely yield e-commerce holiday sales between $144 and $149 billion. Kiplinger cites 21 percent growth.

$162.6 and $166.9 billion, up from $146.5 billion in 2018. Even more optimistic, Deloitte forecasts e-commerce sales will grow 14 to 18 percent year-over-year, compared to sales increasing by just over 11 percent in 2018. This robust growth will likely yield e-commerce holiday sales between $144 and $149 billion. Kiplinger cites 21 percent growth.

The digital landscape will keep changing, and social channels are set for another big shift, anticipates marketing consultant, Andrea Hill, of the Chicago-based Hill Management Group. “Consumers have discovered lots of new ways to buy jewelry. Online, yes, But also thousands of jewelry studio artists and bench jewelers and private jewelers that don’t work through the traditional specialty retail store model, but find their customers through social media.”

Many non-traditional sellers of jewelry have been successful because they’re willing to do the work of connecting in more meaningful ways digitally with consumers, says Hill, something traditional jewelry retailers have been reluctant to get good at. Much of the retail social media she sees is still being handled by cookie-cutter agency feeds, although she’s glad the industry is finally talking more seriously about getting up to speed.

“There’s a lot of jewelry purchased out there, we just need to be nimble enough to react to the changing landscape,” says Jeffrey Cohen, vice-president of sales, KGS Jewels, New York. “We have to adjust our way of thinking and embrace the evolving buying patterns and habits of our end users.”

Relevant Experiences

An advocate for virtual inventory and digital marketing solutions to jewelers since 2003, W.R. Cobb Company of East Providence, Rhode Island finds that the successful retailers are using sales tools like 3D visuals and 360-degree view product videos to mimic the in-store experience online, and tablet kiosks for information, virtual inventory, and custom design options that bring online in store.

Jewelers offering experiences relevant to people that love jewelry and gems are capturing sales, says Hill, who references the comeback of small bookstores In the age of Amazon and Alibaba, by offering experiences for book lovers.

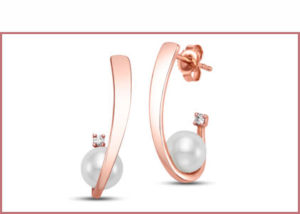

Keeping in mind, as the research shows, that consumers want to engage and pre-shop online, social media is the ideal channel for jewelers to help shoppers find the perfect gift, says Dana Cali for the New York pearl house Mastoloni.

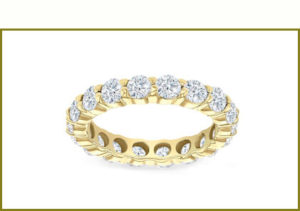

“Consumers look to social media for gift inspiration, advice, ideas,” reminds Cali. “They’re looking for guidance as to what experts – aka jewelers and jewelry brands – deem the perfect gift or season’s must-have.” She underscores that jewelry is considered among the most sentimental gifts to give and receive. About a quarter of consumers rate jewelry a top gift for the holidays, finds NRF.

“Consumers look to social media for gift inspiration, advice, ideas,” reminds Cali. “They’re looking for guidance as to what experts – aka jewelers and jewelry brands – deem the perfect gift or season’s must-have.” She underscores that jewelry is considered among the most sentimental gifts to give and receive. About a quarter of consumers rate jewelry a top gift for the holidays, finds NRF.

Outreach, like creating a holiday gift guide on Pinterest with boards designed by style, price, and person, helps jewelers to connect with consumers who are ready and able to buy says Cali. The added bonus is the variety of analytics offered by each platform to see what’s working and what’s not to fine-tune your messaging.