New Generation Of Consumers

Because the customer paradigm has shifted from men to women, jewelry manufacturers and retailers must understand the female market.

The landscape of the jewelry industry has changed dramatically, with only 48 percent of adults married today in the United States, as compared to 78 percent in the 1950s, finds She-conomy, specializing in marketing to women.

Market research finds that 51 percent of female consumers buy jewelry for themselves, 14 percent buy for their partner/spouse, and 17 percent make purchases with their significant other.

“This means that women are purchasing and influencing the purchases of 81 percent of all jewelry sales,” reports Stephanie Holland, author and founder of She-conomy, Birmingham, Alabama, who was a recent panelist on a Plumb Club webinar about women consumers.

“This means that women are purchasing and influencing the purchases of 81 percent of all jewelry sales,” reports Stephanie Holland, author and founder of She-conomy, Birmingham, Alabama, who was a recent panelist on a Plumb Club webinar about women consumers.

Because the customer paradigm has shifted from men to women, jewelry manufacturers and retailers must understand the female market. “The faces of the new jewelry consumer are now multicultural, self-purchasing females and the next generation of bridal,” explains Holland. “The most powerful of these are the self-purchasing female.”

Uplift Diversity

The challenge is that most jewelry stores, as well as manufacturers are male-owned and operated,” says Holland. “This is further exacerbated by the fact that advertising is also a male dominated industry. When you have 89 percent of the advertising creative directors being men, yet 81 percent of your consumers being women, there is undoubtedly going to be a disconnect.”

She-conomy finds that 91 percent of women feel advertisers don’t connect with them, and just about three quarters are ready to walk away from brands that don’t listen to them.

Want to attract more women, hire and uplift more women into leadership roles. The big buzzwords in business are inclusion and diversity (I&D). According to a McKinsey & Co. report released January 2018, the relationship between diversity and business performance is strong.

inclusion and diversity (I&D). According to a McKinsey & Co. report released January 2018, the relationship between diversity and business performance is strong.

Companies in the top-quartile for gender diversity on executive teams were 21 percent more likely to outperform on profitability, and 27 percent more likely to have superior value creation.

Marketing consultant Andrea Hill of the Chicago-based Hill Management Group, also a presenter in The Plumb Club webinar, says jewelry stores are still designed around how men buy. “As an industry we have focused on diamonds, the 4Cs, and selling by certificate — techniques that work when selling to men, when the social construct said they had to buy a big engagement ring. Now, that construct has been diminished.”

It’s less about the Four Cs and price, and more about how jewelry makes her feel, says Valerie Fletcher, vice president of design and product development for the NYC-based Original Designs Inc. (ODI). “From the advertising to the retail experience, it’s crucial to understand that women shop and relate to jewelry differently than men.”

Because the industry is male dominated, Holland encourages companies to be cognizant that they are not simply talking to themselves, what they think needs to be said, as opposed to talking to their customers.

Making Connections

To connect effectively with a woman, you must know what motivates her, says Holland. Research reveals that a woman’s top motivations for buying herself jewelry are to be able to get exactly what she wants; reward herself for a milestone reached; commemorate a special memory; or “just because”.

Be it bridal or fashion, a woman wants to wear jewelry that says something about her, says Fletcher. “As a self-purchasing woman, I don’t want to buy something generic. Many women have been given a heart pendant, tennis bracelet and diamond studs because they’re ‘safe’ purchases any woman would love to receive as a gift. We want to choose something unique and personal — shoulder dusters or ear climbers instead of studs or hoops.”

Be it bridal or fashion, a woman wants to wear jewelry that says something about her, says Fletcher. “As a self-purchasing woman, I don’t want to buy something generic. Many women have been given a heart pendant, tennis bracelet and diamond studs because they’re ‘safe’ purchases any woman would love to receive as a gift. We want to choose something unique and personal — shoulder dusters or ear climbers instead of studs or hoops.”

Hill says that for most women jewelry is about life, love, fashion, or personal accomplishment. “Show your female shopper how the jewelry fits with her life,” she says. “Market the context, not the thing.” Men are more interested in the visuals of an item, and anything performance or status-related about it, she cites. Women relate to the ideas and relationships associated with the product.

An important conversation jewelers can be having with women, says Fletcher, is how jewelry works together. “Stackable bangles and rings, and layering necklaces can be collected and worn in different combinations,” says Fletcher. “Fine jewelry should be an everyday luxury that we treat ourselves to, and collect, as we do with designer shoes and bags!”

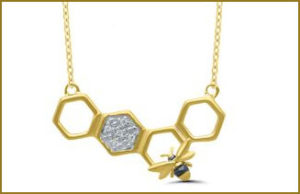

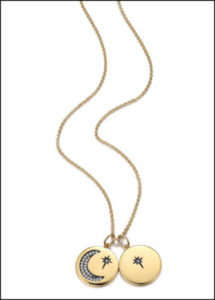

There are some great styles that speak to this in The Plumb Club’s Radiant Universe Collection, highlighting pieces created by the group’s manufacturing members. Brands like Benchmark created white, rose and yellow gold stacker bands with sun-inspired motif. MWI’s latest Eloquence Natural Collection has wonderful moon and stars themed stackable rings in natural fancy color diamonds and white diamonds in three different colors of gold. And, Prime Art & Jewel introduced celestial-inspired pendant and charm style necklaces in gold with diamond accents that are made for layering.

Growth Opportunities

A recent De Beers study sees the self-purchase trend as offering one of the clearest opportunities for future growth in the diamond and jewelry industry. The research suggests jewelers carry a selection of diamond jewelry that appeals to women self-purchasers. “This should become as much of a focus for jewelers, as bridal and other relationship-related jewelry,” says Robin Gandhi for Aneri Jewels and Laxmi Diamonds in New York City.

The Diamond Producers Association (DPA) will continue promoting its latest Real is a Diamond campaign this fall,  “For Me, From Me”, focused on women self-purchase. It celebrates a diversity of stories around women who would buy classic, stylish diamond jewelry for themselves.

“For Me, From Me”, focused on women self-purchase. It celebrates a diversity of stories around women who would buy classic, stylish diamond jewelry for themselves.

Samuel Sandberg, Chairman of the New York City-based A. Jaffe advocates jewelers to be more aggressive on social media. “It’s all digital now, very visual platforms like Instagram, Pinterest and Facebook are important,” he says, “Jewelers can micro target, micro market their message.” And, retailers don’t have to reinvent the wheel, with plenty of content from groups like DPA and vendor/brand partners to get in on and push the conversation.