Diamond Directions

America’s love of diamonds isn’t by accident. Mid-20th century marketing efforts from De Beers, including Its “A Diamond Is Forever” campaign and the two-months’ salary guideline for purchasing an engagement ring, have ensured that more than half of all fine jewelry sold in the U.S. features diamonds. Yet as popular as diamonds are, they’re not immune from challenges on the world stage. Two wars—Russia-Ukraine and Israel-Hamas—are affecting how manufacturers obtain and sell the gems, while lab-grown diamond manufacturing is the ultimate market disruptor, causing prices of both mined and lab-made diamonds to fluctuate wildly as of late. Below, we unpack the facts about these situations and offer a snapshot of the newest diamond jewels available to collectors.

Diamond Difficulties?

Two major diamond centers—Russia and Israel—are in the grip of turmoil for different reasons that are equally disturbing to international jewelry markets. Sanctions against Russia and a looming ban on Russian-origin diamonds exceeding 1 carat in size have forced firms to scrutinize their diamond sourcing while cut and polished diamonds out of Israel have sometimes faced delays.

Diamond imports from Russia have been banned in the U.S. since 2022, though those cut and polished in other countries have still gotten through because of the substantial transformation clause set in place by the government. The goal of that measure was to give time to businesses to find new sources.

Recent plans from industry groups aim to carry out the wishes of nations belonging to the Group of Seven (G7), which are determined to ban Russian diamonds entirely. And in an early December meeting, G7 members revealed they would introduce “import restrictions on non-industrial diamonds, mined, processed, or produced in Russia, by January 1, 2024, followed by more phased restrictions on the import of Russian diamonds processed in third countries targeting March 1, 2024.”

Further, G7 members who import large volumes of rough diamonds must establish “a robust traceability-based verification and certification mechanism for rough diamonds within the G7 by September 1, 2024.”

Some big players in U.S. jewelry manufacturing have been fielding compliance inquiries from select clients.

“Many of our customers are insisting on stones which are not of Russian origin,” says Lachish Awad, manager of customer service at Jasani.

As a sightholder, KGS Jewels obtains most of its diamonds from De Beers’ sources, including a new manufacturing facility in Botswana. Richard Bachu, vice president of sales, says the Russia issue isn’t really affecting KGS’s business, though questions do periodically arise from clients. “They ask if we are in compliance to make sure they are protected,” he says.

For Shefi Diamonds, the Russia-origin question is even less of an issue. “The majority of the diamonds we use are sourced from Australia and then cut in India,” explains Surbhi Jain, head of marketing. “Therefore, the potential impact on our operations is somewhat mitigated by the diversified nature of our supply chain.”

And given that Novell “isn’t in the center stone business,” says sales manager Rick Mulholland—Novell makes wedding bands—both wars have had minimal impact on operations. Similarly, Awad, who sources from Israel, a hub for cutting important stones, is relieved that his business, too, hasn’t (yet) been affected.

According to some interviewees, bigger issues than these wars—if you can believe it—exist in pricing and driving home the desirability of diamonds.

“The uncertainty surrounding diamond prices and the upward trend in gold prices may pose challenges for our business,” says Shefi Diamonds’ Jain.

For Sandeep Shah, president of Sandeep Diamond, the dearth of consumer marketing to inspire diamond desire is a larger problem.

“There is a lack of creation of desire from the miners, retailers, and wholesaler—all of the stakeholders in the diamond and jewelry industry,” he says. “[The industry] is alienating consumers by not doing enough to attract them to stores to buy diamond jewelry—mined or lab grown.”

Trending Designs

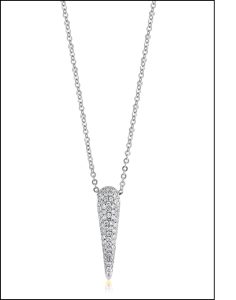

Complicated pricing and origin issues aside, customers seek out stores for fresh diamond jewelry looks. Manufacturers and supplier partners rarely disappoint in this arena, turning out many an innovative diamond-encrusted design. And based on insights just shared by The Plumb Club community, next season’s styles are already shaping up to be memorable ones.

For starters, manufacturers who take the annual trek to the VicenzaOro fair in Italy in January routinely find artistry and craftsmanship from the country inspiring. Both Jasani and KGS Jewels sent teams to the fair in January 2023 to see the newness. Standouts included textured collections—“Textures were in the majority of designs,” says Lachish Awad, Jasani’s manager of customer service—and bezel-set diamonds as well as initial pendants. KGS’s Richard Bachu, vice president of sales, recalls the importance of rope and beaded designs in yellow gold, which he expects retailers to embrace in 2024.

As far as motifs, insects are still trending, as are geometric shapes, minimalist styles, spiritual influences, and flora and animals. Valerie Fletcher, vice president of design and product development at ODI, is debuting a CoExist collection for 2024 that includes “universal symbols of peace, enlightenment, and balance along with religious icons,” she says.

She didn’t need to look far for inspiration—simply turning on the news was reason enough to create this inspiring collection.

“The designs are not only about personal expression, but also symbols of connection, commonality, and community,” she adds.

At KGS, ladybugs and dragonflies are in favor, but not this winged creature: the butterfly. It’s been trending heavily for some time now, so a break is in order. “We’re going to stay away from them,” Bachu notes.

And while not a trend, something his firm will explore is event-driven collections. Say, for Valentine’s Day, Mother’s Day, Father’s Day, and the like. Options include diamond bracelets for Mom, diamond pendants for sweethearts, and diamond cufflinks for Dad, among other possibilities.

“We want to develop collections that directly speak to consumers on these occasions,” he says. “While we’re making jewelry all year round, customers are buying for those specific times.”

Retailer and end user feedback drive other decisions. Based on this input at Ostbye, Sparkle Lane was born. It’s a diamond-set sterling silver line of whimsical yet classic touches like fluted accents. “We worked with a few of our top retailers and created this based on their suggestions,” observes Theresa Namie, merchandise manager.

Other top-of-mind design trends include bold gold, diamond hoops, signet rings, and medallion-style pendants. In the gender-neutral department, styling is masculine but smaller than men’s pieces and includes dog tags, chunky link bracelets, and huggie earrings.

Prices, too, have an influence on collection directions. For example, the decreasing prices of mined and lab-grown diamonds are causing manufacturers like Jasani’s Awad to lower their diamond jewelry prices. “Corrections are also in process for past collections,” he says.

And with the price of gold increasing, daintier styles are inevitable. Plus, platinum prices have never been so attractive—especially when compared to gold. That’s why ODI is answering their retailer’s call for classic platinum designs with mined diamonds (think hearts, crosses, and anniversary bands among other styles).

Another category that’s trending for the manufacturer? Luxury silver and diamond pieces like Cuban links pavéd in rocks.

Finally, with lab-grown diamond prices in a freefall, the relative calm of the mined diamond space—minus a less-triggering price drop phenomenon—presents an opportunity for wedding jewelry maker Novell. Sales manager Rick Mulholland points to its Diamond Delite Collection of machine-set diamond numbers, with appealing styling and the intrigue of the natural diamond story.

“Each diamond carries a unique narrative, often born from a remote mining location, and can be passed down through generations,” he says. “This rich history and heritage can significantly elevate the value of a natural diamond.”

Lab Grown Landscape

Prices are fluctuating in the diamond market for both mined and lab-growns. As awareness of man-made diamonds spreads and intrigues consumers, availability and better qualities have mushroomed, spreading faster through the market than a California wildfire. This scenario has led to drastic lab-grown price drops, as typically happens with the evolution of any new technology and paved the way for a decrease in mined-diamond desire among consumers, according to some manufacturers. Once shoppers learned that they could spend less for a bigger, more beautiful lab-grown diamond, prices on mined diamonds dropped, too.

To Sandeep Shah, president of Sandeep Diamond, the price of mined diamonds is inconsequential. The bigger issue, he says, is diminished demand at the retail level for mined diamonds “coupled with the cannibalization of mined-diamond demand by lab-growns,” he says.

Others agree, including David Gaynes, vice president of sales at Indigo Jewelry, and Surbhi Jain, head of marketing at Shefi Diamonds.

“The emergence and growth of the lab-grown diamond sector has introduced a level of instability to the overall diamond market,” says Jain.

KGS’ Jewels’ Richard Bachu, vice president of sales, has a firm grasp of the mined-versus-lab-grown landscape. Lab-growns give consumers a bigger bang for their buck, and retailers can make a healthy profit. And the mall merchants who stock his lab-grown diamond jewelry are seeing twentysomething shoppers coming into stores to buy.

“They normally shop on Blue Nile, James Allen, or Brilliant Earth, but they’re going into mall jewelers now because of lab-growns,” observes Bachu. “A consumer can get a 2 ct. lab-grown for the price of a small natural; they’re not thinking about what it will be worth in two years. Older customers love lab-growns because they can buy a ring and still take a trip.”

Shah agrees. “This is a consumer-driven business,” he says. “Clients dictate what sells.”

As far as pricing, there’s no doubt that lab-growns and jewelry set with them have dropped, but their “retail prices have not dropped as much as wholesale prices on a percentage basis,” says Gaynes.

Jeffrey Cohen, president of Craft Lab Grown Diamonds, agrees. “Over the next 12–18 months, I expect the gap between wholesale and retail prices to shrink, meaning we will see significant price decreases at the retail level,” he says.

In terms of volume sold, that situation is a different story, says Lachish Awad, manager of customer service at Jasani. “While sales of mined diamond jewelry have fallen, sales of lab-grown diamonds have increased,” he says.

Because of this volatility, manufacturers like Ostbye are leaning more into mined diamond designs.

“It’s easier to maintain the pricing for our retailers,” says Theresa Namie, merchandise manager. “Price is our biggest factor, as it fluctuates so much, making it harder for the retailer to invest in lab-grown diamonds.”

ODI, too, is sticking with naturals. First, the firm believes in the intrinsic value of mined diamonds and their value to source communities when responsibly obtained. Second, ODI wants to ensure that the consumer has the best information available to make an informed purchasing decision.

Cohen, a supporter of both mined and natural diamonds, knows there’s a place for both.

“It has always been our strategy to sell either mined or lab grown based upon each’s unique selling proposition and strengths,” he says. “There are great opportunities available for both, as long as approached the ‘right’ way.”