Positive Holiday, Hopeful New Year

Being proactive and ready to be reactive is undoubtedly the strategy for businesses wishing to succeed in the current environment and beyond.

The National Retail Federation (NRF) forecasts that holiday sales during November and December will increase between 3.6 percent and 5.2 percent over 2019 to reach a total $755 billion to $767 billion. The numbers compare with a 4 percent increase to $729 billion in 2019, and an average holiday sales increase of 3.5 percent over the past five years.

This figure also includes online and other non-store holiday sales, which the NRF expects will increase between 20 percent and 30 percent for the season to $202 billion and $218 billion, up from $169 billion in 2019.

Data from the NPD Group reveals that jewelry sales in particular, which were down some 30 percent through the summer, have recovered in recent months, with the holidays expected to give jewelers a big lift. About 30 percent of annual jewelry sales typically are made in November and December, according to historic data from NPD, providing jewelers the chance to get back on track this holiday season for the year.

Expectations for 2021 remain a mixed bag of uncertainty and cautious optimism. Bain & Company reports in its latest Luxury Study that it does not expect the market to return to 2019 levels until at least late 2022, although it does expect 10 percent to 19 percent growth for the personal luxury goods market in 2021.

The personal luxury goods market — which includes fashion, jewelry, watches and beauty — contracted for the first time since 2009, Bain reports, falling by 23 percent to $257 billion. In question for 2021 are the macroeconomic conditions, the evolution of COVID-19, the speed of return to travel globally, and the resilience and confidence of consumers.

Steady Sales Since August

Business at retail for August, September and October exceeded, in some cases by double digits, over 2019, shares Michael Lerche, President and COO of Goldstar, the New York-based diamond jewelry manufacturer, echoing what many vendors in The Plumb Club have been reporting.

“This resulted in additional orders for this fall, and although we cannot make back what we lost from March to June,” says Lerche, “our year will not be as bad as we thought it would be back in the early summer.”

CEO Bruce Pucciarello reports that Novell’s Core business rebounded quickly after the spring, and then some, growth in its precious metal band division, so business has been very good for the Rahway, New Jersey based wedding ring manufacturer. Novell also has benefited from its new relationship with Continental that has opened new markets for the company. Particularly valuable is its ability to stock and manufacture Continental’s extensive product collection at a highly functional domestic drop-ship facility to service customers.

CEO Bruce Pucciarello reports that Novell’s Core business rebounded quickly after the spring, and then some, growth in its precious metal band division, so business has been very good for the Rahway, New Jersey based wedding ring manufacturer. Novell also has benefited from its new relationship with Continental that has opened new markets for the company. Particularly valuable is its ability to stock and manufacture Continental’s extensive product collection at a highly functional domestic drop-ship facility to service customers.

Neil Shah of Shah Luxury, New York, concurs that the year has gone surprisingly well, with independent jewelers, who are his customers, performing very well, adjusting to the new normal with curbside pickup and other customer centric services like virtual appointments. From a B2B perspective, he cites that the company launched an online dashboard for our retailers to place and maintain their orders that has been very effective.

Hopeful for New Year

Extremely bullish for a return to pre COVID numbers, Lerche believes an important caveat in 2021 is to be adept at virtual selling, both B2B and B2C. Referencing The Plumb Club’s TPC-365, new proprietary virtual sales platform with BOSS logics, Lerche, who serves as president of The Plumb Club says: “We feel virtual selling will be the future, and especially for the next 12 months.”

Being proactive and ready to be reactive is undoubtedly the modus operandi for businesses that wish to succeed in the current environment, concurs Pucciarello, who also feels “exceptionally good” about 2021. His expectations for the jewelry business for 2021 are “very strong for some, sustainable for others, not devastating for anyone.”

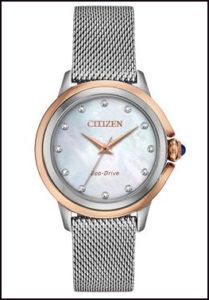

Success is dependent on being nimble and able to adapt quickly and easily to the changing retail environment, sees Jeffrey Cohen, president Citizen Watch America in New York. He believes that retailers who promote what makes them special — the longevity of their relationship with the local community, their product knowledge, and their ability to schedule individual appointments in a safe environment — will prevail.

Success is dependent on being nimble and able to adapt quickly and easily to the changing retail environment, sees Jeffrey Cohen, president Citizen Watch America in New York. He believes that retailers who promote what makes them special — the longevity of their relationship with the local community, their product knowledge, and their ability to schedule individual appointments in a safe environment — will prevail.

Pucciarello believes that partnerships will be integral to success moving forward. The way forward he says are “products with plans and cooperative working relationships between producers and distributers, where we are respectful that we all find profit together. That or we shrink in gross revenue as an industry.”

Storytelling Remains Key

Purchasing gifts for friends and loved ones, even for oneself is a way for consumers to shift focus from the uncertainty and stress of the pandemic to celebrating the holidays and the promise of our return to a better tomorrow.

CNBC reported in articles dated Nov. 16 and 25 how shoppers are seeking personalized, thoughtful holiday gifts to feel connected during the pandemic. Among the examples shared was jewelry with stories that resonate during the pandemic. A great example is the String Of collection by the Minneapolis, Minnesota- based manufacturer Ostbye that creates different takes on the iconic infinity symbol in silver, 10K rose gold and diamonds to convey messages of love, faith, forever and celebration. She cites this type of “postcard jewelry” as a strong trend that will continue through Valentine’s Day.

Bridal sales will continue to be strong in 2021. Severine Ferrari, editor and founder of Engagement 101, told The Plumb Club in November that she expects a big engagement season through the months ahead. In fact, CNBC reports that Signet Jewelry expects pandemic-fueled romance to buoy sales.

“Whether out of sentiment or fear, people are not waiting to get engaged,” Shah concurs. “And, with couples spending less on the wedding and travel, they’re spending more on their rings, and buying a larger stone. Many couples are buying rings ready for delivery because they don’t want to wait!” Lerche notes that while classic, simple styling is leading the way in bridal, fancy shape centers like oval and pear are popular.

Cohen notices a growing uptick in self-purchasing. “Many consumers are rewarding themselves with the purchase of a new watch to add to their wardrobe.”

With all the virtual meet-ups professionally and socially, consumers are looking for “Zoom” worthy jewelry to spice up their on-screen look, sees Cora Lee Colaizzi, marketing director and senior merchandiser for Quality Gold, Fairfield, Ohio. “Putting on jewelry right before a Zoom call, makes most feel polished and professional.” She cites earrings, particularly hoops and necklaces like the “paperclip“ style among the favorites.