VIVA LAS VEGAS

Plumb Club Members had more than luck on their side at this year’s JCK Las Vegas. Booths were stocked with newness, retailers brought glass-half-full thinking (and strong buying plans), and both members and merchants left Sin City with optimism and maybe even a little extra oomph thanks to the oxygen bar and massage chairs. Read on to learn how your peers fared, retailer sentiment, and what sold.

Optimism & Savvy Spending

Though exhibitors’ observations on traffic were mixed, accounting for RX Events, producer of JCK Las Vegas, reveals that the number of attendees increased 8% over the 2022 edition. PC member reports on retailer sales to date this year were also mixed, though members claim that many in attendance were there to shop.

“Most [customers] said they would be thrilled to have another year like 2021 or 2022,” says Jonathan Goldman, CEO of Frederick Goldman. “But we had the right kind of traffic there for us. We had serious buyers and meaningful conversations.”

Some brands reported slight dips in retailer spending, but the flipside is that shoppers were strategic in selections to ensure better sell-through. “They were more thoughtful in their planning,” observes Kat Whitacre, U.S. sales and marketing director at Chic Pistachio, which maintains the Aurelie Gi and Ania Haie lines.

Matthew Behnam, president of Samuel B., agrees. “Retailers were working with their data to make smarter buying decisions.

In the past, stores have come with little information about how certain categories were doing in store, but this year many showed up with reports. They knew which categories were slow and where they had gaps in inventory.”

For sure, lab-grown diamonds remain both a good seller and hot topic. Retailers are aware of fluctuating prices and want consumers to have confidence in their purchases, and they still do, particularly in the bridal category. Shoppers like getting a bigger diamond center stone in their engagement ring for less than they would spend on a mined diamond. This remains a familiar transaction for Goldman and his clients, as well as those of Goldstar Jewellery, which expanded its lab-grown wedding ring options, according to Steven Lerche, chief operating officer.

In the diamond fashion arena, IDD Luxe’s SkySet line of fashion-forward looks and a proprietary stone setting with lab-grown or mined diamonds was another highlight. “We picked up 16 new doors,” says Kendra Bridelle, president of the company’s new luxury division. (IDD is the seasoned parent company.)

Meanwhile, customers of Ostbye’s Theresa Namie, merchandise manager, were happy about the education offered on lab-growns at the show. “JCK had a lot of good programming, and the feedback was positive from the retailers,” she says.

One of Whitacre’s biggest takeaways touched on the travel industry: It’s back, and jewelry sales in holiday destinations were benefiting.

“Our stores in tourist areas are having the most success,” she says. “Consumers are spending more on travel now, and they’re buying more jewelry when doing so. People aren’t as concerned about spending when they’re on vacation.”

For Heather Brown, vice president of content and editorial for The Kingswood Company, a maker of jewelry cleaning products, she and her team delighted in the continuing popularity of private-label goods like hers. “Sophisticated retailers are finding success and value with a product exclusive to their brand,” she says. “Jewelry care cuts across almost any SKU, as every jewelry category requires at-home care between professional cleanings.”

For Behnam, some of his fave show moments happened not at his booth, but the nearby oxygen bar and massage chairs.

“The oxygen bar was cool!” he remarks. “It and the massage chairs offered us and clients a little chance to relax during the show. I made quite a few trips to both.”

Jewelry Trend Takeaways

While overarching trends of enamel, oversize and mixed metal designs, gender neutral styles, lab-grown lines, and nature motifs like bugs and butterflies continue to dominate most jewelry design offerings, more new looks can be found in the bridal category, silver, price point pieces, and talismans.

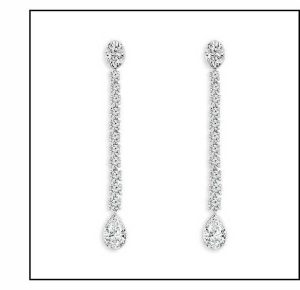

IDD Luxe’s new SkySet line, which hosted a soft launch earlier this year at a smaller trade show and a full debut at JCK Las Vegas, offers fashionable silhouettes like line earrings set with lab-grown diamonds, one of the industry’s biggest trends.

“SkySet allows a woman to buy a big look for the money,” says Kendra Bridelle, president of IDD Luxe’s luxury division. (SkySet can also be ordered with mined diamonds.)

Not surprisingly, lab-grown diamonds are still trending in the wedding ring category, despite price drops. This is why Steven Lerche, chief operating officer of Goldstar Jewellery, offered more SKUs in bands and engagement rings that are ready made with the rocks. Theresa Namie, merchandise manager for Ostbye, confirms the significance of the category for her brand as well.

“Lab-grown diamonds are still selling strong,” she says. “As many are trying to navigate this category, they are finding that the key to selling is being honest about the product so customers can make informed decisions. Many consumers ask for lab grown and others never want to see them, so it is good to have options.”

Another popular item in the wedding category is jackets for engagement rings, particularly solitaires. “There is no better way to enhance an engagement ring,” notes Namie. “And if you have fickle customers like me, multiple ring jackets or wraps can be a great way to redesign your ring.”

Also hot? Bold gold looks. These were another frequent seller at the Ostbye booth. Goldstar’s Lerche, too, is experiencing a growing sell-through of “chunkier” gold looks because they’re sturdy for everyday wear, and yellow is the preferred color for this aesthetic. Kat Whitacre, U.S. sales and marketing director at Chic Pistachio, owner of the Aurelie Gi and Ania Haie lines, says their offerings are also “very yellow gold focused,” with new designs featuring bulkier links and chains, including larger paper clips necklaces. Two-tone pieces, too, had a showing, not only in Chic Pistachio lines but in Prime Art & Jewels’ Charles Garnier. Prime Art & Jewels also had gender-neutral numbers.

Bug and floral motifs, permanent jewelry, and curated ear stacks are other quick sells, as is anything with symbolism. “It’s important,” confirms Namie. “And [symbolism] is an easy way to promote a special message.”

Whitacre sees a lot of interest in mix and match and customizable pieces as well as multiple piercings. Her firm beefed up offerings of earrings for the show and is even broadening its client horizons to more than just jewelry-only stores; Chic Pistachio is also reaching out to piercing studios. “We’ve seen a huge interest in body jewelry and ear curation,” she says.

And a super upscale trend is happening at Samuel B. Known for its Balinese-inspired silver designs, the U.S.-based manufacturer is seeing a huge interest in platinum bridal in its EverSpark collection. Why? The price of gold now versus platinum. “People are realizing they can spend just a little more and get platinum,” he explains. “So, over the past three months, we took every bridal style we make and are now offering a platinum option, whereas it used to be a special order.”

In the arena of trends, Heather Brown’s fave is encountering retailers looking for ways to use jewelry care products as giftables, not just retail items. “Offering a gift with purchase allows consumers to try out a jewelry care product with the promise of a return to the store to purchase more,” says the vice president of content and editorial for The Kingswood Company.

New Looks, Line Debuts

JCK Las Vegas may be Ground Zero for jewelry product debuts, and PC members rose to the challenge. New collections and jewels celebrated trends of the moment and ones on the horizon.

For starters, retailers’ cautious optimism and spending inspired brands to develop price-point-sensitive jewels, including in sterling silver. Ostbye is developing such a line to bridge the price gap from silver to gold, and it’s also creating diamond pieces with 0.25 to 0.50 carats in total to appeal to fine-jewelry lovers on a budget. “These styles offer an affordable price for a higher-end look,” says Theresa Namie, merchandise manager.

Two-tone collections also speak to shoppers on a budget, which is why Chic Pistachio’s Ania Haie line unveiled a mixed-metal collection called Tough Love featuring sterling silver and 14k gold plate. Another new offering is Ania Haie’s Taking Shape collection, which features organic silhouettes, and Pop Charms. (Ania Haie pieces are sterling silver with some 14k gold plate.)

Meanwhile, the Aurelie Gi division of the brand debuted two new collections—Siren Song, with waves and pearls, and New Wave, “all swirling shapes with an edgy feel,” says Kat Whitacre, U.S. sales and marketing director. New additions were also made to the Piercing collection and in the For Keeps permanent jewelry collection, including anklets—just in time for summer. All Aurelie Gi pieces are 14k gold.

A 14-karat-gold surprise at the show was a new line made in the metal by Samuel B., of sterling silver fame. Looks include fashion basics and birthstone styles with gemstones and full-cut diamond accents. These offerings are available for order, unlike the brand’s silver designs, which are in stock for quick fulfillment. New additions were also made to its EverSpark bridal line.

And Goldstar Jewellery’s Steven Lerche, chief operating officer, unveiled new wedding ring inserts and enhancers for its bridal clients.

“We have invested in more of these because of the growth of lab-grown diamond solitaire purchases,” he says. “And we can fill these enhancement bands with lab-grown or natural diamonds.”

IDD Luxe’s lines of SkySet fashion-forward diamond jewels and MOZÉ bridal rings are rich in best-selling styles. Given that the luxury division and both lines were created just months ago, both are new for retailers to see. “Our sales were a 50-50 split of SkySet and MOZÉ,” explains Kendra Bridelle, president of the new luxury division.

SkySet features a proprietary stone setting with little metal covering the diamonds. “SkySet gives the illusion of diamond dancing on air—the diamonds look like stars in the sky,” Bridelle adds.

Meanwhile, MOZÉ bridal designs are all about the power of two—the couple in the eyes of the consumer and maximizing inventory need and turn for the retailer. MOZÉ’s easy-to-swap-out heads can be affixed to any shank in the line without requiring a special order.

Retailers can also help clients build the ring of their dreams through IDD Luxe’s virtual engagement ring builder, which enables users to change not only metal color and diamond cut but also different ring heads.

“IDD Luxe services the retailers and provides the right tools—including marketing assets—to create their own brands in store,” adds Bridelle.

From The Kingswood Company, expect to see updated packaging aligning with current trends in the beauty category, labeling in French and Spanish, and a new branded standing display with shelves that can hold “50 or more products,” explains Heather Brown, vice president of editorial and content. “The display offers merchandising flexibility and showcases any assortment of Clean + Care® products in a modern, cohesive presentation,” she adds.