The Diamond Dream

“These are strange and difficult times for the diamond industry,” hails Jon C. Phillips, GG, CG, market analyst for The GemGuide, GemWorld International. In a nutshell: there’s too much rough in the marketplace and it’s too expensive based on polished outcomes; polished is too expensive based on current selective demands and high inventories; the industry is over-leveraged and markets in Asia are slow amid local policy changes and stock market declines.

But the diamond dream is still alive and well despite market challenges, reassures Stephen Lussier, CEO of De Beers Forevermark, at the annual Rapaport State of the Diamond Industry, JCK Las Vegas. “Global diamond jewelry sales increased to a new record high of $81 billion in 2014, with the major markets—U.S., China and India—all growing.” He hails bridal the foundation of the diamond business, and diamond the No. 1 desired gift of all luxury gifts.

But the diamond dream is still alive and well despite market challenges, reassures Stephen Lussier, CEO of De Beers Forevermark, at the annual Rapaport State of the Diamond Industry, JCK Las Vegas. “Global diamond jewelry sales increased to a new record high of $81 billion in 2014, with the major markets—U.S., China and India—all growing.” He hails bridal the foundation of the diamond business, and diamond the No. 1 desired gift of all luxury gifts.

Yet Lussier reminds that all value in the diamond business emanates from consumer desire for and confidence in the product. He says the millennial generation must be engaged in the diamond dream and jewelers must find new ways of teaching them about it.

Market Watch

“The traditionally stable, unique supply and demand model of the diamond market has been severely shaken to reflect new values and needs. “The increasing downward pressure on prices has analysts wondering if it’s merely a long overdue onetime correction or permanent change where pricing is dictated by actual market economics versus the oligopolistic style pricing system we’ve had up to now,” explains Phillips.

According to The GemGuide, polished prices were the first to react to the slowing demand and oversupply with declining prices throughout the year, some areas trading as much as 10% less than this time last year. Rough prices have seen some declines from 3% to 4%, but not enough to make the cutting and polishing of most rough profitable.

Diamond manufacturers are tired of losing money on polished goods and are more circumspect about what they manufacture, says Leslie Lew, vice president of MWI Eloquence, New York. “It’s challenging because prices are relatively high, although weakened. There is a disconnect that has exacerbated between the price of rough and polished. People are buying less rough, closing cutting factories and laying off workers. As diamonds get consumed, inventories will level off, and certain in-demand items will be in short supply.”

The industry is just starting to find its foothold, adjusting to changes in the distribution channel. “The demand is there, it’s just a matter of things shaking out on the supply side,” says Neil Shah, CFO of Shah Luxury, New York. He sees the market stabilizing by the middle of next year with demand strong long-term, advocating that building brands and relationships are most important to success.

Capturing Millennials

Lussier outlines four areas to pursue to capture millennials: defend the core symbolism of diamonds, discuss timeless versus disposable fashion, win in the digital space, and fight for the integrity of the industry. Rebecca Foerster, executive vice president of strategic planning and marketing for Leo Schachter Diamonds, New York, cites as key values: innovation and uniqueness, authenticity and reassurance, and customer involvement.

Consumers come to a jeweler with a basic knowledge of the 4Cs, reminds Derek Palmer, global marketing director for Pluczenik, New York, noting that they care about many things like the environment, reliable sources, sustainability, and community involvement, even if they don’t verbalize it. “But above all,” he says, “sell the beauty of the stone, otherwise it is just another commodity.”

Consumers come to a jeweler with a basic knowledge of the 4Cs, reminds Derek Palmer, global marketing director for Pluczenik, New York, noting that they care about many things like the environment, reliable sources, sustainability, and community involvement, even if they don’t verbalize it. “But above all,” he says, “sell the beauty of the stone, otherwise it is just another commodity.”

Jewelers must embrace the customer’s education and help them make the right choice based on their needs,” encourages Foerster. “Consider yourself a curator who can take them to the diamonds and brands that suit them best.”

Lussier advises jewelers invest in brands to do the emotional work for them; dramatically improve their marketing content; and partner with midstream suppliers to create better margins and participate in telling the diamond story.

Add Value

Given the challenging climate, the commodity generic diamond business is tough, with all the competition from the Internet and other retailers. “It offers no margins and independent jewelers don’t have the leverage on prices the big players do,” says Rob Bates, diamond market analyst and senior editor for JCK magazine, who advises jewelers carry something different. “If you just do what everyone else does, you’re in trouble. Jewelers need to have something to say about their diamonds that makes them stand out, whether they have a specific cut, new designs, are branded, or have a socially conscious origin.”

Retailers are looking for diamond offerings not dictated by the commodities market, says Lew, hence interest in fancy shapes and colors in diamonds. He reports that curved fancy shapes are selling well, but notes that manufacturers tend to not have a lot in stock. “Most are investing in manufacturing rounds.” He believes the fact that jewelers sell a lot of round and princess cuts is a self-fulfilling prophecy. “If jewelers were offering other shapes, they’d sell more of them, especially in today’s market where they offer a better value.”

There’s also tremendous traction in color diamonds, adds Lew, with crossover from bridal to fashion. He cites the popularity of rings with natural fancy color centers in shades of cognac, champagne and yellow popular from ¼ to ¾ carat; and color enhanced diamonds selling very well in fashion jewelry designs.

Moreover, hallmarked products from certified companies could provide a unique value-added proposition that attracts premium prices, says Martin Rapaport, chairman of the Rapaport Group and founder of Rapaport Diamond Report, in his State of the Diamond Industry address at JCK Las Vegas. He predicts demand for this product with certification or hallmarking will increase.

Moreover, hallmarked products from certified companies could provide a unique value-added proposition that attracts premium prices, says Martin Rapaport, chairman of the Rapaport Group and founder of Rapaport Diamond Report, in his State of the Diamond Industry address at JCK Las Vegas. He predicts demand for this product with certification or hallmarking will increase.

Also important for jewelers, Jeff Weinman, executive vice president of sales for Tache USA, New York, touts the promotion of the Kimberley Process that documents stones are conflict free and from reputable sources. He advises jewelers join, and pressure their suppliers to commit to the Responsible Jewellery Council, a not-for-profit, standards setting and certification organization.

Bestsellers

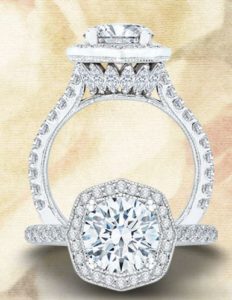

Classic staples in wedding and fashion jewelry continue to reign—like channel-set bands; studs; hearts and crosses; and solitaires. And, despite jewelers’ fatigue for the halo, it remains a bestseller, in single and double styles.

The “dancing” diamond trend also will remain strong through holidays 2016, shares Grant Mobley, vice president of sales, Simply Diamonds, a JewelMark company, New York. “The majors have invested heavily in this category expecting to get an extra two seasons out of it.” He advises independents carry better qualities and unique designs to differentiate.

In diamond fashion jewelry, products that retail for not much more than $500 sell best, says Weinman. He cites design trends incorporating geometrics and negative space, micro setting, and delicate free form as popular. Straddling the line between bridal and fashion, stackable diamond bands offer lots of possibilities, especially in mixing gold colors.

A proponent for entry-level bridal, Lew advocates jewelers offer product in the $1,000-$3,000 range as part of their solution to attract millennials. “Retailers are trying to sell to young couples saddled with $50,000 to $150,000 in student loan debt. They’re not coming in to buy a 2-carat center, more like .40 to.60 points. Capture them with entry-level collections and give them the currency to trade up.”

Embrace Technology

Shah notes that the millennials grew up receiving technology as a gift, where Boomers and GenXers received jewelry for a milestone event or birthday like sweet 16, and concurs with Lussier that they must be taught about jewelry and the meaning behind it. But he advocates using the tools they’re comfortable with.

Millennials are using their smart devices to look up things in real time. “Retailers need to embrace this reality and make it part of the conversation,” says Foerster. “Have an iPad or tablet on hand to look things up from informational sites to virtual inventories, or to explore custom options. Come from the same platform, speak their language.”

Schachter & Co is big on apps, says Foerster, introducing in October the Leo Diamond app for Sterling stores, with plans to launch a LVE app for independent retailers. “We believe apps are a great way to communicate. The Leo app is dynamic and interactive, with social media and gaming features, and the opportunity to build your own ring.” She advocates immersing in social media. “Conduct special promotions, contests, and events to keep customers engaged.”

Schachter & Co is big on apps, says Foerster, introducing in October the Leo Diamond app for Sterling stores, with plans to launch a LVE app for independent retailers. “We believe apps are a great way to communicate. The Leo app is dynamic and interactive, with social media and gaming features, and the opportunity to build your own ring.” She advocates immersing in social media. “Conduct special promotions, contests, and events to keep customers engaged.”

Weinman reminds jewelers that websites must be adaptable to a variety of smart devices since consumers use cell phones and tablets to do much of their shopping and surfing. “Jewelers must invest online. They must invest in engaging content, and to show and sell their jewelry online.”