What Consumers Say About Pearls

If there’s one thing that’s very clear in the results of this benchmark study, it’s that pearls are already a consumer favorite, so promote your pearls!

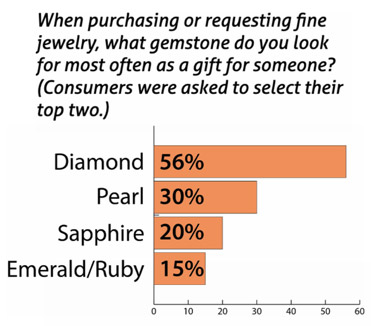

Beloved across demographics, pearls rank among the top gems that consumers have purchased and would purchase as a gift for someone or themselves — in good company with sapphire, ruby and emerald, after diamond.

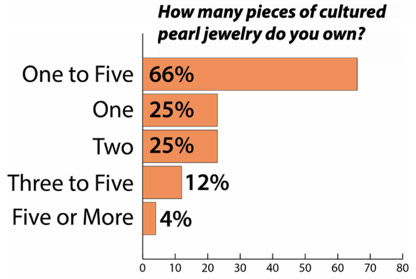

Pearl Ownership is Strong across demographics, as most jewelry consumers surveyed (66%) own at least one pearl jewel. Of those, 69% own a stand, 62% pearl earrings.

Testament to Timelessness of Pearls is the fact that 65% of pearl jewelry owners have at least one family heirloom among their pearl pieces.

46% of jewelry consumers surveyed report pearls are a popular gift or self purchase across demographics.

Pearls are Popular Birthday and Anniversary Gift, as 52% of consumers who have purchased or received pearl jewelry in the past 3 years say that is was for a birthday, 46% for an anniversary—two occasions someone is celebrating every day.

Consumers aged 25-35, especially consider pearls to be a top gem to give, receive and self-purchase. Younger consumers are inspiring two trends that speak to pearls’ broad appeal: men in pearls and pearl engagement rings.

— 37% of male consumers surveyed said they have and would wear pearls. Men aged 25-45, in particular, embrace pearls: 42%-47% versus 16% of men aged 46- 55.

— 28% of jewelry consumers say “yes” and 43% “maybe” to considering pearl as a center gem for an engagement ring. The youngest demographic, ages 25-35, is on board with 36% responding “yes” and 40% “maybe”.

Pearls’ Sustainable Story Holds the Key to Cultivation Education, providing the perfect entrée to discuss the process. While the survey reveals high awareness of cultured pearls, with 81% of consumers having heard the term, only 34% know what it means. The story of responsibly cultured pearls is one of a renewable resource that not only contributes to the health of the marine environment, but also helps to sustain families in remote communities. Data revealed that 60% of consumers were unaware that pearls are sustainable. The stories of pearl cultivation and pearl as a sustainable gem are intertwined.

The Bottom Line, the pearl trade does not have to sell consumers on cultured pearls, because they already like, have and desire them. Invest in the product, carry a wider selection, and take time to talk and post about what makes pearls the perfect gift to give, receive, and buy for oneself.

Pearl Already Consumer Favorite

Pearl ranks among the top gems that consumers would purchase as a gift for someone or for themselves.

While diamond leads as the U.S. consumers‘ favorite gem, across demographics, pearl is in good company with sapphire, emerald and ruby among the top three picks for most fine jewelry consumers.

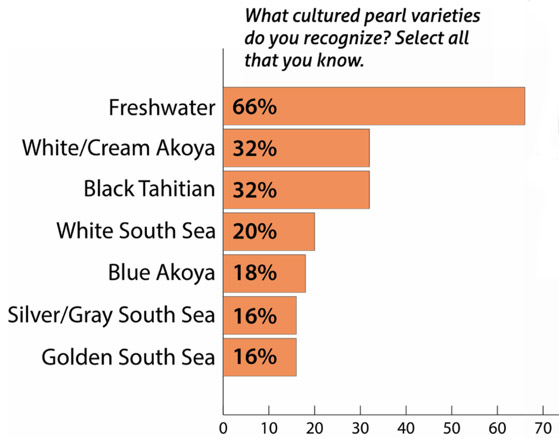

Pearl Awareness High Knowledge Limited

Awareness among consumers of the term “cultured pearl” is high at 81%, with only 34% indicating that they know exactly what “cultured” means.

The data reveals that the 25- 35 year olds — pearls’ biggest fan base — is the least educated about the product, with 21% believing a cultured pearl is man-made and 9% thinking it refers to pearls worn by high society (only 1% of 46-55 set think that).

Consumers in the $150,000+ household income bracket appear to be more knowledgeable about pearl cultivation, with over 43% of consumers with HHI of $200K+ and 39% of those in the $150K-$200K set citing they’re hip to the process.

All age groups were equal in their lack of awareness, however more men (47%) than women (34%) say they are aware of pearls’ sustainability, as well as 57% of consumers in the highest income bracket.

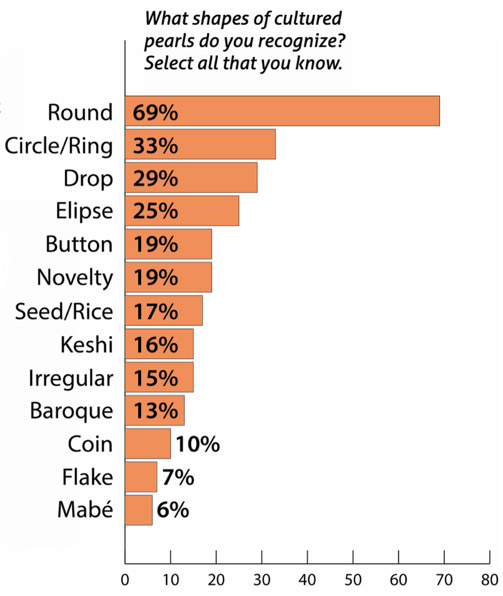

Over two-thirds of consumers know that pearls can be round, and a quarter to a third know they also can be off-round, drop and circle/ring shaped. Awareness wanes with the more unusual shapes.

Pearl Ownership Strong

A majority of jewelry consumers own at least one piece of pearl jewelry. There is strong ownership in the market across demographics when it comes to classic cultured pearl strands and earrings.

Spending over $3,000 on pearls in the past two years are 32% of consumers in the $200K household income group, as well as 43%-48% of 25-45 year olds.

Pearl Occasions Abroad

Pearls’ Fashion Connection

Pearls have been on a fashion high for some time. Just about every popular lifestyle publication and platform is writing about pearl jewelry as the ultimate fashion movement. WhoWhatWear.com hails pearls 2021’s most timeless jewelry trend, citing the surprise element in the styling of layered and mismatched pearls, as we’ve been seeing on the runways for several seasons.

Dolce & Gabbana, Miu Miu, Prada, Moschino, Givenchy, Dior, Carolina Herrera, Versace, and, of course, Chanel are just some of the powerhouse brands accessorizing their fashions with pearls. Even men’s fashion designers, like Ryan Roche, are piling pearl strands on their male runway models.

Promoting Pearl Occasions

Of the 28% of consumers who have either received or purchased pearl jewelry in the past 3 years, more than half have done so for a birthday, and nearly half for an anniversary.

From an age perspective, 55% of 36-55 year olds cite pearls to give and receive for birthdays, compared to 48% of consumers aged 25-35. For the youngest group, 50% of consumers aged 25-35 cite anniversaries a top occasion to give and get pearls, compared to 45% of consumers 36-45, and 36% age 46-55.

More men (56%) than women (41%) see pearls as something to give and get for an anniversary. More men (55%) than women (50%) also cite pearls for birthdays, and appear more receptive than women, 17% to 13%, to the idea of gifting pearls for the birth of a child.

More than half of consumers (51%) aged 25-35 would buy pearls as a gift-to-self (their top choice), compared to 42% of 36-55 year olds. Women (50%) are more likely than men (40%) to self-gift pearls, although 40% is a bold statement.

Wedding Gem Opportunities

Pearls have had a long history as the wedding gem, associated with brides dating back to ancient Hindu writings of Kirshna, the protector, who gathered pearls from the sea to give to his daughter to wear on her wedding day.

Less than a quarter (22%) of jewelry consumers cite pearls as their choice to give and receive for a wedding party gift, and 21% for bridal/wedding day jewels. Given pearls’ history as a bridal gem, symbolic of pure love, it’s notable that the percentages are not higher.

Over a quarter (27%-28%) of consumers aged 25-35 cited pearls for bridal and wedding party gifts, for 36-45 year olds that drops to

17%-18%, and for ages 46-55 it’s 11%-14%. With people getting married later and some more than once in their life, pearls have the OPPORTUNITY to be a top accessory and gift for the bride and bridal party.

Nearly a quarter of single consumers (23%) cited pearls for bridal and 17% for wedding party gifts. While 25% of consumers who are engaged cited bridal, ZERO associated pearls with wedding party gifts, a lost OPPORTUNITY for jewelers who do not marry their diamond bridal customers with pearls early in the wedding-planning process.

Pearl Influence and Inspiration

Over half (55%) of pearl jewelry consumers say they are not influenced by famous people, both male and female, who have been wearing pearl jewelry recently.

Only 18% admit that they definitely are influenced by star power, 27% say “maybe”.

More than a quarter (27%) of consumers aged 25-35 say that what personalities are wearing in pearls does influence them, compared to 8% of 46-55 year olds.

More men (22%) than women (17%) said that what celebrities are wearing in pearls does influence them.

Two trends where “star power” has put a spotlight on pearls:

Increased media coverage of young male celebrities like Harry Styles, Jaden Smith, Marc Jacobs, Patrick O’Connor, ASAP Rocky, and Troy Sivan, who have been photographed in pearl jewelry, has focused attention on pearls.

As eloquently described by writer Nick Haramis in the New York Times fall 2020, “for men, the pearl necklace represents both the unraveling and buttressing of gender norms”. In dressing, the pearl is “a gateway to genderless fashion that emphasizes the very distinction it’s meant to dismantle. Pearls are elevated objects from the bottom of the sea, and they represent exactly what they are: a silky orb that lives inside an armor of rock-hard grit.”

Growing interest in pearls as a center gem for engagement rings after celebrities like Emma Stone, Michelle Williams and Ariana Grande got engaged with pearl.

While pearls may not be as practical as diamond or other hard gems like sapphire and ruby for daily wear, a gem is chosen based on what it means to the couple. Popular wedding planning media like Brides magazine and The Knot are including pearls in their trends coverage. The New York Times, in a 2020 article on the trend, noted that the sudden popularity of pearl engagement rings could be both part of a larger movement against tired traditions around marriage, as well as a nod toward sustainability.

More women would choose pearls, because they like the look and want to be different.

More men (17%) than women (11%) would choose pearl because it’s sustainable.

More men (13%) than women (7%) would choose pearl because it could be more affordable than a diamond.

Pearl Trends, Classic & Modern

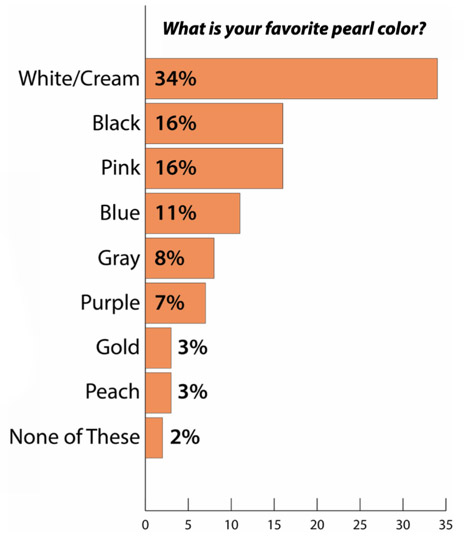

Around a third to nearly half of consumers identify white/cream as their favorite pearl color, followed by 16% who like pink and black, and 11% who cite blue.

Analyzing the data by age, more than 10% of consumers aged 25-35 chose gray, compared to 7% for the other age groups; yet younger consumers are less interested in black, 13%, compared to 30% for 36-45 year olds and 15% for 46-55. Also 19% of consumers aged 46-55 prefer pink pearls, compared to 14%-15% for the younger age groups. Peach and gold colors received the least interest, 2%-4%, across all ages.

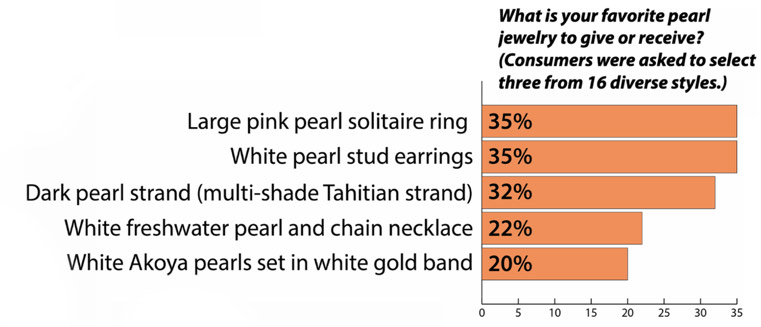

When asked what style of cultured pearl jewelry they desire, 42% of women said pearl strand, 40% pearl earrings 27% of women said pearl ring, 23% pearl bracelet.

Male jewelry consumers have shown throughout this survey their interest in fine jewelry, including pearls, to gift and self-purchase.

Pearl cufflinks and rings are popular across age groups; younger men also like pearl bracelets, and men aged 36-55 said they’d consider wearing a pearl strand. Curiously, women as they age are not interested in seeing men in a pearl strand: ZERO 46-55- year-olds, compared to 10%-11% of women age 25-45 who would.

Ironically, women are not as enthusiastic about seeing men in pearls, with 69% resounding “no” when asked about the notion.

However, 20% are in support of men in pearls, and 12% say “maybe”. Younger women, 28% of consumers aged 25-35, can support it, compared to 19% of 36-45 and 9% of 46-55 year olds.

19% of male jewelry consumers selected this style as one of three they liked from a choice of 16 diverse pearl pieces shown in the survey. Only 9% of women selected this style.

Racial cross tabulations shows that 21% of Black/African American jewelry consumers picked this bracelet, nearly twice as high as the average.

Source: The Cultured Pearl Association of America. MVI Marketing LLC.