Millennial and Gen Z Attitudes Towards Diamonds

Consumer Insights Report on Diamond Desirability

The NATURAL DIAMOND COUNCIL has set up a tracking survey to increase understanding about the desirability,

perceived values, and shopping habits for natural diamond jewelry among American Millennials (currently aged

25–39) and Generation Z (aged 18–24).

Together these generations account for 38% of the adult population but more than 60% of demand for natural diamond jewelry. Their income in real terms is projected to rise by more than 70% in the coming decade as they move towards their peak working and spending years. This report details key results from the first wave of this tracking study, conducted online by 360 Market Reach in October 2020 on 5000 respondents.

Outcome

The results demonstrate that this cohort of 18–39 year-olds have a strong relationship with diamond jewelry, placing it high on their wish lists both to buy for themselves and to give to others. Recurrent themes in the survey are the importance attached to the lasting value, uniqueness, emotional connection and versatility of diamond jewelry and the strong satisfaction among acquirers; those who had bought or received diamonds were the most enthusiastic for more. Looking forward this cohort plans to continue purchasing diamond jewelry in the year ahead, mostly following acquisition patterns seen in the last 2 years but potentially with increasing use of social media to provide inspiration. For gift purchases there may be increased involvement of the recipient in the research and purchase decision.

Analysis

Diamond jewelry is highly desired, appreciated particularly for its lasting value, uniqueness, emotional connection and versatility.

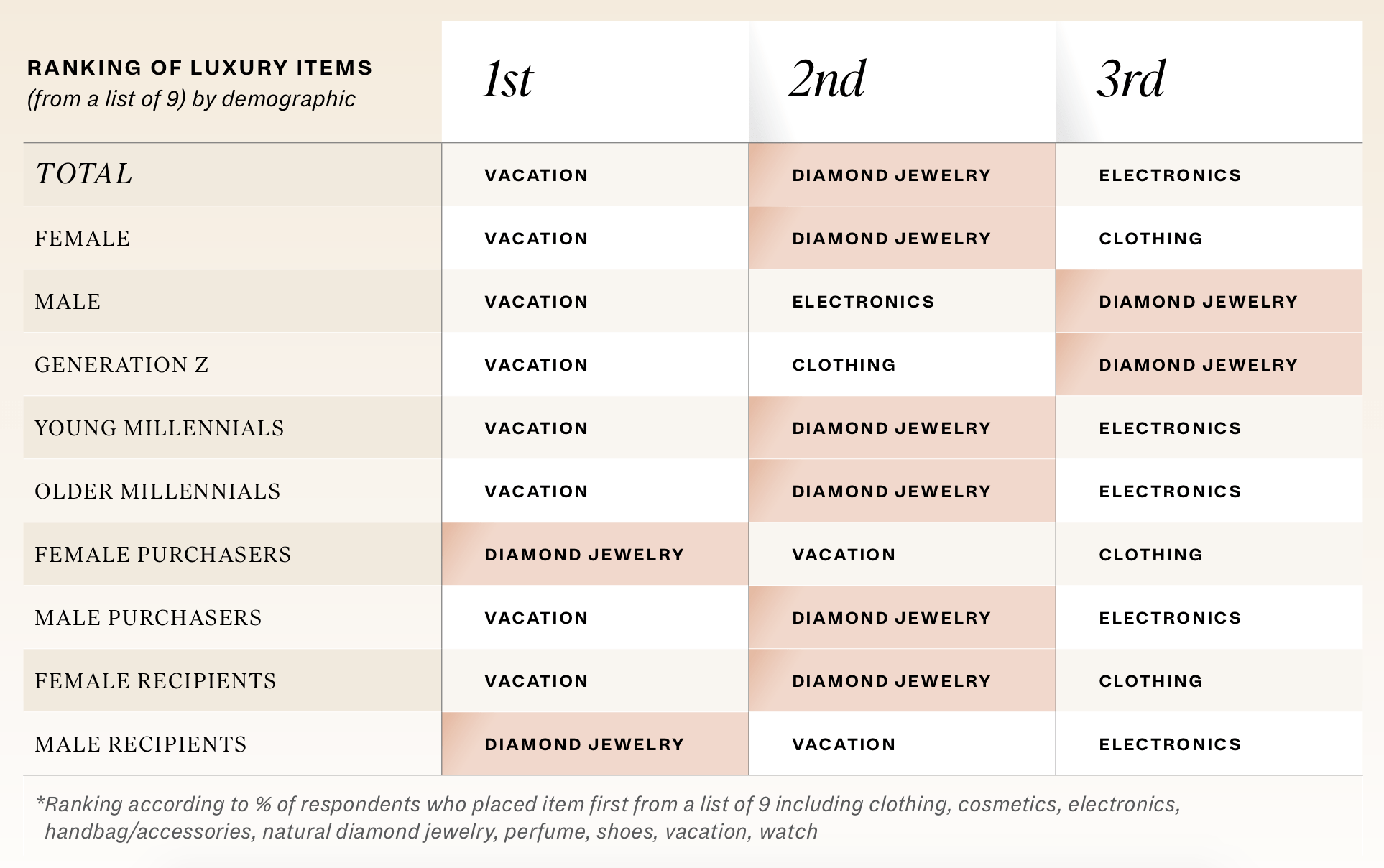

Natural diamond jewelry is highly desired by all generations. When prompted with a list of 9 luxury items and asked to consider which they would most want to buy or receive if money were no object then diamond jewelry was the most desirable luxury good overall (second for Generation Z); only the desire for vacations was ranked higher in each case. Desire for diamond jewelry was particularly strong amongst consumers who had already bought or received diamond jewelry.

There was widespread agreement also that natural diamonds are unique; 70% strongly or somewhat agreed with the statement that each diamond is “one of a kind”. Respondents also widely agreed that diamonds represent a symbol of love and exclusivity (68%), authenticity (65%) and rarity (57%).

Millennials and Generation Z acquire natural diamond jewelry both for themselves and to gift

Around half of all jewelry purchasers over the last 24 months have acquired natural diamond jewelry. Looking further at this group:

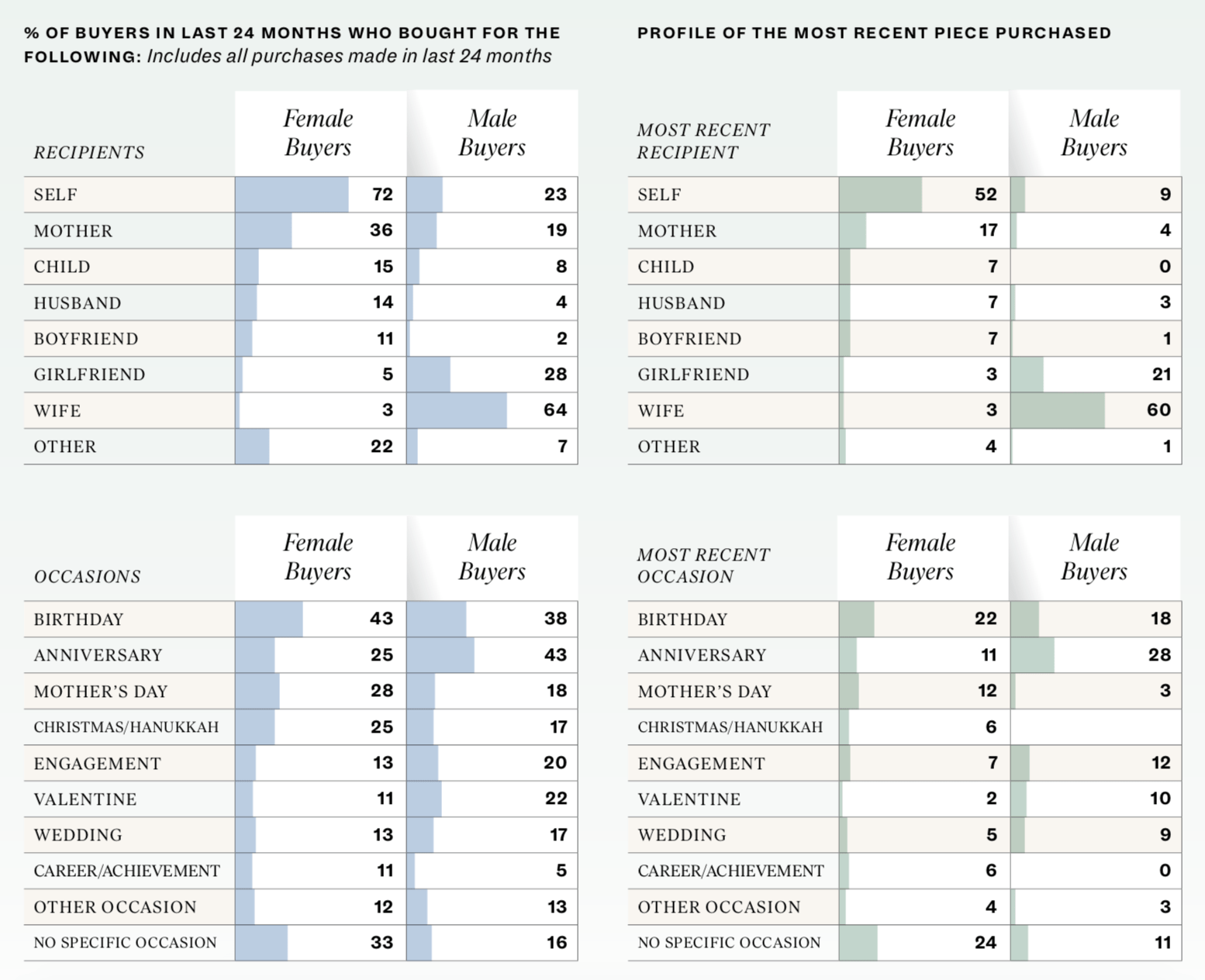

— Half of natural diamond jewelry purchasers have bought diamond jewelry to be worn personally by them- selves. This has been a particularly strong driver for acquisition by women; 72% of female purchasers have bought at least one piece for themselves compared to 23% by men. For these women the key reasons for buying for themselves included: design (mentioned by 51%—they “found a piece of jewelry they really loved”), versatility (49%—“it can be worn and appreciated everyday”) and long-term style and value (46%).

— Almost 80% of purchasers have bought diamond jewelry as a gift (with 28% buying both for gifts and for them- selves). Males largely gift to their significant others, while women gift to their mothers and children as well

as their significant others. Key reasons for giving diamond jewelry as a gift included its long-term value (45%), the fact that it can worn everyday (39%—but particularly important to woman), the design “a piece that the recipient would love” (40%) and as diamond jewelry is a perfect symbol of love for someone else (33%).

— Around a quarter of purchasers bought a piece of diamond jewelry ‘just because’, with no special occasion in mind. 89% of purchasers bought for a special occasion; either in connection with an engagement/wedding (25% of purchasers), or for annual events such as birthdays, anniversaries, Mother’s Day, Valentine’s Day, Christmas and Hanukkah (72%), or for other special occasions such as a birth of a child or a career achievement (17%).

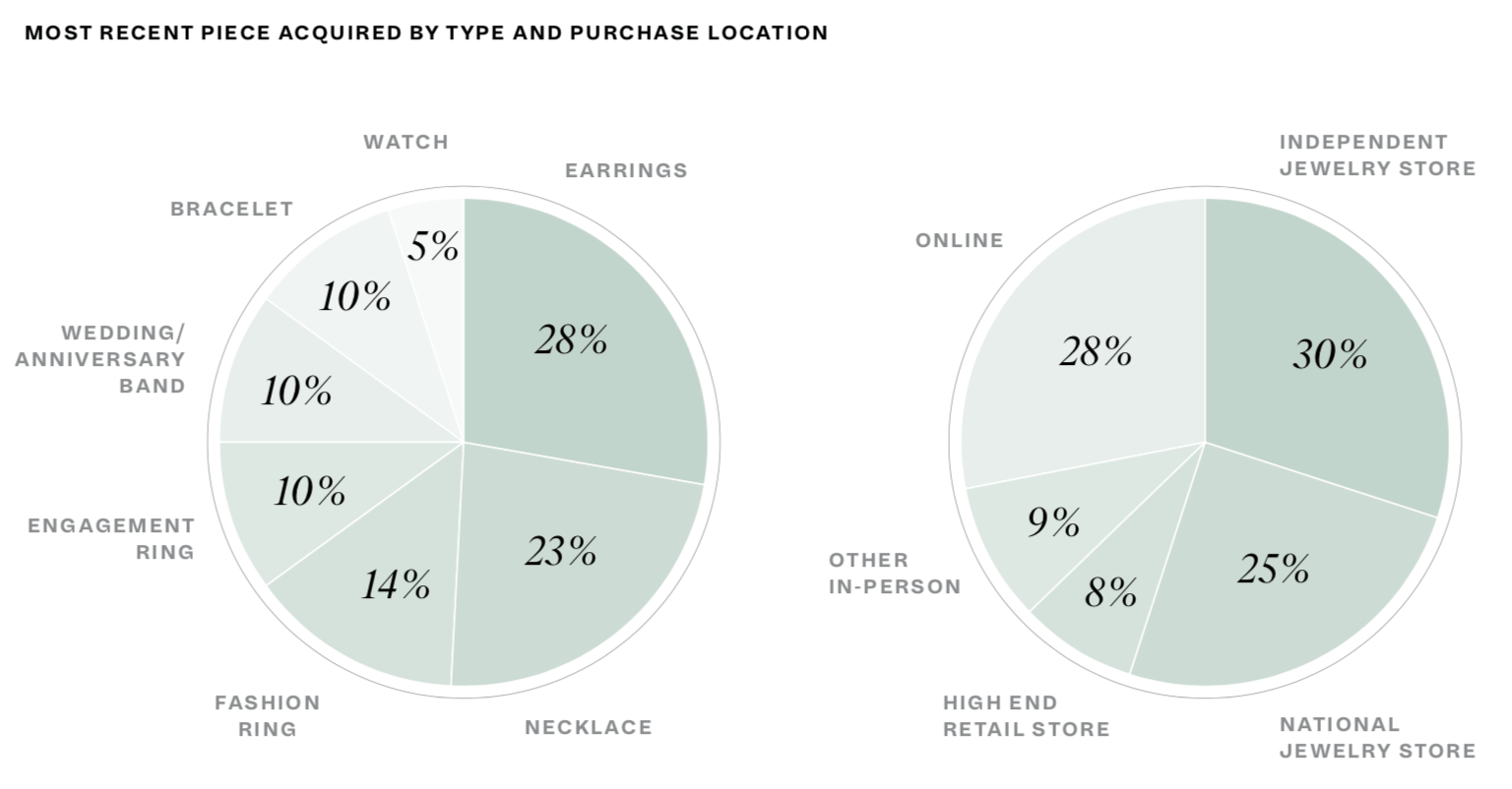

About half the natural diamond pieces acquired are earrings and necklaces; their popularity may be height- ened currently by the pandemic and associated “Zoom buying”. A further third of pieces are rings, split 10% engagement rings, 10% wedding/anniversary bands and 14% fashion rings. The average price paid for pieces acquired in the last 2 years was $2400, with male purchasers paying $3000 and females $1900.

Buyers typically research their purchase, visiting 4–5 retail touchpoints before making their final decision. About half of gift purchases involve participation by the recipient

84% of purchasers of natural diamond jewelry conducted research prior to their acquisition. Many compared prices online (66%), sought advice from friends/family (32%), looked for inspiration on social media (26%) and read articles (24% overall but 32% of male buyers). Typically buyers visited 4–5 retail touchpoints (averaging 2.6 online and 2 in person) before making the final purchase. While the majority of the most recent purchases of natural diamond jewelry were made in person 28% were made online. About half of those receiving diamond jewelry as a gift were involved in the purchase process.

Looking to the year ahead there will be continuing interest by millennials and Generation Z in natural diamond jewelry but social media will play an increasing role in inspiring their actions

The encouraging strength of attitudes towards jewelry and diamonds in these generations are confirmed by their purchase intentions for the coming year; 37% anticipate buying jewelry in the next 12 months (including 38% of Generation Z) while 27% expect to receive jewelry (31% Generation Z). Similarly 20% of respondents say they will definitely or probably buy natural diamond jewelry in the next 12 months while 12% of respon- dents expect to receive it as a gift.

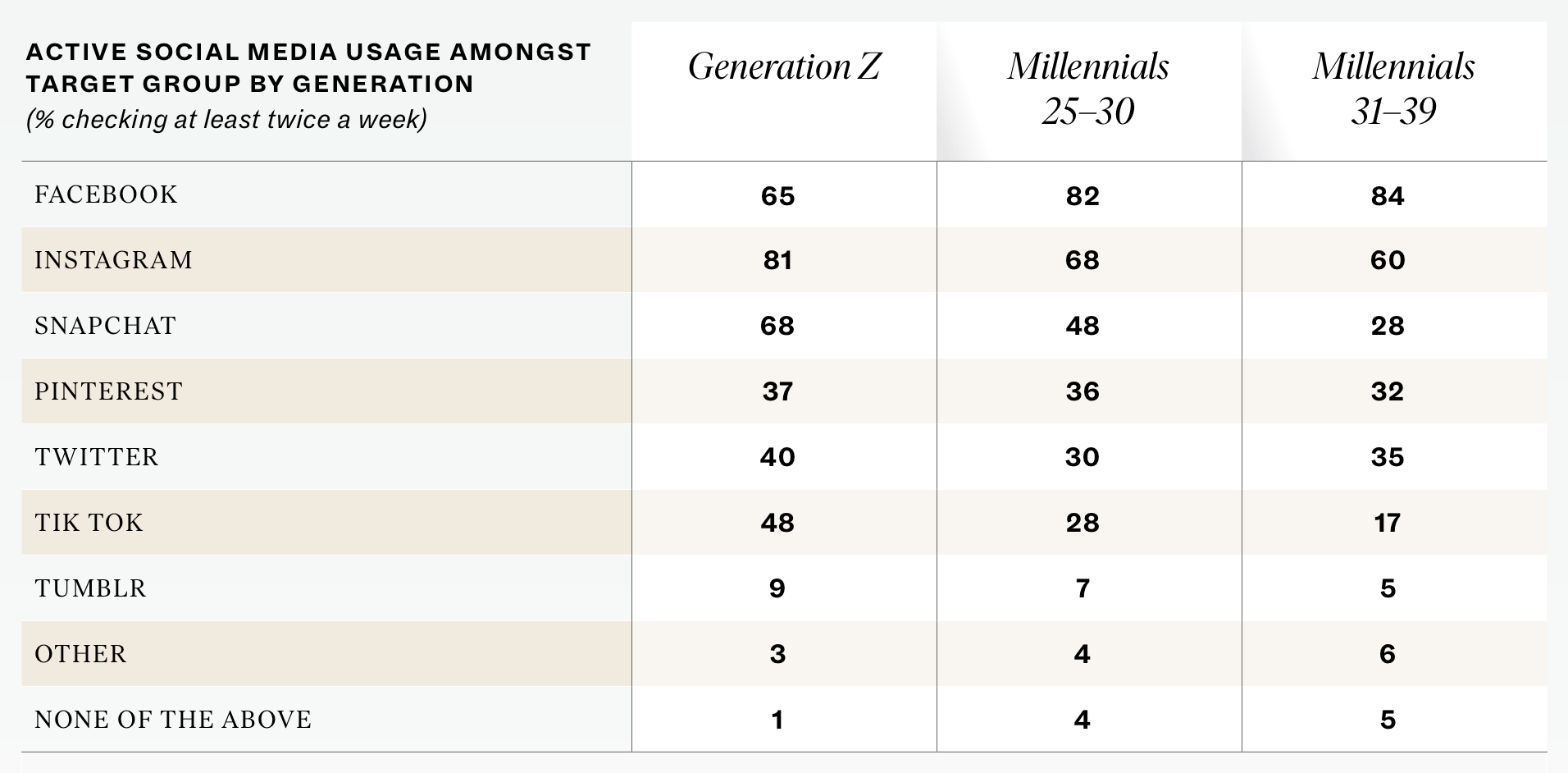

The expected profile of these purchases by occasion, product type and wearer will mostly be similar to that observed in the past 2 years. However those planning to gift are likely to be seeking an increased level of participation from the recipient—only 40% of those planning to buy gifts intend to make the decision completely on their own while just 26% of those expecting to receive anticipate they will not be involved. There is also an increased expectation of the use of social media for inspiration, with 36% overall and 40% of male future buyers planning to engage with social media for ideas and advice. 96% of the target group are active on at least one form of social media.

The pandemic will continue to impact the purchase process—though at the time of the survey 51% of respondents said they were comfortable going into physical stores. Safety measures considered important by at least 25% of respondents included requiring customers to wear masks at all times, employees wearing masks, limiting the number of customers allowed in the store at one time, enforcing social distancing and allowing customers to be seen in a private area.

Methodology

The online survey was fielded in October 2020 on 5000 respondents aged 18–39 from 360 Market Reach’s consumer panel. The sample comprised 15% from Generation Z (age 18–24), 40% Younger Millennials (25–30) and 45% older millennials. It excluded diamond jewelry rejectors, defined as those who had not purchased diamond jewelry in the past 2 years AND would definitely not be open to acquiring diamond jewelry in the future. The objectives were to track consumer desire for diamond jewelry relative to other luxury goods/ experiences, to develop greater understanding about any barriers to consumption and to benchmark the consumer’s purchase process.

Source: Natural Diamond Council, Consumer Insights Report on Diamond Desirability. Image: Natural Diamond Council