La Vida Vegas

Shortly after JCK Las Vegas shoppers and exhibitors left Sin City, reports of sales and trends emerged. Vendors said attendees stayed for less time than in years past, but they were laser-focused on strategic buys. Among those purchases were fashion styles in platinum and yellow gold (despite higher prices) as well as colored gemstones, link numbers, and sentimental jewels.

Few suppliers had time to hit up the fair’s educational seminars because sales were so brisk. Shefi Diamonds and Paris 1901, a division of Prime Art & Jewel, were among the bustling businesses. Surbhi Jain, marketing director of the former, had to miss the talks due to “high engagement” at the booth, while Sam Hupp, vice president of sales for the latter, had a similarly pleasant problem—“We were too busy with appointments.”

This news is well received considering the year the industry is seeing: two wars, an impending U.S. election, and what many call a currently sluggish economy. Hopefully, the serious mood in Vegas and sales at the show are an indicator of a better fall (for all) to come; they certainly are for Jain.

“We are excited about the positive response and look forward to implementing new strategies based on our experiences at the show,” she says.

Business As Usual?

The mood of buyers at JCK Las Vegas was upbeat but intense; those who attended were on a mission. Data from JCK Events reveal that attendance was down by 700 guests compared with 2023. The total number was 17,300, which isn’t too shabby for the biggest fine-jewelry fair in North America.

“Even in times when there is uncertainty in the jewelry industry, JCK proves once again to be the place the entire industry gathers to source products, unveil new technologies and strategies, learn, discuss, network, and place orders for the rest of the selling season,” Sarin Bachmann, group vice president of RX’s jewelry portfolio and event leader for JCK, told the media.

As for the reason for the drop, rising costs play a role.

“Attendees of the show were much more focused than in previous years,” reveals Sam Hupp, vice president of sales for Paris 1901, a division of Prime Art & Jewel. “Buyers were staying less days and working to pack more meetings into the days attending. From conversations, this was due to the cost of hotels, etc.”

Monica McDaniel, vice president of marketing for Chatham, has similar observations. Business is steady, she maintains, and her clientele for manmade gems and gem-set jewelry are adapting quickly to challenges in the market. Among them is the diamond dilemma—“uncertainty surrounding the future of diamonds, lab-grown and mined,” she says.

This diamond doubt is helping to pave a path for interest in lab-grown color and its attainable pricing. Chatham is ready with “quality high-end looks at more affordable prices than like-quality mined pieces,” adds McDaniel. “Optimism and a level of heightened curiosity sums up this year’s show for Chatham, as well as our overall business for the year. Interest in the lab-grown color category is developing and picking up momentum.”

Eric Wadia, vice president of marketing and corporate communications at Asian Star Company, Ltd., noticed a different direction—renewed interest in mined diamonds because of the fluctuating costs of synthetics.

“Customers attended the show with clear and purposeful intentions, showing a strong interest in making informed and deliberate purchases,” he says. “Bridal jewelry remains the most dominant category for retailers. However, they have also observed a growing trend in self-purchasing, particularly in fashion jewelry.”

Shefi Diamonds’ Surbhi Jain, marketing director, also sees interest in fashion-forward styles. “Business has been fantastic this year, and our marketing services (including customizable catalogs) continue to set us apart from the competition.”

Wadia agrees on the offer of tailor-made jewels to satisfy client needs. “Business has been steady, with retailers effectively adapting to meet the diverse needs of customers and focusing on facilitating bespoke offerings.”

Hupp may be seeing the biggest business wins thus far this year. He cites double-digit sales increases and threefold growth in JCK appointments over last year.

“Categories and stories were more important than pricing,” he says. “We found that buyers were still looking for the newest trends, but they needed branding as a reason for their clientele to purchase.”

Jain agrees. “Our show was wonderful. Our marketing services, combined with stunning products, continue to differentiate us in the market.”

For sure, modern consumer behavior is driving these events. “Self-rewards to mark personal milestones and personal style are highly valued,” adds Wadia.

Tracking Trends

The annual trade fairs in Las Vegas are a hotspot for seeing new trends unfold. This year’s JCK Las Vegas show was no different, allowing retailers to eyeball the latest design inspirations, many of which will land in stores by the fourth quarter.

Top trends spied in Sin City include message jewelry and sentimental styles (still!). Zodiac pieces and heraldic symbols were important for ODI according to Valerie Fletcher, vice president of design and product development.

“Anything personal—initials, messages, symbols, and icons—did really well,” she says.

In metal-intense looks, layering chains of all types—from paper clip links to stations—and platinum fashion and vermeil designs sold well because of the price of gold.

“Paperclip-style necklaces and bracelets have officially moved from a trend to a true staple,” confirms Sam Hupp, vice president of sales for Paris 1901, a division of Prime Art & Jewel. “We have them in multiple brands in our fashion house in different sizes, metals, and finishes. They all seem to have a position and need without compromising sales growth.”

For ODI, Cuban links for men were hot. “Bracelets and necklaces are great sellers, especially with black diamonds,” adds Fletcher. And for platinum, bridal is the obvious choice but “delicate, everyday fashion pieces also did great at the show—definitely a lot of interest there,” she observes.

Another important trend is color. Pricing ups and downs in the diamond market are leading many to take a closer look at gemstones for important purchases like engagement rings and for fashion numbers. Color inspires everyone differently, and for every favorite hue, there’s a gemstone found in nature to match.

“We had a lot of requests for color—mostly amethyst and blue topaz,” notes Fletcher. “People asked for fashion looks with multiple stones.”

Color is the focus for Chatham, a maker of lab-grown jewels. At the show this year, clients were interested in two- and three-stone rings as well as dainty cuffs, all set with a variety of manmade gems, including synthetic emeralds. One of its best-sellers? A 5.50 ct. lab-grown oval ruby flanked by 3.30 cts. t.w. lab-grown half-moon-shape diamonds.

“This item was picked up by almost every visitor to that showcase,” says Monica McDaniel, vice president of marketing.

At Imperial, cultured freshwater and Akoya pearls were paired with aquamarine and morganite as well as enamel to create fresh looks for bridal and fashion. “We are pursuing pearl and enamel more and have designed a handful of very beautiful and saleable designs,” says Kathy Grenier, vice president of business relations.

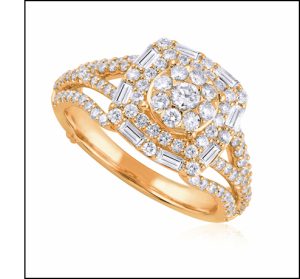

Finally, some diamond jewelry makers say they’re getting increased requests for cluster styles of natural or mined diamonds.

“Retailers are focusing on offering products with larger visual impacts,” says Eric Wadia, vice president of marketing and corporate communications at Asian Star Company, Ltd.

“Innovations in cluster plate designs have become a key strategy, allowing bridal jewelry to appear more substantial and luxurious. This approach helps natural diamonds stand out against the competition from lab-grown alternatives.”

Product Debuts

If you’ve followed new looks emerging from the Las Vegas trade shows, you may agree that jewelry merchandisers are doing their jobs well. That’s because what’s trending is also what’s showing up in new collections, giving retailers timely options to choose for this year’s holiday sales.

Color, trends, talismans, linear necklaces and bracelets, silver and vermeil fashion looks, and more, were among the offerings. High gold prices are paving the way for oversize sterling designs such as the Lux Silver collection from ODI.

“Big, bold looks with chunky silver mixed with sections of diamond pavé and link styles did especially well,” explains Valerie Fletcher, vice president of design and product development. “A lot of customers requested these styles in vermeil, which is not surprising considering the cost of gold.”

In her Men’s Shield Pendant collection, looks include lions and fleur-de-lis among others in matte-finished gold or sterling silver, sometimes with blackened effects. In Paris 1901’s men’s collection dubbed ETHOS, which debuted last year, sales were four times greater than in 2023. “Men’s jewelry was one of the biggest inquiries we had,” says Sam Hupp, vice president of sales. Paris 1901 is a division of Prime Art & Jewel. “There is a tremendous appetite for precious metal men’s jewelry. Retailers are moving away from steel and brass … looking for a higher ticket to move their clients into to make better use of the sale. A men’s steel ring is worth 30 margin dollars, but a men’s silver ring could be worth 200 margin dollars.”

More debuts for Paris 1901 include its Monte Luna lab-grown diamond fashion line and M by Monte Luna, a demi-fine lab-grown diamond line of fashion jewelry.

A point that all merchants must keep in mind, no matter the metal or design? The growth of the self-purchasing market for fashion-forward looks. It’s happening now, says Eric Wadia, vice president of marketing and corporate communications at Asian Star Company, Ltd.

“This shift presents a lucrative opportunity for retailers as more consumers are inclined to buy jewelry for personal enjoyment and expression,” he says.

To meet those needs, Wadia unveiled value-oriented cluster designs for natural diamonds, beaded metal styles with diamonds, modern pearl jewelry, and gemstone and diamond sets.

And given just how hot colored gemstone sales are, new offerings in those were available from both manmade gem maker Chatham and ODI. The latter’s Precious Crush designs featured—you guessed it—crushed gemstones encased in clear resin.

“Colors are bright and have a lot of sparkle,” says Fletcher. “Different gems can be combined to represent flags and sports teams.”

Two new collections from Chatham, meanwhile, cater to a higher-end clientele. The first features classic looks like tennis necklaces in 14k gold, and the second is made in 18k gold with bold cuts of its beautiful lab-grown gemstones like emeralds and diamonds.

“Both were met with incredible enthusiasm from retailers,” says Monica McDaniel, vice president of marketing.

Non-jewelry makers had their own special offerings. Consider The Kingswood Company, a producer of jewelry cleaner. It unveiled a new retail fixture program comprising freestanding units with more space for merchandising a jewelry care line than classic countertop fixtures.

“Three options are available in different footprints, each with unique features to integrate into a variety of sophisticated retail environments,” explains Heather Brown, vice president of content and editorial. “The fixtures are available to both private-label customers and those who stock the CLEAN+CARE® product line.”

After six months of use during a testing period, an Ohio-based merchant saw “a marked increase in jewelry care product sales,” shares Brown. “Essentially, the system is a silent salesperson, it is its own category—not an afterthought.”