Fancy Colored Diamond Market Review

The global market for fancy color diamonds is witnessing significant growth, driven by increasing demand from passionate collectors of high-end jewelry and individual investors. This market review by the Fancy Color Research Foundation aims to provide a concise overview of the current state of the fancy color diamond market, analyzing its unique qualities, jeweler approaches, and the remaining timeline for diamond mining.

Covering a wide range of topics, the report explores the history of fancy color diamonds, proper methods for visual analysis, and the challenges they face at auctions. It also discusses manufacturing trends, different diamond categories, and the appropriate approach for retailers when discussing rarity. For the first time, the report unveils the actual size of the wholesale market in terms of dollar amount and explains the price behavior across various weight groups.

Additionally, the report examines advanced grading approaches transforming trading and retail practices for these extraordinary gems. It also analyzes the key challenges and opportunities in the industry, addressing the threats faced by the fancy color diamond market.

With its comprehensive insights, this report provides valuable information for stakeholders, enabling them to navigate the dynamic landscape of the growing fancy-color diamond market.

HISTORY

Fancy color diamonds have been coveted throughout history for their rare and exotic hues. Some of the earliest records of these gems date back to the 6th century when diamonds from the Golconda mine in India were highly prized for their colorless clarity and occasional pink, blue, and yellow hues. These diamonds were incorporated into the jewels of royalty and aristocrats, including the famous Hope Diamond and many other important gems.

Throughout the centuries, fancy color diamonds continued to capture the attention of the world’s most wealthy and powerful individuals. In the 18th and 19th centuries, diamonds in shades of pink, blue, and green were highly valued, and many of these gems were set into exquisite pieces of jewelry worn by aristocrats. For example, the Grand Duchess Vladimir Tiara, created in the early 1900s, features numerous pink and white diamonds and was worn by the Romanovs, the ruling family of Russia. The Patiala Necklace (with a large vivid yellow center) was a necklace designed & made by the Cartier S.A. in 1928.

In the mid-20th century, fancy color diamonds became increasingly popular, with yellow diamonds in particular gaining attention. In 1961, the largest known yellow diamond at the time, the Tiffany Yellow Diamond, appeared in the iconic movie Breakfast At Tiffany’s and was the first ever fancy color diamond on the silver screen.

During the 1970s and 1980s, the market for fancy-color diamonds saw notable growth. Independent jewelers played a significant role in selling these rare diamonds to high-profile figures, including the Saudi royal family, the Sultan of Brunei (who still holds the world’s largest fancy color diamond collection), and other Middle Eastern leaders. Meanwhile, in the Western hemisphere, affluent industrialists and celebrities like Paul and Bunny Mellon, the Horten Family, Elizabeth Taylor, the Wallis Simpson family, and many more sought out these elusive diamonds without fully grasping their rarity or investment potential.

Privately owned jewelers played a crucial role in facilitating these sales, with many emerging from wholesale backgrounds and gaining a competitive advantage over larger brands as they made these multimillion-dollar purchases and sales by themselves while sharing the most intimate secrets of their clients. These visionaries became the founding fathers of the fancy color diamond history. Among them were esteemed names like Shlomo and Aliza Moussaieff, Laurence Graff, and David Morris from London; Harry Winston, Oscar Heyman, and Fred Leighton from New York; Alexander Reza from Paris; Maria Gaspari and the Bulgari family from Italy; Chopard, Mouawad, Chatila and the Gol Brothers from Geneva, Ephraim Zion from Hong Kong among many others who are not mentioned here. Moving into the 1980s and 1990s, pink diamonds experienced a surge in popularity. The fame of the Hancock Red (1987) paved the way to multimillion-dollar per carat prices paid for rare fancy color diamonds. Pink diamonds from the Argyle mine in Western Australia, particularly the vivid pink and red varieties, captured the attention of collectors and became highly sought-after. During the 1980s, Japanese collectors, known for their affinity for blue fancy color diamonds, also entered the diamond collectibles market, further fueling its growth.

In the early 2000s, a wide range of diamond colors began to capture the attention of collectors, with these colors fetching some of the highest prices ever seen for fancy-color diamonds. 2010 marked the year when new Chinese jewelry collectors noticeably gravitated towards fancy-color diamonds. Prices peaked and set a new threshold for almost all colors that year. Notable examples include the 12.03-carat Blue Moon diamond, selling for $48.5 million in 2015, the 14.62-carat Oppenheimer Blue, selling for $57.5 million in 2016 while one-carat vivid purplish pink diamonds, and the exclusive Argyle tenders sold for $1.5 million per carat and fancy red for over $3 million per carat. Finally, the 11.15-carat Williamson pink star broke all auction records with a $5.2 million per carat at Sotheby’s during 2022. Fancy color diamonds continue to captivate collectors and jewelry lovers with their rare beauty and unique characteristics and achieve even higher prices when sold behind closed doors, mainly through known jewelry designers and international jewelry brands.

ORIGIN & MINING

Most of the world’s unearthed diamonds are located 150-750 km below the Earth’s crust. Prehistoric volcanic eruptions brought a limited amount within reachable distance, down to a few hundred meters underneath the Earth’s crust. According to the Fancy Color Research Foundation review from 2019, considering the low likelihood of finding a few mega diamond mines in the next 30 years, the last diamonds will be mined in approximately 57 years.

Currently, 40 mines worldwide account for 90% of the world’s diamond production, but only 13% of them have a lifespan between 40 to 57 years. The availability of diamonds of all colors and quality levels will be affected, without exceptions. The finite number of diamonds in circulation will reach its end much sooner than jewelers realize. This is not a hyperbole; it is the most overlooked piece of information within the jewelry industry, with little knowledge available outside of it. Within this 40 to 57-year span, 98% of all diamond mines will be exhausted, and within 20 years, the majority of the 45 most notable diamond mines currently operating will cease to exist, creating a significant shortage in supply. Fancy color diamonds are formed underground alongside colorless diamonds and share the same fate.

There are no mines that yield a large amount of fancy-color diamonds. Most mines happen to randomly discover them in a small ratio among the colorless diamonds they extract, regardless of whether the mining is underground, alluvial, or marine. In certain geographic areas, it is possible to establish a connection between a specific color and size with its origin.

Here are a few examples.

- The Argyle mine in Western Australia reached the end of its life in 2022. Millions of carats of colorless and brown rough diamonds were extracted every year at a low price per carat. A fragment of them accounted for the largest amount of small pink diamonds in the world and the primary source of fancy vivid p/pink and red diamonds below 2 carats. These unique pink diamonds generated the highest average price per carat known to this day in relation to their weight. No other mine has uncovered this unique combination of color, size, and quantity of pink and red diamonds, and it seems like there won’t be anything similar in the foreseeable future. The remaining polished pink melée (0.01 to 0.14 carats) available in the market represents the final samples of this category.

- The Premier mine, also known as the Cullinan mine, is renowned for being the main producer of Type IIb blue fancy color Diamonds for many centuries. However, in other geographic regions, Type IIb blue rough diamonds are occasionally discovered as well, such as the Orapa Mine in Botswana, Sierra Leone, and occasionally Brazil.

India was once a significant producer of blue fancy color rough diamonds, including the famous Hope Diamond, but its diamond mines were depleted two centuries ago. Type Ia blue (or variations with green modifiers) diamonds can occasionally be found in the eastern part of the African continent. It is important to note that Type IIb is not a testimony of quality but rather an indicator of the source. - Yellow melée diamonds are primarily sourced from Congo. The unique visual characteristics and unmistakable rough shape of Congolese yellow diamonds led us to an unequivocal conclusion, through interviews with diamond traders in Surat, India, (the main hub of fancy color melée) that more than 90% of yellow melée in high saturations between 0.01 to 0.15 carats originate from Congo and are manufactured by one or two companies alone. The remaining 10% is divided among the Zimmi area in Sierra Leone, the Ural Mountains in the Russian Federation, and Africa. Each of these sources produces yellow fancy color diamonds with distinct color qualities and sizes. Experienced diamond dealers will find them quite easy to identify.

- Yellow fancy-colored rough diamonds, especially in larger sizes (above 2 carats), can be found in almost every diamond mine. However, they always represent only a fraction of the mine’s overall rough output, and it’s nearly impossible to trace them back to their specific mine based solely on their appearance once polished. That said, certain yellow fancy-color diamonds can be distinguished by their color characteristics, shape, or inclusions, both in their rough and polished states. For example, yellow diamonds from the Zimmi area in Sierra Leone stand out due to their distinct saturation and undertone, characteristic black inclusions, and absence of fluorescence. Similarly, yellow diamonds from the Misery pipe in the Northwest Territories of Canada are notable for their unique warm undertone.

- Pink fancy color diamonds, above the melee size category, are found in several mines, primarily in South Africa and Angola. Pink diamonds are also discovered in Russia, typically exhibiting a purple body color. Brazil is recognized for producing alluvial pink rough diamonds, and it serves almost as the last source of red diamonds.

- Green fancy color diamonds are found in some areas around the world, mainly in countries that are rich in radioactive elements, causing the green color. For example, Brazil, Africa, and Indonesia.

- Some blue, pink, yellow, and green fancy color diamonds, in smaller sizes, are unearthed in Indonesia, however, the amount is insignificant.

MANUFACTURING

Cutting and polishing of fancy color diamonds historically were done like colorless diamonds until the beginning of the 1980s. During this decade, diamond manufacturers started to explore new ways to reinforce the color by lengthening the distances light travels within a fancy color diamond and achieving higher saturations. In 1994, the grade vivid was introduced to describe diamonds with exceptional saturation, something that encouraged the industry to excel in the art of modifying the diamond’s facets to reinforce its color. On the other hand, clarity, symmetry, and polish were never considered significant influential parameters on price or demand until this day. In the early years of the new millennium, the knowledge about reinforcing a diamond’s color was used to achieve a higher saturation grade on the GIA report. Color dispersion on the face-up of a diamond came in second.

Today, fancy color manufacturers realize that fancy color diamonds with a fully colored face-up are considered more attractive, leading most manufacturers to master this technique.

For much of the late 20th century and into the early 21st century, most fancy color diamonds were modified from the colorless classic cut and exhibited a well-concentrated color under the table while leaving a noticeable colorless frame on the crown that surrounded the table.

In more recent years, a new cutting style was introduced that altered the approach to fancy-color diamonds. This relatively new cutting style allows for perfect color dispersion and has gained popularity in almost every market. However, it comes with the trade-offs of a slightly smaller face-up in relation to its weight and, in cushion-shaped diamonds, the replacement of the traditional rounded corners with pointy ones, resembling an actual bed pillow.

Initially, there was resistance to this new outline, but its design was deliberate to contribute to its perfect color dispersion. Without going into too many technical explanations, one of the key factors enhancing this high dispersion in these new cushion-shaped diamonds is indeed the pointy corners of the shape, which refract light more efficiently across the shape. The second modification in this modern cutting style is the split bezel on the crown, coupled with a lowered crown angle near the table. This change leads to greater weight loss, and to compensate, most manufacturers create an extremely thick girdle, resulting in a high depth percentage. Consequently, many of the new fancy color diamonds produced today have higher color dispersion and a smaller face-up compared to their predecessors.

FANCY COLOR DIAMOND CATEGORIES

In this chapter, we will examine and map the different segments of color diamonds that are available for jewelers. We will explore the distinct characteristics of each segment and discuss the potential sources from which they originate.

Yellow Melée

Yellow fancy color diamond melée comes in a wide range of shades and saturations, ranging from fancy light to fancy vivid, and deep. It also comes with various color modifiers such as orange, brown, or green with clarities ranging from VS to I2. Yellow melée is popular amongst jewelry designers and can be seen in almost any jewelry category, including in luxury watches. With the increasing popularity of lab-grown diamonds, the jewelry industry is adapting its approach towards fancy-color diamonds as well. In recent years, diamond wholesalers have been sending yellow diamonds to diamond laboratories to ensure that no lab-grown diamonds are mistakenly mixed in during the production process. This precautionary measure reflects the evolving dynamics of the industry. Highly saturated yellow fancy color melée is sourced mainly from Congo and manufactured in India. The average polished size produced from Congolese rough is between 1.2mm to 1.8mm. Sizes under 1 millimeter or larger than 2.8 millimeters are being produced in minimal quantities.

A similar category of diamonds can also be manufactured from yellow rough diamonds found in South Africa, but most of them will be with lighter saturations ranging from fancy light to fancy intense yellow, and a large portion will be in larger sizes from 2.5 to 3.2 millimeters although smaller size is available as well. Melée diamonds sourced from Sierra Leone typically offer larger sizes with a unique color sensation, ranging mainly from fancy intense to fancy vivid. The clarities of these diamonds usually range from VVS to SI1.

Pink Melée

Pink melée has been unearthed in the Argyle mine in Australia. These diamonds exhibit a range of intensities and sizes, ranging from faint to vivid, ranging from a “warm” orangey/brownish pink to a “cold” purple pink. Although the majority of these pink diamonds possess a blue fluorescent property, it does not impact their appearance. The size of pink melée diamonds typically ranges from 0.01 to 0.14 carats in all clarity grades. Rough diamonds that yield pink melée are no longer available. According to our estimates, 5,000 to 10,000 carats are remaining on the market, stored with dozens of wholesalers and jewelers. Once the supply of pink melée runs out, this category will no longer be available for anyone. Following our conversation with manufacturers, we did not find any evidence to suggest the existence of another source for the small pink rough.

Other regions that produce pink rough in these small sizes account for less than 1% of the overall amount.

* The Argyle mine also produced a smaller-sized category of violet-gray diamonds.

Yellow Diamonds between 0.20 to 0.99

Yellow fancy color diamonds, primarily in sizes ranging from 0.20 to 0.99 carats and in shapes other than rounds, constitute the second-largest section in terms of unit numbers, following melée diamonds. Each year, thousands of these diamonds, predominantly in cushion and radiant cuts with a smaller portion in other fancy shapes, enter the market, with the majority accompanied by GIA reports. The significant quantity of diamonds in this category enables the crafting of relatively uniform and consistent layouts for necklaces, bracelets, and eternity rings. Recently, there’s been a notable increase in the number of diamonds within this size range that feature higher clarities and consistent makes.

Yellow diamonds from 1 carat and above

Yellow fancy color diamonds in this category represent the most popular article. Lighter colors and smaller sizes represent the entry-level diamond in a single piece of jewelry while large yellow diamonds, or midsize intense and vivid yellow are coveted by diamond connoisseurs as they create a strong visual impact with their pleasant yellow color and are considered to be quite rare. Exceptionally large fancy vivid yellow diamonds sometimes fetch prices per carat, of light pink or blue diamonds.

Exotic colors – all sizes

We have divided this category into two groups. The first group includes colors that are either in their single form or diamonds that have a color modifier other than brown or gray. This group includes colors such as bluish-green, yellow-orange, purplish pink, and pinkish orange, as well as single-color diamonds like blue, red, purple, pink, green, and others.

Diamonds in this color section are typically found at top retailers and are sought after by savvy diamond lovers who recognize the long-term wealth preservation element or aim to differentiate themselves with their jewelry collection. Diamonds with these colors can reach the highest price per carat in the diamond market.

The second group comprises diamonds with an earthy color palette, exhibiting a combination of brown or gray with other colors. Examples include fancy yellowish-brownish orange or fancy grayish green, among others. This group is considered to be more accessible in price but can still have a significant impact on a piece of jewelry.

MARKET SIZE

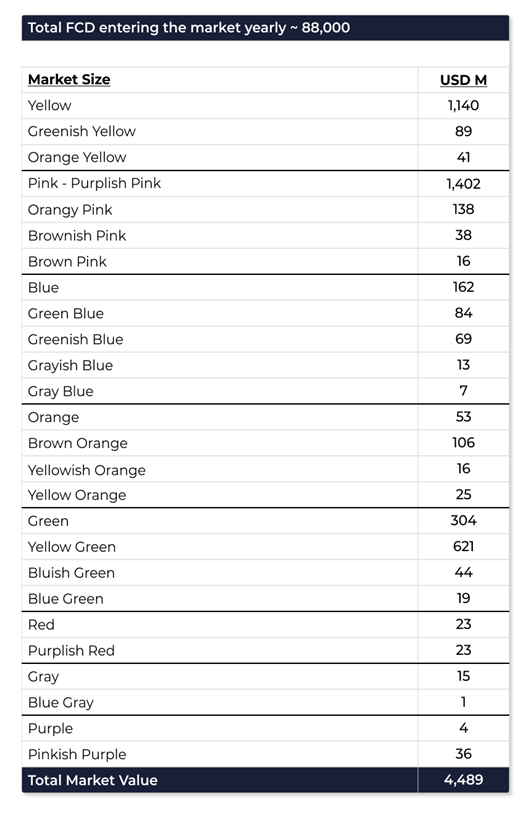

In an effort to estimate the total value of fancy color diamonds (FCDs) produced annually (referred to as “Market Size”), one must estimate the total number of FCDs produced each year in every color, size, and saturation. Then, this number needs to be multiplied by the market value of each diamond “type.” For instance, to calculate the market size of 5-carat Fancy Yellow diamonds produced annually in all shapes (~X), one needs to consider the wholesale price per carat, obtained from the Fancy Color Diamond Index, and multiply it by the number of diamonds of this “type”. Given the vast range of sizes (up to 100 carats), the multitude of colors with modifiers, a variety of saturations, and different clarities, there are thousands of diamond “types” in the FCD market. To handle this extensive number, a sensible methodology needs to be implemented, which will be further detailed. For this exercise, we utilized all relevant databases of the FCRF, including the “Rarity database” and the “FCRF Price Index”. We also gathered additional information from market suppliers as necessary.

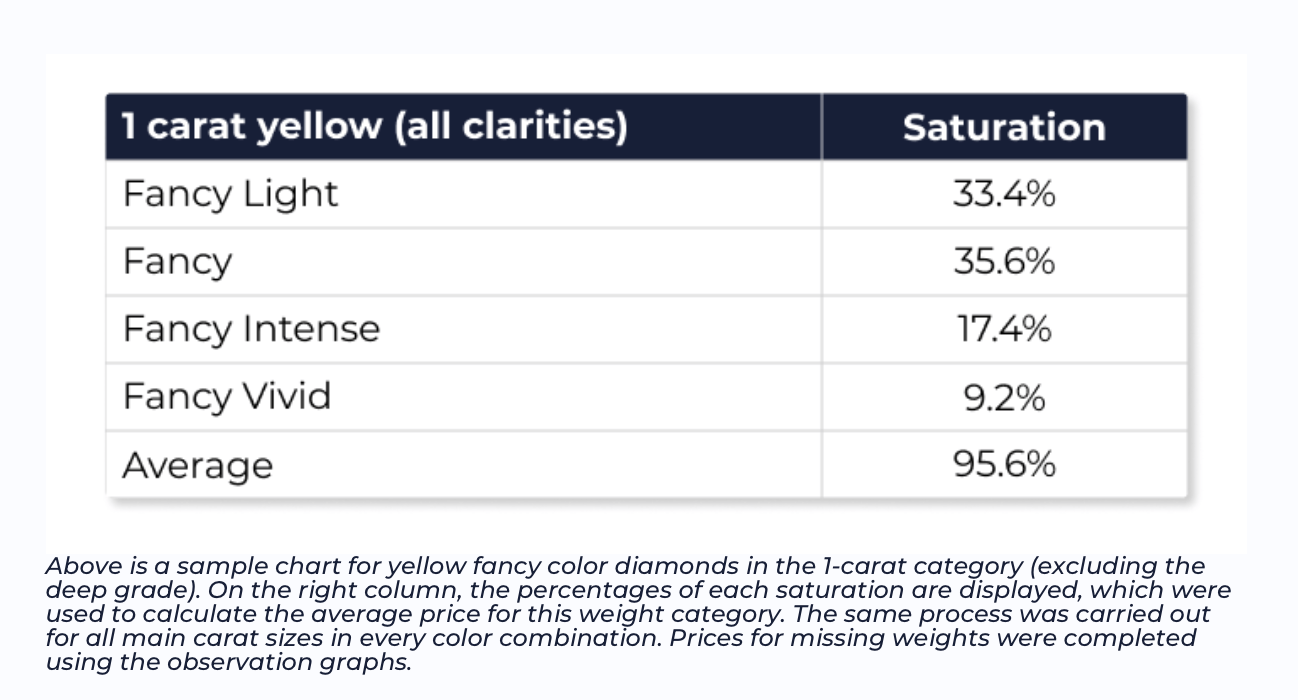

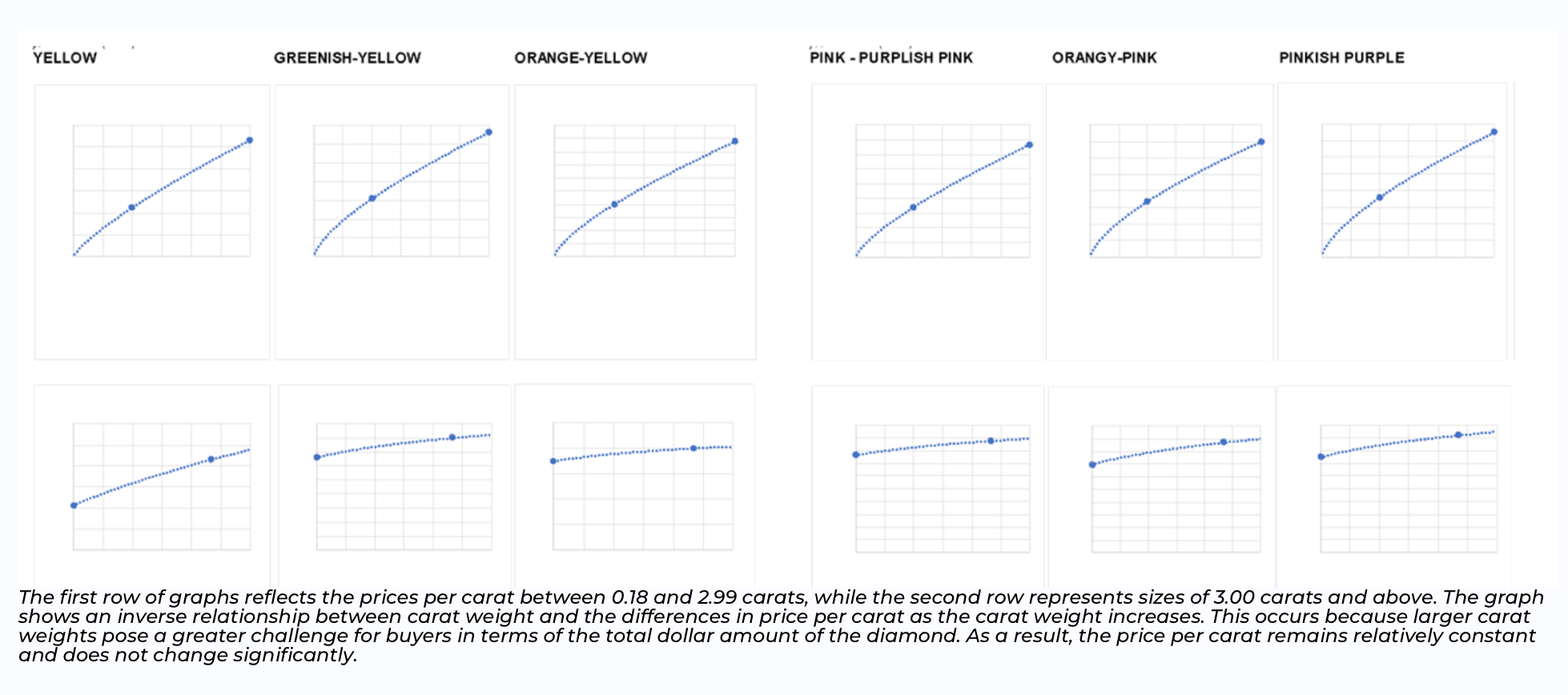

Our approach began with outlining the total number of diamonds in 25 different weight categories for each diamond color, encompassing all shapes and saturations. We specifically selected three weights (1, 3, and 10 carats) for each diamond color and calculated the average price per carat at each weight, taking into account the breakdown of saturations relevant to the given weight. See the example below.

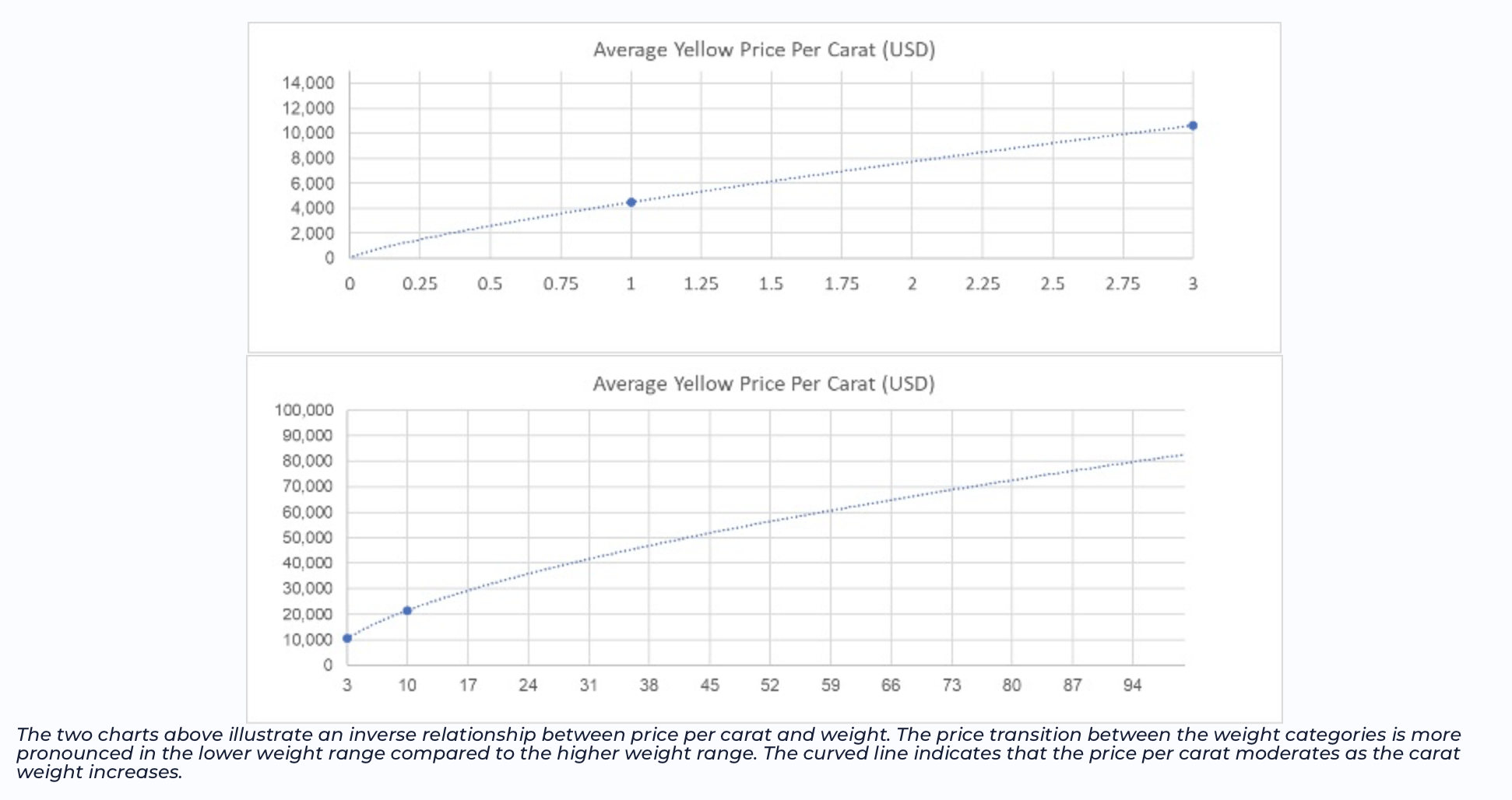

To calculate the price per carat for each weight category under 3 carats the average price for 1 carat and 3 carats was used to create the price trend for low-weight diamonds (0.18 carat to 2.99 carat). See the graph below for Yellow diamonds.

The total number of new fancy-color diamonds entering the market and passing through the GIA lab in a year is estimated to range from 90,000 to 110,000. This figure also includes diamonds from the preowned market that receive a new report. Please note that fancy color diamonds without a GIA report are not accounted for in this estimation.

* The numbers in the table include all possible modifiers and color combinations, which are included within the solid colors figures. The Red market value reflects the pre-closure period of the Argyle mine.

THE WHOLESALE ECOSYSTEM

According to the World Federation of Diamond Bourses, 28,780 registered companies act under the umbrella of this organization that represents the wholesale segment of the diamond industry. With bourses in Tel Aviv and Australia, Antwerp, and South Africa, New York and Tokyo, Mumbai to the West coast of the USA, and many others. It is important to note that there are relevant trading centers that are not included under this organization whose contribution cannot be ignored such as Switzerland, Brazil, Russia, and Indonesia.

Out of all these markets, the estimated global number of companies who actively manufacture and trade within this $4.5 billion dollar market of natural fancy color diamonds is estimated to be between 350 to 400 companies, in various sizes.

The unique fancy color diamond segment includes a variety of companies and individuals who specialize in different parts of this multi-faceted industry. Indian companies produce thousands of carats of melée as well as independent adventurers from Antwerp who travel to the forests of Brazil, whose entire yearly activity can be summed up in 30 diamonds with exotic colors. It includes veteran dealers from Geneva who specialize in rare diamonds, as well as mid-size dealers on the east and west coast of the US, servicing the largest market in the world of independent jewelry stores, situated between the two coasts. It also includes the Israeli diamond bourse which is the most active marketplace of fancy color specialists situated under one roof and Far East diamond traders who supply the needs of novice Chinese clients.

Meanwhile, the trade of fancy-color rough diamonds has undergone significant changes. Previously, it was common for rough dealers to trade color rough with manufacturers. However, the current trend involves rough dealers receiving color rough from mining companies and either manufacturing it themselves or collaborating with other traders who possess the expertise to market it downstream and maximize profitability. This shift reflects a new approach in the industry’s supply chain for fancy-color rough diamonds.

Source: The Fancy Color Research Foundation