Fraud and Mitigating Risk:

A Retail Educational Opportunity

NEW YORK – The Plumb Club presented an important retailer learning opportunity in connection with Jewelers of America (JA) and Synchrony Bank. The virtual presentation, “How Big is Fraud – Mitigating Your Risk”, was held in the Jewelers Resource Center Auditorium on Wednesday, July 27th at 1pm (EDT) and was open to the entire jewelry industry.

View the Recording of this Presentation Below

So, how big is fraud in retail? It is estimated that by 2023, retailers will be losing $130 billion yearly to fraudulent transactions. That number is expected to continue to rise annually!

Attending retailers will learn about:

- Various types of fraud:

- Internal (fraudulent refunds and credits)

- External (identity theft, synthetic theft, first-party fraud, lost/stolen fraud, counterfeit fraud, account take-over fraud.

- Key indicators of fraud, including identifying client behavior and patterns that could alert a sales associate to potentially fraudulent transactions before they happen.

- Employee training and internal controls a store owner can implement to help mitigate risk.

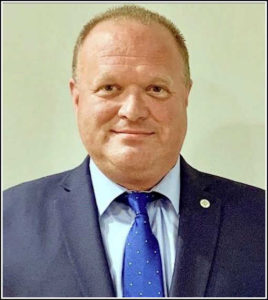

This essential retailer information, along with statistics, insights, and prevention tips, will be presented by Mark Solomon, vice president of fraud investigations, Synchrony Bank. Solomon is responsible for investigating large-scale fraud, financial and cybercriminal activities for the institution.

This essential retailer information, along with statistics, insights, and prevention tips, will be presented by Mark Solomon, vice president of fraud investigations, Synchrony Bank. Solomon is responsible for investigating large-scale fraud, financial and cybercriminal activities for the institution.

Prior to Synchrony, Solomon retired as “Detective 1st Grade” after a distinguished 26-year career with the Greenwich Police Department. He spent more than 18 years serving in the Detective Division, with 11 years assigned to the CT Financial Crime Task Force (U.S. Secret Service).

![]()