It’s a Woman’s World

The Future is Female

The Future is Female

The purchasing power of women in the United States ranges from $5 trillion to $15 trillion annually, touts Girl Power Marketing, communication, influencer and brand experiences agency. Women control more than 60% of all personal wealth in the U.S. Over the next decade women will control two-thirds of all consumer wealth in the country and be the beneficiaries of the largest transference of wealth in our history, an estimated $12 to $40 trillion.

Women are definitely buying more jewelry for themselves, according to Lyst, the world’s largest fashion search platform, as reported in an August 9, 2017, article in Forbes, “Female Self-Purchasing Isn’t Just A Jewelry Industry Pipedream.” The author, Rachelle Bergstein, writes that “whether it’s the result of increased female agency, greater economic empowerment, or the ease and temptations of online shopping and social media,” the percentage of women compared to men on Lyst who purchase women’s jewelry has increased 14% from 2016 to 2017.

The article also cites De Beers Group 2016 Diamond Insight Report that identified “the self-purchase trend as one of the clearest opportunities for future growth” in the jewelry industry. And, an article published in Racked last February titled: “The New Tiffany & Co. Needs Women” that reported attracting female self-purchasers the focus of its strategy moving forward.

Lyst told Forbes that women make 78% of women’s jewelry purchases. While women are likely to spend less on individual pieces than men, Lyst found that they buy up to three times more jewelry. They’re shopping for jewelry the way they shop for shoes and handbags, as accessible, justifiable indulgences.

In a May 2017 study, MVI Marketing through its Jewelry Consumer Council reveals that women continue to have a strong emotional bond with wearing fine jewelry. Over 67% said wearing fine jewelry makes them feel “special”, with more than 91% saying they want to purchase more, and nearly 60% saying they need no special occasion to do it.

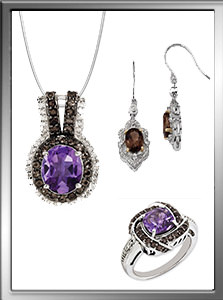

Marty Hurwitz, CEO of the Los Angeles-based jewelry-focused marketing firm, reports that jewelry retailers continue to lag in this important consumer segment. Self-purchasing females, particularly younger women say they don’t see variety, color or fashion styles well represented in fine jewelry stores. They say they are interested in more color to go with their outfits, with at least one-quarter of self-purchasing women expecting to buy jewelry containing a gemstone or pearl at least once in a year.

Color Destination

Atlanta designer Sara Blaine says that women make better purchases for themselves than men do. She points out that women don’t send their boyfriend or husband to buy shoes, a handbag, or dress for them because they don’t know what he might come back with; the same goes for jewelry. If there is one trend that drives that point home is that few men buy engagement rings anymore without input from their fiancées.

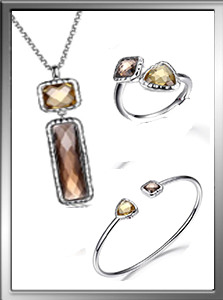

With online shopping and social media women are buying more jewelry for themselves, reports Maren Spence, merchandise manager for Ostbye, Minneapolis, Minnesota. “There is a big opportunity for growth in marketing to self-purchasing women because women are not waiting for men to buy them jewelry like it was positioned in the past. Stores can work on merchandising specifically for this, training staff and posting on social media.”

With online shopping and social media women are buying more jewelry for themselves, reports Maren Spence, merchandise manager for Ostbye, Minneapolis, Minnesota. “There is a big opportunity for growth in marketing to self-purchasing women because women are not waiting for men to buy them jewelry like it was positioned in the past. Stores can work on merchandising specifically for this, training staff and posting on social media.”

Alisa Bunger, director of sales, B88 Division of the Dallas-based Prime Art Jewel, known for its Elle Jewelry brand, says it’s all about making the experience “guilt-free” with designs that complement a woman’s wardrobe and are attainable. Research by MVI, as well as National Jeweler magazine in 2017 concurs that the average retail price per unit popular for self-purchase women is under $1,000.

“Everyone has a favorite color and color stone jewelry sells year round,” says Cora Lee Colaizzi, director of marketing and catalogs and senior merchandiser Quality Gold, Fairfield, Ohio. “Jewelers can’t rely on bridal where margins are declining. Most complain about price shopping customers and seasonal/price-points where there’s so much competition for the dollar.” She notes that retailers who merchandise cases to draw attention from all buyers throughout the year and position themselves as color experts in their communities are successful.