While proper sendoff gifts for young people on their journey to adulthood vary as much as the degrees they’ve secured, choosing a graduation gift needn’t be complicated. Giving fine jewelry sends a strong message—your accomplishment is worthy of note and has great value, like a karat gold keepsake. This is why gold remains a top choice among givers; it has lasting value, sends a positive message, and looks tasteful atop all types of professional dress.

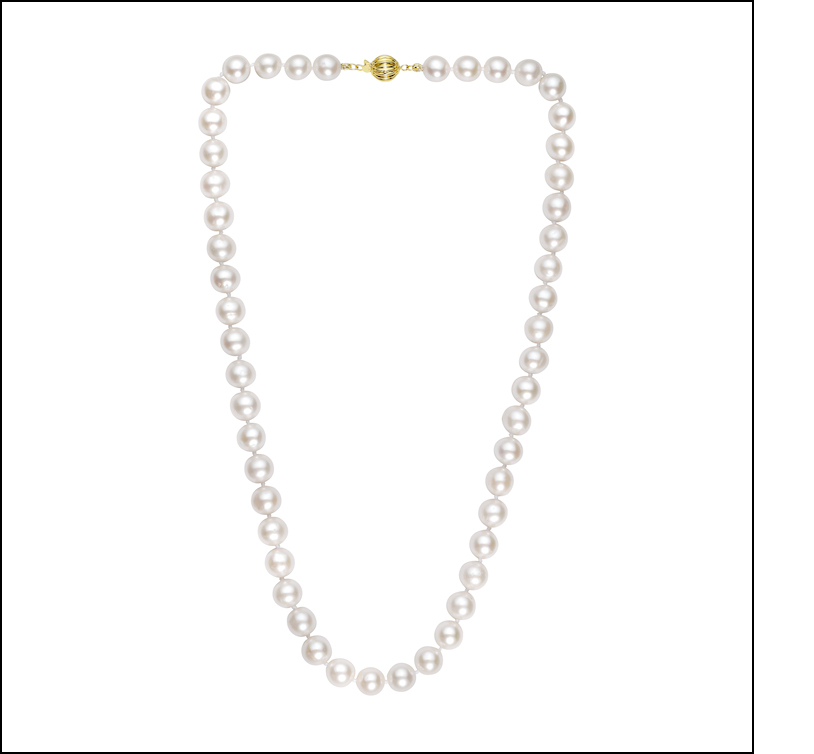

Manufacturers have plenty of style recommendations for merchants beyond class rings. Those seeking some guidance should consider starting grads with the classics—diamond or pearl studs, gold hoop earrings, or stackable rings. “For young people who are just starting to build a jewelry collection, the basics are always appreciated,” observes Valerie Fletcher, vice president of design and product development at ODI / Original Designs.

PeriLynn Glasner, design and marketing director at Lali Jewels, agrees. “You can’t go wrong with classic pearls or diamonds as well as something in the gemstone color of the grad’s school or birthstone,” she explains.

The classic diamond pendant, line bracelet, or ring are other go-to gifts. “These never go out of style,” she adds.

More timeless choices, some of which can certainly be budget friendly, involve “earrings or pendants as they eliminate the need to know a specific size,” notes Surbhi Jain, marketing director at Shefi Diamonds.

An option that Jain offers his clients? Baguette-cut gemstone and round diamond cross pendants from his company’s Majestic Gems offerings.

“They’re ideal for graduates and other occasions,” Surbhi says. Shefi’s styles are available in ruby, emerald, and sapphire in white and yellow gold—classic looks that will endure.

Meanwhile, Royal Chain’s Phillip Gabriel Maroof, vice president of marketing and design, maintains that his most ordered grad gifts are “smaller gold pendants and thinner bracelet styles that are fashionable without breaking the bank.”

“This year, we encourage our retail clients to order more variety in gold earrings—don’t be afraid of bigger styles,” he says. “For 2024, Royal Chain is debuting Raindrop stud earrings as well as our Heart Tag rolo link chains.”

Heart tag bracelets and necklaces are an oft-worn style in karat gold or sterling silver as well as a look that is hard to miss in many a young woman’s personal collection.

Personalized pieces that mark a moment or accomplishment are also a good idea.

“For something more meaningful, consider pieces that represent achievement, a journey, or a bright future, like a compass with a sentimental message engraved on the back,” says Fletcher.

Her firm’s yellow gold compass pendant necklace makes a bold statement in yellow gold with diamond accents.

Other gifts that aid with organization and personal care are also available. For example, jewelry cleaning kits that combine two or more products designed to care for a variety of jewelry pieces can be optimal selections for women and men.

“Many of these young people will have received class rings or other jewelry gifts to celebrate their accomplishment (think watches and necklaces), so having the right products to clean these fine pieces is ideal,” says Heather Brown, vice president of content and editorial for The Kingswood Company.

While Mom and Dad may forever treasure the macaroni necklace you made for them in kindergarten, adult children can gift with a little more gusto (and gold). It’s safe to say that few mothers have ever turned their nose up at a necklace. That’s why retailers have them at the ready come May; surely motherly appreciation should be available in forms other than Hallmark cards and brunch.

Enter the manufacturers, with a bevy of new precious offerings. The Plumb Club talked to some of the largest and most directional makers about how they’re stocking clients’ stores.

The most frequently ordered items are karat gold pendants, bracelets, and hoop earrings. Prime Art & Jewel’s Susie Wilty, director of sales, knows that bracelets stack just as well (or better) as rings and make for easy gifts to give annually. “Bracelets are nice to build on year over year,” she says.

At the Royal Chain Group, gold hoop earrings and heart pendants are top sellers, though bracelets aren’t far behind.

“We’ve seen bracelets perform well during the [spring] season,” says Phillip Gabriel Maroof, vice president of marketing and design. “These holidays are typically our best sales period for gold outside of the winter period.”

Maroof expects bead styles to do well this year and has added a two-tone rose and white gold version to its best-selling Ice chain. “We also introduced a new line of gemstone-accented paperclip bracelets in four color options and new vintage-style hand-engraved 14k gold bangles,” he says.

At Shefi Diamonds, moms love 14k gold and diamond dangling earrings in different shapes, and Lali Jewels maintains that its matching sets have some appeal. ODI features mother-and-child pendants that are “less traditional and more trend-driven,” à la enamel, texturing, and personalization, according to Valerie Fletcher, vice president of design and product development. “Spring themes like butterflies and flowers are also popular as well as gifts for nontraditional moms,” she adds. “Fur babies count! Paws and other pet-theme jewelry sell well.”

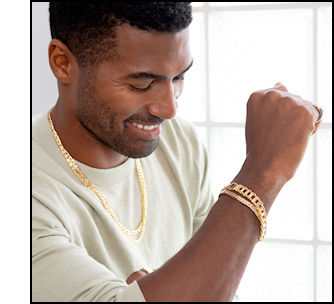

For dads, the options have improved a great deal over the last several years. A demand for better men’s jewelry has paved the way for “clean, crisp, and classic” numbers, according to Fletcher.

“The trusty ‘Dad’ ring has been displaced by a plethora of unfussy, understated men’s jewelry,” she continues. Among them are dog tags or shield-shape pendants “with emblems or icons that have meaning for the wearer, or ID bracelets.”

She particularly loves multiple ID bracelets that can be engraved or personalized with kids’ names.

Bracelets for men are another popular choice at Phillip Gavriel, which unveiled curb chains with e-coatings and double paperclip links in sterling silver with 18k yellow gold accents. A sterling twisted cable bracelet is also new, as are two-tone sterling and karat gold styles which are “a great option for customers seeking a lower price point,” says Maroof.

Two-tone styles are also popular among Shefi Diamonds’ shoppers. Its Shefian Men’s Collection features looks, including rings, accented with various carat weights of diamonds. Rings for dads are a hit at Lali Jewels as well, and while Wilty’s Ethos men’s collection has some, too, its pendants and bracelets are most popular. Prime Art & Jewel unveiled the line at the 2023 JCK Las Vegas show, and retailer faves included chunky chain, black sapphires and statement pieces. “These are classics that will stand the test of time,” Wilty explains.

Two important reminders: don’t neglect to merchandise the inventory you already have on hand for sales and don’t forget to offer care and cleaning products as add-on sales.

With regard to the latter, suggest products that are made specifically for certain types of jewelry, encourages Heather Brown, vice president of content and editorial for The Kingswood Company. “For example, a gentle jewelry cleaning formula is perfect for pearls, while a jewelry cleaning wipe is ideal for a watch,” she says.

Perhaps the best insight for Mothers and Father’s Day sales is to zero in on the recipient’s taste rather than following trends exclusively.

“Gifts should be as personal as the individual,” explains Wilty. “Every item can be special when shopping for an individual.”

Traditional spring buying opportunities include Mothers & Father’s Day and graduation gifts, but there’s another non-Hallmark holiday for which the jewelry industry can thank the Richline Group (RG): May Is Gold Month (MIGM).

RG started MIGM 21 years ago as a marketing idea. Since then, it has blossomed into a trademarked calendar event that benefits anyone who sells karat gold, not just the 20 retailers with which RG officially works, providing creative assets and paid social media posts and enlisting influencers for further promotion.

“MIGM is much more than a marketing campaign for us,” explains Elaine Klopman, RG’s director of marketing. “It’s an opportunity to highlight the appeal and beauty of gold jewelry and elevate the entire category of karat gold.”

Still, despite the massive opportunity that MIGM provides, the industry can’t ignore the realities of 2024: mixed reports on fourth-quarter 2023 sales and an impending U.S. election. How are both affecting sales now, and could these events diminish consumer excitement for innovations in karat-gold jewelry designs? Industry titans weigh in.

Capitalizing on May Is Gold Month

Considering that the Richline Group (RG) is a vertically integrated presence throughout the precious materials supply chain, from manufacturing to marketing, its 21-year-old May Is Gold Month (MIGM) initiative makes much sense. Gold is part of the DNA of its properties and of those firms they serve.

Casting a spotlight on karat-gold jewelry is an obvious goal for the jewelry conglomerate, but another “is to ensure the retailers can make the most of MIGM by tailoring their promotions to fit their brand and customers’ expectations,” says Elaine Klopman, director of marketing.

Many in the industry, including Klopman, know that MIGM’s momentum certainly lasts longer than the month itself.

“Promoting gold jewelry goes beyond May,” she continues. “We are always looking for creative ways to highlight the gold category, working with our clients all year on different sales and marketing campaigns.”

Shefi Diamonds’ Surbhi Jain, marketing director, agrees.

“MIGM can be a fantastic promotional opportunity in the jewelry industry,” she says. “Capitalizing on this theme can enhance our brand visibility and potentially boost sales.”

And given the collective commercial power that MIGM partners provide, it’s not surprising that non-RG partners benefit as well. Just like generic diamond ads from the De Beers Group aid the entire jewelry industry, so, too, do MIGM promotions. Call it riding on RG’s coattails or just flat out effective, MIGM is an approaching calendar date that no one should ignore.

Quality Gold, Inc. needs no convincing. “Gold is a 365-day product,” confirms Cora Lee Colaizzi, marketing director, whose clients include it in promotions year-round—not just Mother’s Day and in May.

Marketing materials highlighting basics, religious jewelry, and best sellers are available for active clients on QGold.com. Additionally, a resource section on the site “contains templates for digital banners, social media posts, and print concepts that the retailer can edit to use,” Colaizzi notes. Meanwhile, trendier products within its Leslie’s and HERCO brands also have their own marketing materials.

At Ostbye, marketing manager Theresa Namie and her team share product photography and reels with retailers to use on their social media platforms. And this year, bold gold designs are a key component of their merchandising mix considering what she calls a “resurgence of yellow gold in 2023.” May is perfectly timed with some of the firm’s newest releases, including a new gold bridal collection “just in time for MIGM,” Namie adds.

Shefi Diamonds also sees a great opportunity for yellow gold in 2024 and will also capitalize on MIGM through email newsletters to its clients and time-sensitive promotions and discounts. Social media posts highlighting gold jewelry will include relevant hashtags such as “#MayIsGoldMonth and #GoldenMay,” according to Jain.

Finally, Heather Brown, vice president of content and editorial for The Kingswood Company, a maker of cleaning products for fine jewelry, encourages retailers to offer information about how to care for gold jewelry, such as soaking pieces in a specially formulated solution and buffing it with a polishing cloth after it dries. “Offering clients useful jewelry care and cleaning information allows them to enjoy their gold jewelry, both new and old, for a lifetime,” she says.

Is the Jewelry Business Golden in 2024?

Cautious optimism is on the minds of many merchants this year, according to manufacturers and brands. Those sentiments aren’t exactly shocking given that the U.S. is heading into an election year, which are notoriously unpredictable; the nation is divided on who will win the election, what new policies they might implement, and how they will affect small business.

“All the news about tough socioeconomic times didn’t impact the independent jeweler much in the fourth quarter of 2023,” insists Cora Lee Colaizzi, marketing director, Quality Gold (QG). “I think the end consumer enjoyed returning to Main Street after the last few years of COVID and restrictions. People are shopping bricks-and-mortar stores.”

Her colleague and national sales director, Jeff Wynkoop, agrees. “People want to get out and shop,” he observes. Plus, retailers tell him that foot traffic in stores is higher than before the pandemic. “In my meetings, our retailers are excited and continue to source new merchandise to show their customers,” he says.

To keep the momentum going, Wynkoop advises retailers to stay focused on their branding and social media pages.

“Buying metrics and analytics have shown us that younger buyers are doing their research online but coming to brick-and-mortar retail stores to get an experience when they purchase,” he says. Take advantage of the traffic and give the consumer an experience they will remember and want to tell others about.”

And while QG merchants are enjoying client face time in stores, Ostbye clients express opposite concerns. Among them? Online sales competition, how to continually drive traffic into stores, “and keep them true to your business,” says marketing manager Theresa Namie.

Differences aside, most say that 2024 has started off well. “Expectations are focused on maintaining flat or slightly above last year,” explains Namie.

An interesting bright spot in the eyes of Lachish Awad, manager of the customer service department for the Elegant Collection for Jasani USA: post-holiday sales are improving. “Most of our clients have exhausted their inventories and are placing orders with us,” he reveals.

As far as what is selling—beyond karat-gold staples—think colored gemstones and diamond-accented Mother’s Day gifts. “There’s a notable demand for precious color gemstones,” observes Surbhi Jain, marketing director of Shefi Diamonds. She points to her brand’s Majestic Gem Collection of baguette-cut colored stone crosses and birthstone collections as proof. These, she continues, “have been warmly embraced by retailers and serve as the ideal gift for any occasion throughout the year.”

Birthstone jewelry moves for Ostbye’s clients, too, who also buy wide gold diamond fashion bands and celestial, ribbon, and leaf motifs. Other fast sellers include heart and cross pendants, yellow gold bridal styles (including ring wraps and inserts), stackables, signets, and medallions. “They are great personal gifts to give,” says Theresa Namie, marketing manager.

“The demand for 14k yellow gold has been high for the last few years after so many years of 14k white gold dominating,” observes Colaizzi. “When the gold price is high, yellow gold owns the center stage in the gold jewelry segment. If COVID proved anything to us, it’s that jewelry is timeless and pandemic-proof!”

Innovations in Gold Jewelry

While karat-gold basics are a perennial favorite, it’s newness that draws customers into stores. New designs are the lifeblood of the fine-jewelry business, and gold is an inventory staple; together, and under the direction of karat gold manufacturing, design, and merchandising pros, innovations in gold jewelry continue to drive businesses forward.

At Shefi Diamonds, diverse textures enhance creations, add drama and emphasis to elevate specific areas of interest, and more.

“Texture enhances the overall richness and value of creations,” according to Surbhi Jain, marketing director, whose Textura collection exemplifies the effect. “We’re seeing a growing inclination towards textured designs.”

It’s a similar story at the Elegant Collection for Jasani USA, which is adding different textured and finished pieces, including lightweight bracelets and flexible bangles, to its inventory. “Our retail clients are asking for them,” confirms Lachish Awad, manager of customer service.

Ostbye’s customers love convertible styles. Consider the brand’s 3-in-1 Enhanceables pendants that morph into earrings that can look like two different ones in a single pair.

“Clients like designs that can be worn in more ways than one,” says Theresa Namie, marketing manager.

To stay on top of client preferences and product directions, Namie devotes ample time to research. “We listen to our customers, watch for strong trends, attend trade shows, and constantly check out social media platforms,” she says.

Ditto for Cora Lee Colaizzi, marketing director, Quality Gold, Inc.

“Our research and development team watches fashion and keeps an eye on designers,” she says. “Our merchandisers attend international shows and are in touch with the top factories globally. And, of course, we listen to our retailers. They have an open line to the brand managers and our sales staff. We will do our best to source something for them if they want something specific.”

Quality Gold’s (QG) collections today include variations on popular link styles like the paperclip, puffed mariner, pocket watch chains, and mixed styles of chains like a byzantine with a more traditional link. The result is a modern option. In its Herco division, expect to see more endless clasp options “that give the impression that they are part of the chain,” explains brand director Paula Garcia. “We have findings that can be easily added so charms are hung from it in the front of the neck,” she continues. Her assortment of bracelets between 10 mm and 30 mm is also increasing.

“We are adding pieces with textures and trendy patterns to mix and match with basics,” she says. “There will be some geometrics with crisp edges, and the HERCO product has a presence. My customer loves solid styles and products with weight and craftsmanship, and we listen to our customers as we decide on products to add to the brand.”

And while innovations are important, so are fashion trends. QG sees a return to styling from the 1980s and 1990s, including yellow gold, bold forms, oversize earrings, bib necklaces, and heavier links.

“Retailers aren’t asking us as much for innovative jewelry as much as they want fashion-forward and trending pieces for their stores that will sell,” adds Colaizzi. “Our retailers want to remain relevant and have options to provide customers seeking a trendy piece or two to freshen their choices and mix with their bread-and-butter basics.”

At the Richline Group, it is leaning heavily into 3D manufacturing, which is evident in its new 3D Men’s Collection.

“We feel that innovation in 3D is in its infancy and that the potential is limitless,” says Elaine Klopman, director of marketing. “One of the advantages of working in 3D is that it allows us to develop fully backed cast product made as one single cast unit whereas in the past, this was impossible to achieve. One of our latest designs, our dagger pendant, features a snake coiled around the dagger, which would have been very difficult if not impossible to achieve with this level of intricate characteristics before the evolution of 3D execution.”

While karat-gold basics are a perennial favorite, it’s newness that draws customers into stores. New designs are the lifeblood of the fine-jewelry business, and gold is an inventory staple; together, and under the direction of karat gold manufacturing, design, and merchandising pros, innovations in gold jewelry continue to drive businesses forward.

At Shefi Diamonds, diverse textures enhance creations, add drama and emphasis to elevate specific areas of interest, and more.

“Texture enhances the overall richness and value of creations,” according to Surbhi Jain, marketing director, whose Textura collection exemplifies the effect. “We’re seeing a growing inclination towards textured designs.”

It’s a similar story at the Elegant Collection for Jasani USA, which is adding different textured and finished pieces, including lightweight bracelets and flexible bangles, to its inventory. “Our retail clients are asking for them,” confirms Lachish Awad, manager of customer service.

Ostbye’s customers love convertible styles. Consider the brand’s 3-in-1 Enhanceables pendants that morph into earrings that can look like two different ones in a single pair.

“Clients like designs that can be worn in more ways than one,” says Theresa Namie, marketing manager.

To stay on top of client preferences and product directions, Namie devotes ample time to research. “We listen to our customers, watch for strong trends, attend trade shows, and constantly check out social media platforms,” she says.

Ditto for Cora Lee Colaizzi, marketing director, Quality Gold, Inc.

“Our research and development team watches fashion and keeps an eye on designers,” she says. “Our merchandisers attend international shows and are in touch with the top factories globally. And, of course, we listen to our retailers. They have an open line to the brand managers and our sales staff. We will do our best to source something for them if they want something specific.”

Quality Gold’s (QG) collections today include variations on popular link styles like the paperclip, puffed mariner, pocket watch chains, and mixed styles of chains like a byzantine with a more traditional link. The result is a modern option. In its Herco division, expect to see more endless clasp options “that give the impression that they are part of the chain,” explains brand director Paula Garcia. “We have findings that can be easily added so charms are hung from it in the front of the neck,” she continues. Her assortment of bracelets between 10 mm and 30 mm is also increasing.

“We are adding pieces with textures and trendy patterns to mix and match with basics,” she says. “There will be some geometrics with crisp edges, and the HERCO product has a presence. My customer loves solid styles and products with weight and craftsmanship, and we listen to our customers as we decide on products to add to the brand.”

And while innovations are important, so are fashion trends. QG sees a return to styling from the 1980s and 1990s, including yellow gold, bold forms, oversize earrings, bib necklaces, and heavier links.

“Retailers aren’t asking us as much for innovative jewelry as much as they want fashion-forward and trending pieces for their stores that will sell,” adds Colaizzi. “Our retailers want to remain relevant and have options to provide customers seeking a trendy piece or two to freshen their choices and mix with their bread-and-butter basics.”

At the Richline Group, it is leaning heavily into 3D manufacturing, which is evident in its new 3D Men’s Collection.

“We feel that innovation in 3D is in its infancy and that the potential is limitless,” says Elaine Klopman, director of marketing. “One of the advantages of working in 3D is that it allows us to develop fully backed cast product made as one single cast unit whereas in the past, this was impossible to achieve. One of our latest designs, our dagger pendant, features a snake coiled around the dagger, which would have been very difficult if not impossible to achieve with this level of intricate characteristics before the evolution of 3D execution.”

Cautious optimism is on the minds of many merchants this year, according to manufacturers and brands. Those sentiments aren’t exactly shocking given that the U.S. is heading into an election year, which are notoriously unpredictable; the nation is divided on who will win the election, what new policies they might implement, and how they will affect small business.

“All the news about tough socioeconomic times didn’t impact the independent jeweler much in the fourth quarter of 2023,” insists Cora Lee Colaizzi, marketing director, Quality Gold (QG). “I think the end consumer enjoyed returning to Main Street after the last few years of COVID and restrictions. People are shopping bricks-and-mortar stores.”

Her colleague and national sales director, Jeff Wynkoop, agrees. “People want to get out and shop,” he observes. Plus, retailers tell him that foot traffic in stores is higher than before the pandemic. “In my meetings, our retailers are excited and continue to source new merchandise to show their customers,” he says.

To keep the momentum going, Wynkoop advises retailers to stay focused on their branding and social media pages.

“Buying metrics and analytics have shown us that younger buyers are doing their research online but coming to brick-and-mortar retail stores to get an experience when they purchase,” he says. Take advantage of the traffic and give the consumer an experience they will remember and want to tell others about.”

And while QG merchants are enjoying client face time in stores, Ostbye clients express opposite concerns. Among them? Online sales competition, how to continually drive traffic into stores, “and keep them true to your business,” says marketing manager Theresa Namie.

Differences aside, most say that 2024 has started off well. “Expectations are focused on maintaining flat or slightly above last year,” explains Namie.

An interesting bright spot in the eyes of Lachish Awad, manager of the customer service department for the Elegant Collection for Jasani USA: post-holiday sales are improving. “Most of our clients have exhausted their inventories and are placing orders with us,” he reveals.

As far as what is selling—beyond karat-gold staples—think colored gemstones and diamond-accented Mother’s Day gifts. “There’s a notable demand for precious color gemstones,” observes Surbhi Jain, marketing director of Shefi Diamonds. She points to her brand’s Majestic Gem Collection of baguette-cut colored stone crosses and birthstone collections as proof. These, she continues, “have been warmly embraced by retailers and serve as the ideal gift for any occasion throughout the year.”

Birthstone jewelry moves for Ostbye’s clients, too, who also buy wide gold diamond fashion bands and celestial, ribbon, and leaf motifs. Other fast sellers include heart and cross pendants, yellow gold bridal styles (including ring wraps and inserts), stackables, signets, and medallions. “They are great personal gifts to give,” says Theresa Namie, marketing manager.

“The demand for 14k yellow gold has been high for the last few years after so many years of 14k white gold dominating,” observes Colaizzi. “When the gold price is high, yellow gold owns the center stage in the gold jewelry segment. If COVID proved anything to us, it’s that jewelry is timeless and pandemic-proof!”

Considering that the Richline Group (RG) is a vertically integrated presence throughout the precious materials supply chain, from manufacturing to marketing, its 21-year-old May Is Gold Month (MIGM) initiative makes much sense. Gold is part of the DNA of its properties and of those firms they serve.

Casting a spotlight on karat-gold jewelry is an obvious goal for the jewelry conglomerate, but another “is to ensure the retailers can make the most of MIGM by tailoring their promotions to fit their brand and customers’ expectations,” says Elaine Klopman, director of marketing.

Many in the industry, including Klopman, know that MIGM’s momentum certainly lasts longer than the month itself.

“Promoting gold jewelry goes beyond May,” she continues. “We are always looking for creative ways to highlight the gold category, working with our clients all year on different sales and marketing campaigns.”

Shefi Diamonds’ Surbhi Jain, marketing director, agrees.

“MIGM can be a fantastic promotional opportunity in the jewelry industry,” she says. “Capitalizing on this theme can enhance our brand visibility and potentially boost sales.”

And given the collective commercial power that MIGM partners provide, it’s not surprising that non-RG partners benefit as well. Just like generic diamond ads from the De Beers Group aid the entire jewelry industry, so, too, do MIGM promotions. Call it riding on RG’s coattails or just flat out effective, MIGM is an approaching calendar date that no one should ignore.

Quality Gold, Inc. needs no convincing. “Gold is a 365-day product,” confirms Cora Lee Colaizzi, marketing director, whose clients include it in promotions year-round—not just Mother’s Day and in May.

Marketing materials highlighting basics, religious jewelry, and best sellers are available for active clients on QGold.com. Additionally, a resource section on the site “contains templates for digital banners, social media posts, and print concepts that the retailer can edit to use,” Colaizzi notes. Meanwhile, trendier products within its Leslie’s and HERCO brands also have their own marketing materials.

At Ostbye, marketing manager Theresa Namie and her team share product photography and reels with retailers to use on their social media platforms. And this year, bold gold designs are a key component of their merchandising mix considering what she calls a “resurgence of yellow gold in 2023.” May is perfectly timed with some of the firm’s newest releases, including a new gold bridal collection “just in time for MIGM,” Namie adds.

Shefi Diamonds also sees a great opportunity for yellow gold in 2024 and will also capitalize on MIGM through email newsletters to its clients and time-sensitive promotions and discounts. Social media posts highlighting gold jewelry will include relevant hashtags such as “#MayIsGoldMonth and #GoldenMay,” according to Jain.

Finally, Heather Brown, vice president of content and editorial for The Kingswood Company, a maker of cleaning products for fine jewelry, encourages retailers to offer information about how to care for gold jewelry, such as soaking pieces in a specially formulated solution and buffing it with a polishing cloth after it dries. “Offering clients useful jewelry care and cleaning information allows them to enjoy their gold jewelry, both new and old, for a lifetime,” she says.

Color evokes passion and drives many a jewelry sale. That’s why retailers must know the new hues their clients are seeing, and there’s no better time than now to get acquainted.

That’s because at the tail end of each fourth quarter, the PANTONE Color Institute debuts its Color of the Year, a key marketing tool. “Retailers should be using color psychology, along with the PANTONE Color of the Year, to boost their color sales,” insists Monica McDaniel, vice president of Chatham, Inc.

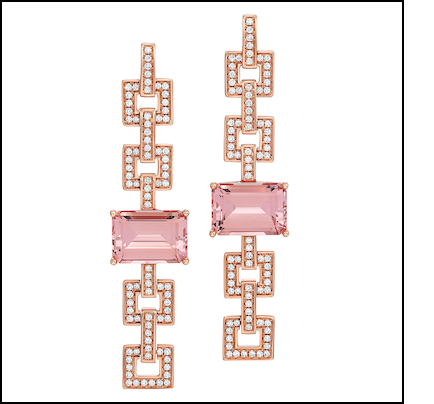

Whether that particular color (Peach Fuzz in 2024) ends up in new jewelry creations or not, color should play a role in store offerings simply for the joyful diversity it provides in a sea of diamond designs. Even Shefi Diamonds likes to capitalize on the momentum PANTONE provides—look to its Peach Blossom Morganite collection as an example—while Lali Jewelry’s Perilynn Glasner, marketing and design director, uses color blocking as an in-store tool to help guide sales.

“Find out what colors the client is attracted to and go from there,” she urges.

Read on to learn more about how manufacturers are leaning into color for 2024 success.

PANTONE’s New Hue

Every December, as many eagerly stock up on presents for loved ones, PANTONE, the color authority, gifts the world an extra-special lagniappe called the Color of the Year. The hue aims to excite consumers about the directional force that color can have and is seen across many categories—from clothes to interior design to accessories. For 2024 the shade is Peach Fuzz, and jewelry manufacturers are hurriedly mapping out the ways they can help retail clients offer appropriate merchandise.

“Color is a powerful psychological tool that should be used by retailers to convert sales,” says Monica McDaniel, vice president, Chatham, Inc. “Different gemstone colors evoke specific emotions and associations. Understanding this can help market and sell gemstones more effectively.”

PANTONE tells us that Peach Fuzz “is a velvety gentle peach tone whose all-embracing spirit enriches mind, body, and soul … capturing our desire to nurture ourselves and others.”

Makers agree with the choice, calling it a good one for all the uncertainty the world is currently experiencing.

McDaniel says that it’s “human nature to seek out things that bring us hope and joy. With its warm and inviting tone, Peach Fuzz is an endearing color that accomplishes just that!”

Valerie Fletcher, vice president of design and product development for ODI, says the Color of the Year “influences everything from textiles to interior design to graphic design and … consumers’ jewelry choices. The Pantone color trend report can be a useful tool when choosing product for your store.”

Surbhi Jain agrees. “It’s crucial to emphasize its role in driving sales, enhancing brand image, and connecting with the ever-evolving tastes of consumers,” says the marketing director for Shefi Diamonds. “Encouraging retailers to embrace this annual color trend positions them as forward-thinking and responsive to the dynamic landscape of design.”

In terms of product, Peach Fuzz offers many opportunities to match its color and complement others. For starters, nearly every firm interviewed calls morganite a near perfect match for the PANTONE color.

Shefi Diamonds has a Peach Blossom brand featuring morganite in both bridal and fashion styles, and its Cinnamon Dulce collection pairs morganite with champagne diamonds, creating a “harmonious combination,” says Jain.

Lab-grown gemstone maker Chatham is well prepared for Peach Fuzz requests given its three different shades of champagne-color lab-grown sapphire, one of which has “richly saturated peach dominant undertones,” notes McDaniel. In Chatham’s upper-end Legacy Collection, lab-grown champagne sapphires are set in 18k rose gold. In fact, Chatham even planned to expand offerings in this material before the PANTONE announcement was made.

“We started to see an increased demand for this color preference since this past summer of 2023,” McDaniel continues. It’s a similar story at Imperial, which debuted rose gold, morganite, and freshwater pearls—peachy pink and white—together long before the Color of the Year was a consideration.

They did so because it was pretty, and now Kathy Grenier, vice president of business development, wonders if Peach Fuzz will “reignite interest” in its morganite selections. Regardless, sharing trend information like the Color of the Year “helps establish Imperial as a source retailers can count on not only for pearls,” she explains.

Royal Chain, too, is banking on the appeal of rose gold and white freshwater pearls, and is positioning that look as an ideal companion for Peach Fuzz–color gems and accessories.

And while Lali Jewelry’s Perilynn Glasner, marketing and design director, will use Peach Fuzz as a backdrop on social media to make her company’s SKUs—some with complementary shades of aquamarine, blue topaz, and green amethyst—pop, others are keen to pair last year’s shade with this new one.

Fletcher is among the enthused. “Because this year’s color falls right next to last year’s Viva Magenta and almost directly across from 2022’s Very Peri, Peach Fuzz blends nicely with either one,” she explains. “So, if you’re someone who buys into the color every year, you now have some great stacking opportunities.”

Color to Wear

While there’s no doubt that Americans love their bright white diamonds, nothing else elicits the emotional response of color and colored gemstones. Makers and merchants who embrace color know its appeal, which is why a slew of new collections are putting a variety of shades in the spotlight.

“Color is a tremendous opportunity for retailers,” maintains Monica McDaniel, vice president, Chatham, Inc. “Color creates higher margins and expands your bottom line. It also creates options for your customer. Data shows that by exposing your customers to an assortment of color possibilities, custom sales increase exponentially.”

Beyond morganite encapsulating PANTONE’s 2024 Peach Fuzz, jewelry manufacturers have rainbow-like assortments to cater to every taste. At ODI, smoky quartz is set in yellow gold to complement neutrals, earth tones, greens, and metallics, making it a gem with unmatched diversity.

“Smoky quartz can be dark and moody or warm and natural,” says Valerie Fletcher, vice president of design and product development. “It’s great for night or day, and it’s affordable in larger sizes.”

Other collections that define ODI’s new offerings include multicolor bezel-set gemstone bracelets like the ones seen on Taylor Swift during her New Eras concert tour. Another is ODI’s LoveFire Greenland Ruby Collection and Polar Pink Greenlandic Sapphire Collection, both complete with displays, marketing materials, and books and videos “to help the sales team and the consumers better understand the rarity, provenance and value of the gems,” adds Fletcher.

Imperial’s new color-rich jewels feature enamel and lab-created blue and pink sapphire and lab-created emerald. It features the lab-growns with pearls in sterling silver offerings to “do something exploratory without a huge investment,” says Kathy Grenier, vice president of business development.

New jewels from Royal Chain feature citrine and mother-of-pearl, and at Shefi Diamonds, aquamarine takes center stage in its Aquabella Collection. At Chatham, Inc., lab-grown chrysoberyl and lab-grown Paraíba-colored spinel debuted in the last year.

“Lab-grown chrysoberyl is a stunning mint green that pairs nicely in both white and yellow gold,” says McDaniel. “Lab-grown Paraíba-colored spinel is a striking seafoam blue, reminiscent of the gorgeous Paraíba tourmaline color.”

This year, more new colors drop at Chatham, including a lab-grown purple sapphire added to its loose stone color menu.

“We have received a great number of requests for purple sapphire in recent years, McDaniel continues. “We will be adding this new color to our stock items list in all the traditional shapes and sizes.” Chatham’s lab-grown champagne sapphire, meanwhile, will be incorporated into new designs for spring-summer 2024.

“Styles will be an expansion of our latest collections, which exhibit clean lines, bezel settings, textured metals, and some geometrics,” adds McDaniel. “Shapes will include emerald cut, pear, round, as well as some of Chatham’s exclusive cuts like the onion and flame.”

At Lali Jewelry, trunk shows are a great place for the brand to test new options and let clients dive into all available products and discover their own preferences. But heed this tip, insists Perilynn Glasner, marketing and design director: Never assume what the customer would like. “Show them more than what they asked for, and you’ll be surprised to see what piques their interest,” she says.

Color-Blocking 101

Couture runways aren’t the only places where color-blocking occurs—it happens, too, in new jewelry collections and is an important concept for jewelers to understand.

Color-blocking pairs opposite colors together for fashion victories (think Mondrian and Stephen Burrows). Fine jewelers need the savvy to confidently suggest colored gemstone and enamel jewels to clients who enter stores in the season’s latest hues. So, when merchants are facing shoppers in Peach Fuzz–color T-shirts, he or she can quickly offer complementary champagne diamonds or, on the other end of the spectrum, minty-green garnets or chrysoprase for an über Miami Vice vibe.

This is valuable information, maintains Monica McDaniel, vice president, Chatham, Inc.

“Anytime jewelry and fashion intersect, you find the ultimate self-expression,” she notes. “Retailers need to understand trends and how to use color in their conversations with the client. Guiding and offering up suggestions sets you apart from other jewelers.”

It’s also meaningful because “it creates an organized shopping experience for the customer,” observes Perilynn Glasner, marketing and design director for Lali Jewelry. During in-store events, her sales teams use color-blocking techniques to showcase collections effectively.

Chatham, Inc., spends a lot of time training its sales force on color lore, symbolism, and how to create a wardrobe around color choices.

“We tell retailers all the time, search engines can show product faster than you can,” says McDaniel. “If the client is inside your store, it’s because they are seeking out your expertise. Furthermore, they want to touch and feel the merchandise.”

According to Surbhi Jain, marketing director of Shefi Diamonds, color-blocking also touches on tonal hues within the same color. Valerie Fletcher, vice president of design and product development at ODI, agrees, adding that color blocking “doesn’t always have to be ‘opposites attract.’” Instead, “It can be two similar shades that create an ombré effect,” she says. “The Fall-Winter 2024 collections of designers like Fendi, Prabal Gurung, and Carolina Herrera use bright color blocking, while Prada does a more muted look.”

In ODI’s jewelry, this translates to two-stone rings featuring a pink tourmaline and a tanzanite, or a red ruby and a pink sapphire.

“Depending on the person, color can be something to be collected and worn in bunches, or it can be intimidating,” Fletcher continues. “For the wary consumer, start with a neutral—like smoky quartz—or a color that blends easily with their wardrobe. Then add larger and brighter pieces that pop.”

Carla Corporation has discovered that grouping like colored gemstone jewels together helps close sales. “It directs the customer’s attention to a specific showcase keeping them focused on the styles available and the task at hand,” offers Brian Fleming, senior vice president.

More tips to sell color from Fleming include stocking and displaying price-point levels to accommodate a variety of budgets and displaying unique and classic styles together to allow staff to best parse options according to taste.

Shefi’s Jain, meanwhile, has this guidance to direct color sales: explore birthstone jewels, personalize with clients’ favorite colors, and embrace trends.

“Stay current by incorporating trends like the Pantone Color of the Year, appealing to customers with a penchant for fashionable choices,” she says.

Couture runways aren’t the only places where color-blocking occurs—it happens, too, in new jewelry collections and is an important concept for jewelers to understand.

Color-blocking pairs opposite colors together for fashion victories (think Mondrian and Stephen Burrows). Fine jewelers need the savvy to confidently suggest colored gemstone and enamel jewels to clients who enter stores in the season’s latest hues. So, when merchants are facing shoppers in Peach Fuzz–color T-shirts, he or she can quickly offer complementary champagne diamonds or, on the other end of the spectrum, minty-green garnets or chrysoprase for an über Miami Vice vibe.

This is valuable information, maintains Monica McDaniel, vice president, Chatham, Inc.

“Anytime jewelry and fashion intersect, you find the ultimate self-expression,” she notes. “Retailers need to understand trends and how to use color in their conversations with the client. Guiding and offering up suggestions sets you apart from other jewelers.”

It’s also meaningful because “it creates an organized shopping experience for the customer,” observes Perilynn Glasner, marketing and design director for Lali Jewelry. During in-store events, her sales teams use color-blocking techniques to showcase collections effectively.

Chatham, Inc., spends a lot of time training its sales force on color lore, symbolism, and how to create a wardrobe around color choices.

“We tell retailers all the time, search engines can show product faster than you can,” says McDaniel. “If the client is inside your store, it’s because they are seeking out your expertise. Furthermore, they want to touch and feel the merchandise.”

According to Surbhi Jain, marketing director of Shefi Diamonds, color-blocking also touches on tonal hues within the same color. Valerie Fletcher, vice president of design and product development at ODI, agrees, adding that color blocking “doesn’t always have to be ‘opposites attract.’” Instead, “It can be two similar shades that create an ombré effect,” she says. “The Fall-Winter 2024 collections of designers like Fendi, Prabal Gurung, and Carolina Herrera use bright color blocking, while Prada does a more muted look.”

In ODI’s jewelry, this translates to two-stone rings featuring a pink tourmaline and a tanzanite, or a red ruby and a pink sapphire.

“Depending on the person, color can be something to be collected and worn in bunches, or it can be intimidating,” Fletcher continues. “For the wary consumer, start with a neutral—like smoky quartz—or a color that blends easily with their wardrobe. Then add larger and brighter pieces that pop.”

Carla Corporation has discovered that grouping like colored gemstone jewels together helps close sales. “It directs the customer’s attention to a specific showcase keeping them focused on the styles available and the task at hand,” offers Brian Fleming, senior vice president.

More tips to sell color from Fleming include stocking and displaying price-point levels to accommodate a variety of budgets and displaying unique and classic styles together to allow staff to best parse options according to taste.

Shefi’s Jain, meanwhile, has this guidance to direct color sales: explore birthstone jewels, personalize with clients’ favorite colors, and embrace trends.

“Stay current by incorporating trends like the Pantone Color of the Year, appealing to customers with a penchant for fashionable choices,” she says.

While there’s no doubt that Americans love their bright white diamonds, nothing else elicits the emotional response of color and colored gemstones. Makers and merchants who embrace color know its appeal, which is why a slew of new collections are putting a variety of shades in the spotlight.

“Color is a tremendous opportunity for retailers,” maintains Monica McDaniel, vice president, Chatham, Inc. “Color creates higher margins and expands your bottom line. It also creates options for your customer. Data shows that by exposing your customers to an assortment of color possibilities, custom sales increase exponentially.”

Beyond morganite encapsulating PANTONE’s 2024 Peach Fuzz, jewelry manufacturers have rainbow-like assortments to cater to every taste. At ODI, smoky quartz is set in yellow gold to complement neutrals, earth tones, greens, and metallics, making it a gem with unmatched diversity.

“Smoky quartz can be dark and moody or warm and natural,” says Valerie Fletcher, vice president of design and product development. “It’s great for night or day, and it’s affordable in larger sizes.”

Other collections that define ODI’s new offerings include multicolor bezel-set gemstone bracelets like the ones seen on Taylor Swift during her New Eras concert tour. Another is ODI’s LoveFire Greenland Ruby Collection and Polar Pink Greenlandic Sapphire Collection, both complete with displays, marketing materials, and books and videos “to help the sales team and the consumers better understand the rarity, provenance and value of the gems,” adds Fletcher.

Imperial’s new color-rich jewels feature enamel and lab-created blue and pink sapphire and lab-created emerald. It features the lab-growns with pearls in sterling silver offerings to “do something exploratory without a huge investment,” says Kathy Grenier, vice president of business development.

New jewels from Royal Chain feature citrine and mother-of-pearl, and at Shefi Diamonds, aquamarine takes center stage in its Aquabella Collection. At Chatham, Inc., lab-grown chrysoberyl and lab-grown Paraíba-colored spinel debuted in the last year.

“Lab-grown chrysoberyl is a stunning mint green that pairs nicely in both white and yellow gold,” says McDaniel. “Lab-grown Paraíba-colored spinel is a striking seafoam blue, reminiscent of the gorgeous Paraíba tourmaline color.”

This year, more new colors drop at Chatham, including a lab-grown purple sapphire added to its loose stone color menu.

“We have received a great number of requests for purple sapphire in recent years, McDaniel continues. “We will be adding this new color to our stock items list in all the traditional shapes and sizes.” Chatham’s lab-grown champagne sapphire, meanwhile, will be incorporated into new designs for spring-summer 2024.

“Styles will be an expansion of our latest collections, which exhibit clean lines, bezel settings, textured metals, and some geometrics,” adds McDaniel. “Shapes will include emerald cut, pear, round, as well as some of Chatham’s exclusive cuts like the onion and flame.”

At Lali Jewelry, trunk shows are a great place for the brand to test new options and let clients dive into all available products and discover their own preferences. But heed this tip, insists Perilynn Glasner, marketing and design director: Never assume what the customer would like. “Show them more than what they asked for, and you’ll be surprised to see what piques their interest,” she says.

Every December, as many eagerly stock up on presents for loved ones, PANTONE, the color authority, gifts the world an extra-special lagniappe called the Color of the Year. The hue aims to excite consumers about the directional force that color can have and is seen across many categories—from clothes to interior design to accessories. For 2024 the shade is Peach Fuzz, and jewelry manufacturers are hurriedly mapping out the ways they can help retail clients offer appropriate merchandise.

“Color is a powerful psychological tool that should be used by retailers to convert sales,” says Monica McDaniel, vice president, Chatham, Inc. “Different gemstone colors evoke specific emotions and associations. Understanding this can help market and sell gemstones more effectively.”

PANTONE tells us that Peach Fuzz “is a velvety gentle peach tone whose all-embracing spirit enriches mind, body, and soul … capturing our desire to nurture ourselves and others.”

Makers agree with the choice, calling it a good one for all the uncertainty the world is currently experiencing.

McDaniel says that it’s “human nature to seek out things that bring us hope and joy. With its warm and inviting tone, Peach Fuzz is an endearing color that accomplishes just that!”

Valerie Fletcher, vice president of design and product development for ODI, says the Color of the Year “influences everything from textiles to interior design to graphic design and … consumers’ jewelry choices. The Pantone color trend report can be a useful tool when choosing product for your store.”

Surbhi Jain agrees. “It’s crucial to emphasize its role in driving sales, enhancing brand image, and connecting with the ever-evolving tastes of consumers,” says the marketing director for Shefi Diamonds. “Encouraging retailers to embrace this annual color trend positions them as forward-thinking and responsive to the dynamic landscape of design.”

In terms of product, Peach Fuzz offers many opportunities to match its color and complement others. For starters, nearly every firm interviewed calls morganite a near perfect match for the PANTONE color.

Shefi Diamonds has a Peach Blossom brand featuring morganite in both bridal and fashion styles, and its Cinnamon Dulce collection pairs morganite with champagne diamonds, creating a “harmonious combination,” says Jain.

Lab-grown gemstone maker Chatham is well prepared for Peach Fuzz requests given its three different shades of champagne-color lab-grown sapphire, one of which has “richly saturated peach dominant undertones,” notes McDaniel. In Chatham’s upper-end Legacy Collection, lab-grown champagne sapphires are set in 18k rose gold. In fact, Chatham even planned to expand offerings in this material before the PANTONE announcement was made.

“We started to see an increased demand for this color preference since this past summer of 2023,” McDaniel continues. It’s a similar story at Imperial, which debuted rose gold, morganite, and freshwater pearls—peachy pink and white—together long before the Color of the Year was a consideration.

They did so because it was pretty, and now Kathy Grenier, vice president of business development, wonders if Peach Fuzz will “reignite interest” in its morganite selections. Regardless, sharing trend information like the Color of the Year “helps establish Imperial as a source retailers can count on not only for pearls,” she explains.

Royal Chain, too, is banking on the appeal of rose gold and white freshwater pearls, and is positioning that look as an ideal companion for Peach Fuzz–color gems and accessories.

And while Lali Jewelry’s Perilynn Glasner, marketing and design director, will use Peach Fuzz as a backdrop on social media to make her company’s SKUs—some with complementary shades of aquamarine, blue topaz, and green amethyst—pop, others are keen to pair last year’s shade with this new one.

Fletcher is among the enthused. “Because this year’s color falls right next to last year’s Viva Magenta and almost directly across from 2022’s Very Peri, Peach Fuzz blends nicely with either one,” she explains. “So, if you’re someone who buys into the color every year, you now have some great stacking opportunities.”