Pedal to the Metal

Silver, gold and platinum retail jewelry sales continue to grow in the U.S. market, providing many opportunities for jewelers to help consumers celebrate their lifestyles and life moments like no other product.

Silver is showing its seventh consecutive year of growth, according to the Silver Promotion Service (SPS). The poll, conducted by National Jeweler/Jewelers of America, cited that 60% of jewelers reported increased sales, up on average 15% in 2015. As a percentage of overall jewelry sales, retailers said silver was up on average 35% in unit volume and 27% in dollar volume. In fact, 45% said silver experienced the best turnover rate in 2015 over all other categories.

Silver is showing its seventh consecutive year of growth, according to the Silver Promotion Service (SPS). The poll, conducted by National Jeweler/Jewelers of America, cited that 60% of jewelers reported increased sales, up on average 15% in 2015. As a percentage of overall jewelry sales, retailers said silver was up on average 35% in unit volume and 27% in dollar volume. In fact, 45% said silver experienced the best turnover rate in 2015 over all other categories.

Gold jewelry demand hit a seven-year high for the first half of 2016, after logging its tenth consecutive quarter of annual growth, reports the World Gold Council (WGC). Demand for the first half year of 48.6t is the strongest since 2009, cites WGC, adding that growth in jewelry and watch sales outstripped that of general retail sales for much of the year-to-date.

Platinum jewelry sales rose by 10% (in ounces) in 2015, reports the annual Platinum Guild International (PGI) Retail Barometer. This marks the third consecutive year of growth, following an 8% increase in 2014, 11% in 2013. The lower price of platinum compared to gold (by 10%), encouraged manufacturers and retailers to increase platinum offerings, including greater visibility of platinum at major chain stores. PGI expects platinum sales to grow 5% to 7% in unit volume in 2016, and demand to rise more than that projected for jewelry overall.

Metal Trends

Silver and gold jewelry share similar style trends, with looks from delicate to dramatic important, a focus on the neck and ear, greater use of color in gems and metals, and more demand for men’s wear.

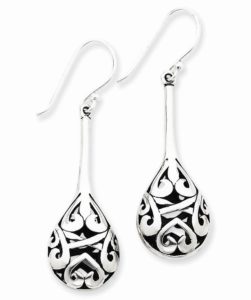

Think statement or stackable, says Emmy Kondo, jewelry consultant for WGC, which aptly describes what’s trending. In gold she cites large, sculptural pieces or dainty designs that are being layered to style. In silver, Gloria Maccaroni, director of brand development for SPS, highlights shorter necklace lengths, drop and dangle earrings, and bracelets and rings that mix and stack.

Bigger, bolder themes seem to be prominent in silver, with more delicate designs that can layered, trending well in gold says Cora-Lee Colaizzi, director of marketing and catalogs and senior merchandiser Quality Gold, Fairfield, Ohio. Across the board, geometric motifs are popular.

Key style trends to watch: Pendants with a purpose are popular in silver and gold necklaces, says Lori Kluempke, senior vice president of Prime Art & Jewel, Dallas, citing its Origa.me with spirit animals and power symbols and Spears and Tumbled Nuggets that embody traits and energy sources. Crosses and lockets in heart, oval and circle shapes are timeless bestsellers, adds Audrey Robbins of Marathon Company, Attleboro, Massachusetts.

The entire earring category is buzzing with excitement because of the great diversity in designs, says Colaizzi, including dangles, drops, buttons, knots, hoops, threaders, and climbers. Kondo sees the stacking trend moving up the ear with multiple piercings and different ear treatments adorning more than lobe.

The entire earring category is buzzing with excitement because of the great diversity in designs, says Colaizzi, including dangles, drops, buttons, knots, hoops, threaders, and climbers. Kondo sees the stacking trend moving up the ear with multiple piercings and different ear treatments adorning more than lobe.

Color is important in silver and gold designs, says Kluempke, particularly pastel blues and pinks in gems like aquamarine, topaz, chalcedony, morganite, and rose quartz, while blackened and rose colored metals bring color to design in bi and tri color combinations favored with white metal.

Moreover, yellow gold is trending in fashion and bridal jewelry, reports Sadhna Venkat for MWI Eloquence, New York, who sets it with white and natural color diamonds like browns and pinks. “The trend towards yellow gold in bridal is a hipper look with diamonds and especially precious gems that are increasingly popular with brides looking for a personalized expression,” concurs PGI President Jenny Luker.

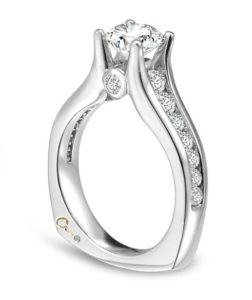

In platinum, Luker continues to see strong sales for engagement rings in classic basics like solitaires and halo, as well as romantic pieces inspired by floral designs or nature motifs. “We’re also seeing more platinum bands selling. They could be stackable or single bands, from small, delicate plain platinum to larger, more intricate styles.”

Many brands hail men’s jewelry the category to watch in silver and gold. “There’s an uptick in interest and demand for menswear, especially fashion cufflinks as more young men are back to wearing French cuffs,” says Eve Chiles for Breuning, Lawrenceville, Georgia. Sales are also robust for men’s silver bracelets and band rings, and heavier styles in gold bracelets and necklaces with old link chains harkening the 90s.

Metal Marketing

The SPS, WGC and PGI offer resources for jewelers to bolster sales for silver, gold and platinum jewelry at retail including market intelligence, product information, sales training, and national marketing campaigns to tap into.

A great example is the current collaboration between SPS and PGI with the Jewelers of America to increase awareness and excitement for platinum engagement rings and wedding bands, as well as silver jewelry gifts for brides, grooms and wedding party. Amanda Gizzi, JA director of PR & events started a TV tour in June to talk up the platinum and silver bridal benefits.

A great example is the current collaboration between SPS and PGI with the Jewelers of America to increase awareness and excitement for platinum engagement rings and wedding bands, as well as silver jewelry gifts for brides, grooms and wedding party. Amanda Gizzi, JA director of PR & events started a TV tour in June to talk up the platinum and silver bridal benefits.

Samuel Sandberg, president of A.Jaffe, New York, attributes the growth of platinum bridal in the last few years to increased advertising and marketing by PGI and brands like his own. He also sees the success of silver jewelry as a bridal add-on gift in the brand’s Maps collection (also in gold).

Also tap into May is Gold month, promoted for a dozen years by the WGC with New York manufacturer Richline. Mark Hanna, CMO of the Richline Group, says the campaign is not just for its customers (mayisgoldmonth.com). “Because the bigger retailers pick it up everyone is talking about gold in a national conversation.” Adds Kondo: “I suggest retailers look at what Richline is doing to use shared hashtags, because the more in sync the voices in the industry the greater impact.”

Phyllis Bergman, CEO of Mercury Rings, a division of Interjewel Group, New York, advocates channeling into PGI digital efforts too, like YouTube videos, online advertising, and social media. Luker encourages retailers and manufacturers to share platinum products, stories or facts socially and use #beplatinum, featured on the social feed of PGI’s newly launched website www.platinumjewelry.com.

Phyllis Bergman, CEO of Mercury Rings, a division of Interjewel Group, New York, advocates channeling into PGI digital efforts too, like YouTube videos, online advertising, and social media. Luker encourages retailers and manufacturers to share platinum products, stories or facts socially and use #beplatinum, featured on the social feed of PGI’s newly launched website www.platinumjewelry.com.