2016 Year in Review and Retail Outlook

With weeks remaining to wrap up 2016 and the holiday selling season, the U.S. retail outlook remains optimistic with moderate sales gains expected over 2015. Back in the summer, the National Retail Federation upgraded its expectations for retail sales growth this year from 3.1% to 3.4%. Online and non-store sales are expected to rise 7% to 10%, up from 6% to 9% forecasted earlier. Contributing factors include improved housing markets, job growth, and higher wages.

“Consumers have seen steady job and income gains resulting in continued confidence and greater use of credit, which bodes well for more spending,” says Jack Kleinhenz, NRF chief economist. He cites the presidential campaign as a “temporary distraction”, with shoppers starting gift buying later than they might otherwise. By Thanksgiving weekend, 154 million shoppers made purchases at stores or online, up from 151 million in 2015.

Neil Shah, Shah Luxury, New York City says he heard retail traffic in October was down, but post election he is hearing positive reports from jewelers. Jeffrey Cohen, vice-president of sales for KGS Jewels, New York City says he’s surprised by the positive numbers on Wall Street. “I hope this carries over to 2017, and the economy sustains these gains. Jewelry will continue to be a challenge in the retail marketplace, but if retailers and manufacturers remain focused they should be able to hold their own.”

Jewelry Stats

The jewelry industry remains cautiously optimistic. “Business this year has been strong,” says Renee Privatt, business development manager for Ostbye, Minneapolis, Minnesota. “A regular cadence of introducing new styles helps keep retail stores interested in looking at product and freshening assortments.”

But some do not expect gangbusters. “It was a solid year, but overall business will be flat with last holiday season,” says Cohen. Michael Lerche, president of Goldstar Jewellery, New York City says the major retailers still order based on holiday or fixture refill, and most took product later this fall.

Year-on-year sales of jewelry by retail stores in the United States grew slightly during the first half of 2016, according to a report by the online trading network, Polygon. Total sales by retail jewelry stores for the period of Q1-Q2 2016 rose to $15.931 billion, up from $15.787 billion in 2015.

Jewelers are adapting to a fragmented and uncertain retail market, reports Polygon: “Many brick-and-mortar jewelers have been struggling with slow sales and slimmer margins in recent years, situations that can be partly attributed to the growing market share of online-only jewelry retailers and successful online sales strategies that have been rolled out by major jewelry brands.”

The Jewelers Board of Trade reported that 1,256 jewelry businesses in the United States have closed this year, a 49% increase from 844 through the first three quarters of 2015. Reasons for the closures, which began in earnest in 2014, include retirements, consolidations, not adapting to changing retail landscape, and slow economic recovery/shrinking middle class. But Shah says jewelers who know their audience, have a good marketing strategy, and are in touch with customers on social media are doing well.

The Jewelers Board of Trade reported that 1,256 jewelry businesses in the United States have closed this year, a 49% increase from 844 through the first three quarters of 2015. Reasons for the closures, which began in earnest in 2014, include retirements, consolidations, not adapting to changing retail landscape, and slow economic recovery/shrinking middle class. But Shah says jewelers who know their audience, have a good marketing strategy, and are in touch with customers on social media are doing well.

Bestsellers

Bridal and anniversary jewelry remain top sellers. Stackable diamond bands in white, yellow and rose gold have outperformed. Cohen also sees two-stone and composite top bridal driving the business. He applauds the two-stone messaging and power of promotion. In fact, Shah hails branded bridal key to sales for the story and experience it represents.

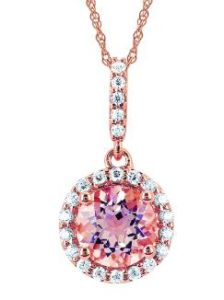

Beyond bridal, Privatt says stackable rings also are fashion favorites. “Diamond and birthstone stackables allow customers to personalize their look.” She reports strong sales for the Ostbye “stacked” ring that gives the look of two rings with a common shank, as well as morganite and rose gold in halo styles.

Rose gold and other gold colors are trending, reports Denise Cabrera, product manager, display and packaging for Rio Grande, a Richline brand in Albuquerque, New Mexico. But she continues to see silver of great importance as an affordable precious metal that’s high in demand. Moreover, she rates leather a popular component, especially for bracelets and in tassels.

Pearls continue to top trends too. Dana Cali, communications for Mastoloni, New York City, cites demand for dainty fashion designs that are convertible and can be layered, as well as unique, oversized, baroque pieces. She also reports strands popular, especially Akoya and white South Sea, perhaps influenced by classic styles spied on the campaign trail.