The Rarity of Natural Diamonds

Are Natural Diamonds Rare?

Natural diamonds are a finite resource. Global natural diamond recovery peaked in 2005, when rough diamond production was around 30% higher than in 2022. The annual recovery of 1 carat diamonds is equivalent in volume to filling an exercise ball.

The process of natural diamond formation means that as an object, they are innately rare. Formation takes place across the span of millions, sometimes billions, of years and occurs in limited zones of the Earth’s mantle at extreme temperatures and pressures.

Natural diamonds are hard to find and have only been found in rock over the last 150 years. The first diamonds were found in caves in India nearly 4000 years ago and for a long time, this was the only known source. Over time, they have become prized for their perfect shape, hardness, rarity, fire resistance and intense light.

These conditions contribute to their rarity, with the annual recovery of 5 carat diamonds and above would fit into a basketball.

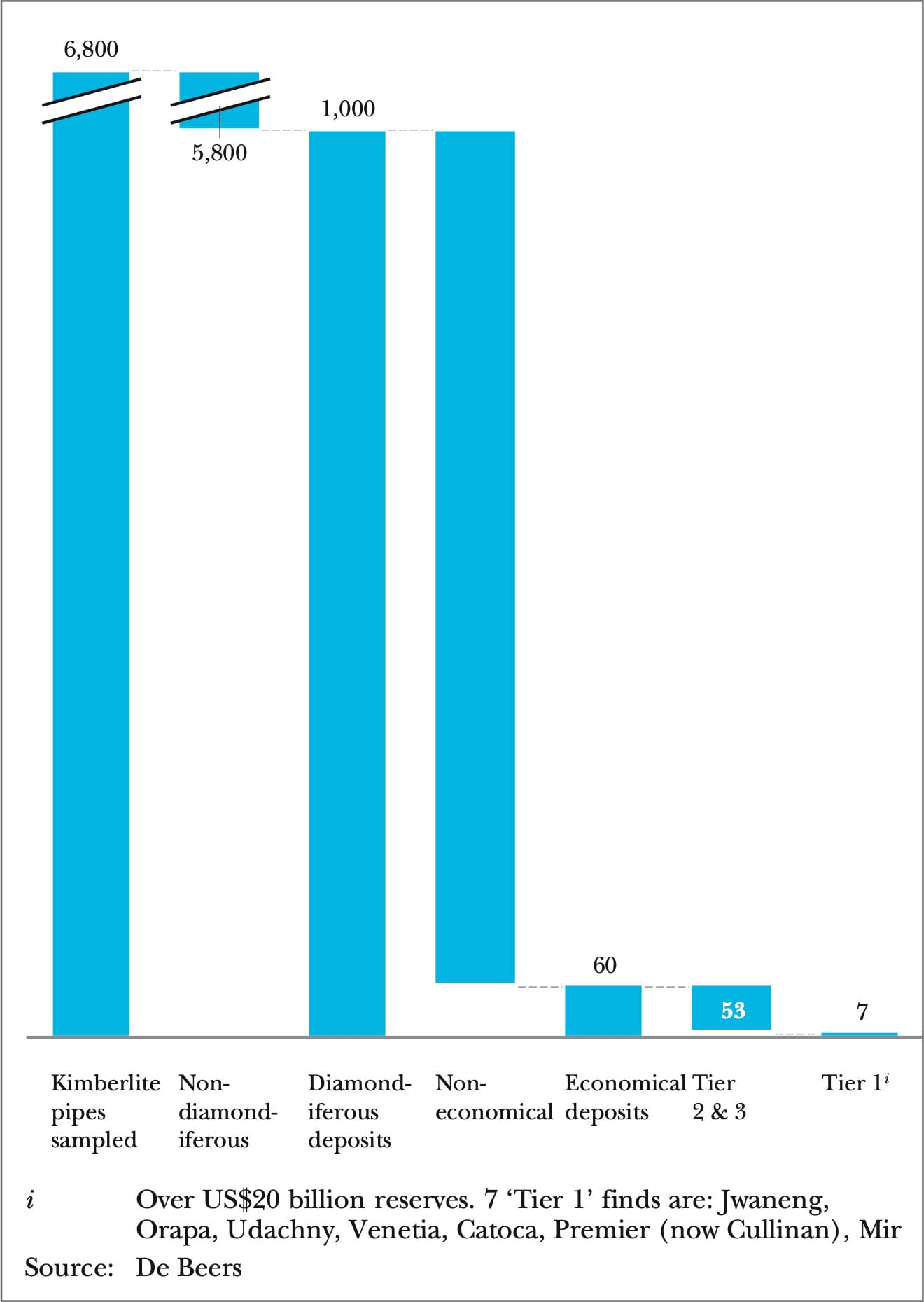

In fact, today there are only 30 significant natural diamond mines in production, with only 7 mines considered to be classified as Tier 1 deposits. Tier 1 deposits are those which have over US$20 billion in reserve.

De Beers Group recorded that over the last 140 years, almost 7,000 kimberlite pipes have been sampled by geologists. Yet, approximately only 60 of these were deemed to be sufficiently rich in natural diamonds to be economically viable for large-scale diamond mining companies.

Graph: Number of diamond deposits sufficiently rich to warrant development

Many industry experts and analysts believe that the annual recovery of natural diamonds peaked in 2005 at 177 million carats. Though this recovery has fluctuated, leading analyst Paul Zimnisky notes depleting legacy mines and limited new supply sources, further punctuated by the Covid-19 pandemic, resulted in a significant production decline. Through his analysis, it is predicted that production is expected to remain within a range of 115-125 million carats annually, a much lower figure than 150 million carats recorded in 2017.

A major contributing factor to this belief is the declining profile of existing mines and the small success rate of exploration. Petra Diamonds states that the success rate in diamond exploration is estimated at less than 1%.

Data recorded via the Kimberley Process from 2014 – 2021 illustrates the gradual decline of rough diamonds recovered and traded under the Kimberley Process Certification Scheme (KPCS) over recent times.

Deep pockets and large financial investment are needed to explore new diamond mining opportunities.

Determining the economic viability of these projects also extends to different types of mining, including alluvial mining. Alluvial mining is a process where stones are found in riverbeds or shorelines after kimberlites have eroded over time. Approximately 10-15% of the world’s diamonds originate from alluvial mining, however, geologists have commented that often they cannot tell how many stones there are. This is a key piece of information in determining if reserves justify economic investment.

The closure of mines which have reached the end of their economic lives include Argyle in Australia, owned by Rio Tinto which closed in November 2020, Victor Mine in Canada owned by De Beers Group which closed in 2019, Voorspoed in South Africa, owned by De Beers Group and Snap Lake, owned by De Beers Group in Canada.

The termination of operations of mines like Argyle, which once produced up to 40 million carats a year is symbolic of the changing landscape of natural diamond mining.

Further potential near-term closures include Diavik, Ekati, Nyurbinskaya and Almazy-Anabara which are expected to either reach economic depletion or conclude conventional mining by the end of this decade.

In fact, industry analyst Zimnisky notes that these mines currently account for a combined 17-20 million carats of annual production, representing approximately 15% of global supply. This represents a significant supply change to the natural diamond industry. De Beers Group is also still exploring new opportunities and in 2022 signed Mineral Investment contracts with Angola to return to exploring the country for new sources.

Source: Natural Diamond Council