May Is Gold Month—Are You Prepared?

Traditional spring buying opportunities include Mothers & Father’s Day and graduation gifts, but there’s another non-Hallmark holiday for which the jewelry industry can thank the Richline Group (RG): May Is Gold Month (MIGM).

RG started MIGM 21 years ago as a marketing idea. Since then, it has blossomed into a trademarked calendar event that benefits anyone who sells karat gold, not just the 20 retailers with which RG officially works, providing creative assets and paid social media posts and enlisting influencers for further promotion.

“MIGM is much more than a marketing campaign for us,” explains Elaine Klopman, RG’s director of marketing. “It’s an opportunity to highlight the appeal and beauty of gold jewelry and elevate the entire category of karat gold.”

Still, despite the massive opportunity that MIGM provides, the industry can’t ignore the realities of 2024: mixed reports on fourth-quarter 2023 sales and an impending U.S. election. How are both affecting sales now, and could these events diminish consumer excitement for innovations in karat-gold jewelry designs? Industry titans weigh in.

Capitalizing on May Is Gold Month

Considering that the Richline Group (RG) is a vertically integrated presence throughout the precious materials supply chain, from manufacturing to marketing, its 21-year-old May Is Gold Month (MIGM) initiative makes much sense. Gold is part of the DNA of its properties and of those firms they serve.

Casting a spotlight on karat-gold jewelry is an obvious goal for the jewelry conglomerate, but another “is to ensure the retailers can make the most of MIGM by tailoring their promotions to fit their brand and customers’ expectations,” says Elaine Klopman, director of marketing.

Many in the industry, including Klopman, know that MIGM’s momentum certainly lasts longer than the month itself.

“Promoting gold jewelry goes beyond May,” she continues. “We are always looking for creative ways to highlight the gold category, working with our clients all year on different sales and marketing campaigns.”

Shefi Diamonds’ Surbhi Jain, marketing director, agrees.

“MIGM can be a fantastic promotional opportunity in the jewelry industry,” she says. “Capitalizing on this theme can enhance our brand visibility and potentially boost sales.”

And given the collective commercial power that MIGM partners provide, it’s not surprising that non-RG partners benefit as well. Just like generic diamond ads from the De Beers Group aid the entire jewelry industry, so, too, do MIGM promotions. Call it riding on RG’s coattails or just flat out effective, MIGM is an approaching calendar date that no one should ignore.

Quality Gold, Inc. needs no convincing. “Gold is a 365-day product,” confirms Cora Lee Colaizzi, marketing director, whose clients include it in promotions year-round—not just Mother’s Day and in May.

Marketing materials highlighting basics, religious jewelry, and best sellers are available for active clients on QGold.com. Additionally, a resource section on the site “contains templates for digital banners, social media posts, and print concepts that the retailer can edit to use,” Colaizzi notes. Meanwhile, trendier products within its Leslie’s and HERCO brands also have their own marketing materials.

At Ostbye, marketing manager Theresa Namie and her team share product photography and reels with retailers to use on their social media platforms. And this year, bold gold designs are a key component of their merchandising mix considering what she calls a “resurgence of yellow gold in 2023.” May is perfectly timed with some of the firm’s newest releases, including a new gold bridal collection “just in time for MIGM,” Namie adds.

Shefi Diamonds also sees a great opportunity for yellow gold in 2024 and will also capitalize on MIGM through email newsletters to its clients and time-sensitive promotions and discounts. Social media posts highlighting gold jewelry will include relevant hashtags such as “#MayIsGoldMonth and #GoldenMay,” according to Jain.

Finally, Heather Brown, vice president of content and editorial for The Kingswood Company, a maker of cleaning products for fine jewelry, encourages retailers to offer information about how to care for gold jewelry, such as soaking pieces in a specially formulated solution and buffing it with a polishing cloth after it dries. “Offering clients useful jewelry care and cleaning information allows them to enjoy their gold jewelry, both new and old, for a lifetime,” she says.

Is the Jewelry Business Golden in 2024?

Cautious optimism is on the minds of many merchants this year, according to manufacturers and brands. Those sentiments aren’t exactly shocking given that the U.S. is heading into an election year, which are notoriously unpredictable; the nation is divided on who will win the election, what new policies they might implement, and how they will affect small business.

“All the news about tough socioeconomic times didn’t impact the independent jeweler much in the fourth quarter of 2023,” insists Cora Lee Colaizzi, marketing director, Quality Gold (QG). “I think the end consumer enjoyed returning to Main Street after the last few years of COVID and restrictions. People are shopping bricks-and-mortar stores.”

Her colleague and national sales director, Jeff Wynkoop, agrees. “People want to get out and shop,” he observes. Plus, retailers tell him that foot traffic in stores is higher than before the pandemic. “In my meetings, our retailers are excited and continue to source new merchandise to show their customers,” he says.

To keep the momentum going, Wynkoop advises retailers to stay focused on their branding and social media pages.

“Buying metrics and analytics have shown us that younger buyers are doing their research online but coming to brick-and-mortar retail stores to get an experience when they purchase,” he says. Take advantage of the traffic and give the consumer an experience they will remember and want to tell others about.”

And while QG merchants are enjoying client face time in stores, Ostbye clients express opposite concerns. Among them? Online sales competition, how to continually drive traffic into stores, “and keep them true to your business,” says marketing manager Theresa Namie.

Differences aside, most say that 2024 has started off well. “Expectations are focused on maintaining flat or slightly above last year,” explains Namie.

An interesting bright spot in the eyes of Lachish Awad, manager of the customer service department for the Elegant Collection for Jasani USA: post-holiday sales are improving. “Most of our clients have exhausted their inventories and are placing orders with us,” he reveals.

As far as what is selling—beyond karat-gold staples—think colored gemstones and diamond-accented Mother’s Day gifts. “There’s a notable demand for precious color gemstones,” observes Surbhi Jain, marketing director of Shefi Diamonds. She points to her brand’s Majestic Gem Collection of baguette-cut colored stone crosses and birthstone collections as proof. These, she continues, “have been warmly embraced by retailers and serve as the ideal gift for any occasion throughout the year.”

Birthstone jewelry moves for Ostbye’s clients, too, who also buy wide gold diamond fashion bands and celestial, ribbon, and leaf motifs. Other fast sellers include heart and cross pendants, yellow gold bridal styles (including ring wraps and inserts), stackables, signets, and medallions. “They are great personal gifts to give,” says Theresa Namie, marketing manager.

“The demand for 14k yellow gold has been high for the last few years after so many years of 14k white gold dominating,” observes Colaizzi. “When the gold price is high, yellow gold owns the center stage in the gold jewelry segment. If COVID proved anything to us, it’s that jewelry is timeless and pandemic-proof!”

Innovations in Gold Jewelry

While karat-gold basics are a perennial favorite, it’s newness that draws customers into stores. New designs are the lifeblood of the fine-jewelry business, and gold is an inventory staple; together, and under the direction of karat gold manufacturing, design, and merchandising pros, innovations in gold jewelry continue to drive businesses forward.

At Shefi Diamonds, diverse textures enhance creations, add drama and emphasis to elevate specific areas of interest, and more.

“Texture enhances the overall richness and value of creations,” according to Surbhi Jain, marketing director, whose Textura collection exemplifies the effect. “We’re seeing a growing inclination towards textured designs.”

It’s a similar story at the Elegant Collection for Jasani USA, which is adding different textured and finished pieces, including lightweight bracelets and flexible bangles, to its inventory. “Our retail clients are asking for them,” confirms Lachish Awad, manager of customer service.

Ostbye’s customers love convertible styles. Consider the brand’s 3-in-1 Enhanceables pendants that morph into earrings that can look like two different ones in a single pair.

“Clients like designs that can be worn in more ways than one,” says Theresa Namie, marketing manager.

To stay on top of client preferences and product directions, Namie devotes ample time to research. “We listen to our customers, watch for strong trends, attend trade shows, and constantly check out social media platforms,” she says.

Ditto for Cora Lee Colaizzi, marketing director, Quality Gold, Inc.

“Our research and development team watches fashion and keeps an eye on designers,” she says. “Our merchandisers attend international shows and are in touch with the top factories globally. And, of course, we listen to our retailers. They have an open line to the brand managers and our sales staff. We will do our best to source something for them if they want something specific.”

Quality Gold’s (QG) collections today include variations on popular link styles like the paperclip, puffed mariner, pocket watch chains, and mixed styles of chains like a byzantine with a more traditional link. The result is a modern option. In its Herco division, expect to see more endless clasp options “that give the impression that they are part of the chain,” explains brand director Paula Garcia. “We have findings that can be easily added so charms are hung from it in the front of the neck,” she continues. Her assortment of bracelets between 10 mm and 30 mm is also increasing.

“We are adding pieces with textures and trendy patterns to mix and match with basics,” she says. “There will be some geometrics with crisp edges, and the HERCO product has a presence. My customer loves solid styles and products with weight and craftsmanship, and we listen to our customers as we decide on products to add to the brand.”

And while innovations are important, so are fashion trends. QG sees a return to styling from the 1980s and 1990s, including yellow gold, bold forms, oversize earrings, bib necklaces, and heavier links.

“Retailers aren’t asking us as much for innovative jewelry as much as they want fashion-forward and trending pieces for their stores that will sell,” adds Colaizzi. “Our retailers want to remain relevant and have options to provide customers seeking a trendy piece or two to freshen their choices and mix with their bread-and-butter basics.”

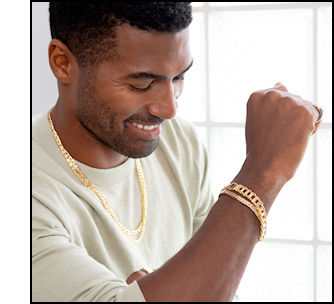

At the Richline Group, it is leaning heavily into 3D manufacturing, which is evident in its new 3D Men’s Collection.

“We feel that innovation in 3D is in its infancy and that the potential is limitless,” says Elaine Klopman, director of marketing. “One of the advantages of working in 3D is that it allows us to develop fully backed cast product made as one single cast unit whereas in the past, this was impossible to achieve. One of our latest designs, our dagger pendant, features a snake coiled around the dagger, which would have been very difficult if not impossible to achieve with this level of intricate characteristics before the evolution of 3D execution.”