Jewelry Insurance Glossary

A

Abandonment:

A condition in insurance plans that forbids the insured from giving the insurer damaged property to be repaired or disposed of. Unless the insurer decides otherwise, the insured is responsible for making arrangements for repair or disposal.

Actual Cash Value (ACV):

The market value of any property that is lost or damaged at the time of the loss. Typically this is defined as the cost to replace the item with similar kind and quality minus depreciation. For jewelry, the standard period of depreciation is 25 years.

Additional Insured:

Additional individuals listed on a policy that receive the same protection coverage. With some insurers, there can be an additional charge for adding an additional insured. At BriteCo, one person can be listed as the ‘additional insured’ on our policies free of charge. This person does not have to be related to the policyholder, and they do not have to live in the same household as the policyholder. This is intended to be used for the fiance or partner of the policyholder to ensure that they would be covered if they were in possession of the item at the time of a loss.

Admitted Carrier:

A business that has the licensed right to offer insurance to the general public. In contrast to surplus lines insurers, which are permitted to sell insurance in a state on a non-admitted basis, admitted businesses in the United States are licensed on a state-by-state basis.

Agreed Value:

Agreed value is a special type of policy, these policies are administered in special circumstances where an item can not be replaced. For example, a 200 year old antique/vintage ring that’s irreplaceable would carry an agreed value policy. Agreed value policies are a lot more expensive.

Application:

A document that must be filled out by the applicant in order to be covered by insurance. By submitting this form, the insurer receives certain information that is necessary for underwriting a particular risk.

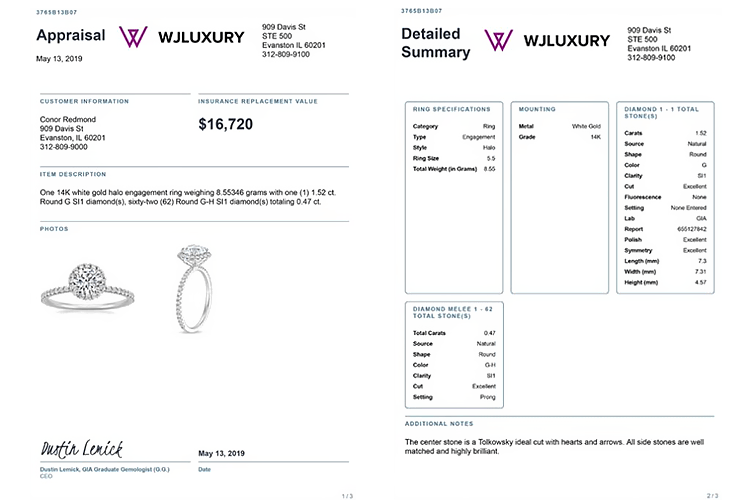

Appraisal:

An appraisal is a detailed report and a monetary valuation of an item. Some things that BriteCo requires to be on an appraisal for jewelry insurance purposes are:

- The policyholder’s name (or the name of their additional insured)

- Information on the jeweler/appraiser conducting the appraisal

- The date

- The carat weight, color, cut, and clarity of any large stones + a diamond report number (if applicable)

- The total carat weight, color, cut, and clarity of any melee accent diamonds

- The metal and metal grade used in the piece

- Critical information that affects the value of the piece

- The appraised value

Because our policies offer repair and replacement only, we are required to insure all items to at least their appraised value in order to meet our 100% insurance to value requirement. Appraisers should always, to the best of their knowledge, appraise an item for its replacement cost.

Appraisal Software:

Software designed to streamline the evaluation process of an item of value. BriteCo’s appraisal tool is a cloud-based software made for jewelers to conduct appraisal reports. BriteCo offers this system free of charge to our jeweler partners. Data is compiled from online wholesale databases for precious metals and precious gemstones to put a monetary value on an evaluated piece of jewelry.

Appraised Value:

The appraised value is a thorough assessment of value at the time of the evaluation, determined by a qualified professional for a specific purpose. For insurance purposes, the appraised value is the cost of replacing the item with a like kind and quality product should there be a loss.This type of appraisal is called an insurance replacement valuation. There are other appraisal types like liquidation value, fair market value, and estate value, but these appraisals are not acceptable for insuring your jewelry. BriteCo requires every item to be insured for its appraised value.

Assignment:

A deal that grants a third party the rights to insurance claims or other policy benefits. This gives the third party the power to submit an insurance claim, decide what repairs need to be made, and collect insurance funds without consulting the policyholder. Most of the time, you need written permission from the insurance company to transfer such rights.

B

Binder:

A contract signed by an agent or insurer that serves as temporary proof of insurance until a policy can be issued. Binders should explicitly identify the insurer with whom the risk is bonded, contain specific time limits, and be in writing. Additionally, they must state the type of policy, the amount of insurance, and the dangers covered.

C

Cancellation:

The premature ending of an insurance policy or bond by either the insured or the insurance company. In order to cancel an insurance policy, insurers must give notice to the insured in advance (usually 30 days).

Carrier:

A corporation that is licensed to provide insurance or reinsurance and acts as the insurer or “carrier” of the policy.

Central Station Burglar Alarm:

An alarm system that notifies an off-site monitoring station when activated by a burglary. These systems are activated on and off at the discretion of the owner. These systems provide the owner with additional protection for their home and valuables.

Claim:

A claim is a request for compensation for losses that are covered by insurance made to an insurance company by either the policyholder or a third party.

Claimant:

A person who submits a claim to an insurer in order to get compensation for damages that are covered by the policy.

Conditions:

The section of the insurance contract that covers the duties and responsibilities of both the insured and the insurance company.

Current Market Value:

This term is most commonly used when discussing watches. The current market value of a watch is the cost it would take to replace the watch today. The watch market is unique and many high-end watches are difficult to find, even if you have the money to purchase them. Most sought-after watches, even used watches, are typically sold for more than the retail price. Since it is not guaranteed that an authorized dealer can provide a watch of like kind and quality within 90 days, we require sufficient limits at market value to source replacements from the secondary market. When buying a watch directly from a retailer for retail price, it is not uncommon to be put on a waiting list for years.

D

Declarations page:

A page in your policy, typically the first page, that contains fundamental information about the policyholder, the items insured, the coverages, and the premium amounts. Also known as a declarations page. When discussing it in an informal manner you may hear it referred to as the “dec” page.

Deductible:

A deductible is the amount that an insured must pay in the event of a loss before the insurance company contributes. BriteCo’s jewelry insurance policies have no deductibles.

Department of Insurance:

A governmental body that is tasked with the regulation and administration of insurance laws as well as other obligations linked with the insurance industry.

Depreciation:

A reduction in the value of an item as a result of deterioration from factors such as age, wear, or other causes.

Detailed Sales Receipt:

A sales receipt is a record of a transaction that states the item that was purchased and the purchase price. A Detailed Sales Receipt lists the primary characteristics of a piece, such as stone characteristics, metal types, and other important details. The purchase price can be below the actual value of the piece, leaving a custom under-insured. At BriteCo, we will increase your coverage to make sure a piece is properly insured.

Diamond Certificate/Report:

Diamonds may be graded by laboratories such as Gemological Institute of America (GIA), International Gemological Institute (IGI), Gemological Science International (GSI), and more. This means that the diamond has been graded by these laboratories with unbiased assessment of a stone’s quality characteristics. This includes the diamond’s shape, carat weight, color, clarity, and more. These documents do not assess the value of the stone, just the quality. Diamond certificates/reports alone are not sufficient documentation for insurance purposes. They should be used to supplement an existing appraisal report.

Documentation Review:

When a policyholder purchases insurance through the direct channel, they will upload an appraisal for each of their items and they will also take a photo for each of their items. Once those have been uploaded to our system, the documents are sent to an underwriter for review. Each item is carefully detailed in our appraisal tool, and the value of the item is verified. Once the risk and documents have been approved, the policy can be issued.

E

Endorsement:

An endorsement is an amendment to an existing insurance contract that changes the terms of the original policy. Endorsements are made to modify coverage in some way. This term can be used interchangeably for changes to the policy, such as updating an address, adding an item, adding protective device credits, etc. It can also be used to denote coverage provisions attached to your policy labeled “endorsement”.

European Gemological Laboratory (EGL):

An independent organization that conducts studies on gems, creates industry resources, and establishes benchmarks for assessing diamond quality. Providing diamond certificates and reports is one of EGL’s primary duties.

Exclusion:

Restriction in your insurance policy that places limits on coverage for specific risks and may eliminate coverage for particular people, places, or types of property.

F

Financial Strength Rating:

(FSR) Expresses an opinion regarding the viability and financial stability of an insurance company. In other words, it’s a review of the insurance company’s financial health and its capacity to settle claims and debts. BriteCo is backed by an AM best A+ rated insurance carrier.

First Notice of Loss (FNOL):

The first notice of loss (FNOL) is the initial report made to an insurance provider following loss, theft, or damage of an insured asset. The first notice of loss (FNOL), also known as the first notification of loss, is normally the first step in the formal claims process lifecycle.

Fraud:

Artifice or deception used to cheat or purposefully mislead. This and material misrepresentation are strongly related concepts. If an insured’s dishonest actions in obtaining insurance are proven, the insurer may refuse to provide coverage and terminate the policy.

G

Gemological Institute of America (GIA):

A free-standing, nonprofit organization that conducts studies on gems, trains gemologists, and establishes benchmarks for assessing diamond quality. Providing diamond certificates and reports is one of GIA’s primary duties.

H

Home Safe:

A strong fireproof cabinet with a complex lock, used for the storage of valuables. To meet BriteCo’s requirement for a home safe endorsement the safe must meet the following criteria:

- A. a burglary safety rating equivalent or better than Underwriters Laboratory Residential Security Container (UL RSC)

- B. is permanently attached to the floor and/or wall; and

- is functional and locked whenever the wearer’s residence is left unattended.

Home Safe Endorsement:

In the insurance application, applicants are asked “When the jewelry is not worn, will it be stored in a home safe?”. If they answer ‘Yes’ to this question, our Home Safe Endorsement will be added to their policy. The insured would have to remain in compliance with this part of the policy in order for coverage to be in effect. Please see the Home Safe definition to see what qualifies as an approved home safe under our policy.

Homeowners Insurance Policy:

A type of property insurance that protects a person financially in the event of a loss or damage to their home, as well as the contents of the home, including furniture and other valuables. In the event of an accident occurring in the home or on the property, homeowners insurance will also cover liability claims.

I

Indemnification:

A common legal rule pertaining to insurance that states that the person receiving coverage under an insurance policy should be returned to roughly the same financial position they were in before their loss. This principle both protects individuals to ensure they are made whole after a claim, while also protecting insurers by ensuring claimants do not receive compensation in excess of a loss.

International Gemological Institute (IGI):

An independent organization that conducts gem studies and grades gemstone qualities in their laboratories. Providing diamond certificates and reports is one of IGI’s primary duties.

Insurable interest:

The interest that a person has in a particular piece of property or another person, such that they would suffer loss if the object or person were harmed. According to insurance law, only things or people in whom you have an insurable interest may be insured.

Insured:

Under our policy, the people that are insured are (1) the policyholder, (2) immediate family members who live in the same household as the policyholder, and (3) the ‘additional insured’, who does not have to live in the same household as the policyholder. You may add one additional insured to your policy at no extra charge.

Insured Limit:

The insured limit on an item is the amount that we will pay up to in order to repair or replace the item. The insured limit on a piece of jewelry should be set to the appraised value of their piece. For watches, the insured limit should be the current market value of the piece. BriteCo will actually cover up to 125% of the insured limit on an item to account for any fluctuations throughout the policy term.

Insurer:

The organization that is responsible for administering a policy and providing the necessary insurance coverage and services.

J

JRQ-Jewelry Replacement/Repair Quote:

This is the quote provided by a jeweler who has been requested to repair or replace an item involved in a claim.

K

L

Lapse:

Quotes and policies can lapse. A lapsed quote is a quote that has expired or is no longer valid. Quotes may lapse automatically after a certain period of time or they can be manually lapsed. A lapsed policy is a policy that is no longer in effect, whether manually or automatically. If a policyholder forgets to renew their policy and it expires, then the policy is lapsed. In these cases, we allow a grace period to reinstate an expired policy. If a policy is canceled during the policy term for whatever reason, the policy would be considered lapsed.

Lab Certificate:

A certification that evaluates the quality of a diamond based on the 4Cs — carat, color, clarity, and cut. Diamond certification is also referred to as diamond grading, and it is highly recommended that you purchase a diamond with a lab certificate.

Liberalization:

If a revision of a form or endorsement that broadens coverage without an additional premium is adopted during the policy period, or within 60 days before the policy is effective, the broadened coverage will apply.

Limit Change:

There are two cases in which the limit for an item on a policy must be adjusted. The first case is when someone purchases a policy for less than the amount the item was appraised for. The second case is for watches when the insured requested insurance for less than the current market value of the watch. All jewelry pieces must be insured for at least their appraised value, and all watches must be insured for at least their current market value.

M

Mitigation:

Efforts made to avoid or minimize the likelihood or expense of a loss.

Material Misrepresentation:

Refers to any omission, falsification, or concealment of information on an applicant’s application or enrollment form.

N

Named perils:

Hazards that are specified, covered, or excluded in an insurance policy.

Negligence:

Failure to exercise the level of care that would be fair under the circumstances. Negligence can be defined as either acting without proper caution or failing to act at all.

Non-admitted Carrier:

An insurance provider that lacks the necessary permits to operate in a given jurisdiction. Such insurers can still write coverage in certain areas through an excess and surplus lines broker who is authorized in that jurisdiction.

O

P

Policyholder:

The policyholder, or primary insured, on a policy is the person whose name the policy is in. Details about a policy can only be discussed with the policyholder themself. If an immediate family member or additional insured inquires about details on a specific policy, although they may be considered insured, we would not be able to disclose that information or allow them to make changes to the policy.

Premium:

The amount of money charged by an insurance company in exchange for coverage.

Preventative Maintenance:

Our policies cover preventative maintenance, which is necessary repair work that would prevent a larger loss. Some examples of this would be: prong retipping; broken, worn or bent prongs; broken earring posts; clasp replacement; restringing of broken or stretched pearl strands; and stone tightening. Preventative maintenance is not the same as maintenance. BriteCo will not cover regular scheduled maintenance that policyholders want to have ‘just in case’.

Producer License:

In order to sell, solicit, or negotiate insurance in the US, an individual must hold a “producer” license. Insurance brokers and agents are both referred to as “producers”. Producers must abide by the different state laws and rules that regulate their operations.

Proof of Loss:

A disclosure that is made about the scope of the claim. This includes:

- Date, time, place and details of the loss

- Other insurance policies or “service plans” that may cover the loss.

- Your interest in the piece (additional insured, relative, etc.)

- Any changes in the titles of the covered property

- A detailed inventory of the lost or damaged items including quantity, description, cost, and actual cash value (ACV)

Property Insurance Credit Score:

A property insurance credit score is not related to your FICO score, and has no impact on your FICO/banking credit. You are notified of our use of property insurance credit score in our notices and disclosures. In the application, you would have to affirm that you read and agreed to those notices and disclosures. The adverse action notice you received should give you more information on what exactly a property insurance credit score is, where you can order a detailed report, and other useful information.

Q

Quote:

A quote is an estimate of the premium a person would pay for insurance coverage based on information provided to an insurance company. You can get a quote on our website by selecting the ‘Check Your Price’ button.

R

Real Time Photo:

After purchasing insurance through the direct channel, a customer will be prompted to upload the appraisal of their item as well as take a real-time photo of their item. They would have to allow BriteCo access to the camera on their smartphone in order to take the photo. We require the photo to be taken of the item directly using our link to prove that it is in their possession and in good condition at the start of coverage. For this reason, we do not allow the photo to be uploaded from your camera roll or saved files.

Referral:

The permission or authorization from your insurance company, which you may need to see a specialist who was suggested.

Reinstatement:

Reinstatement refers to a person’s previously terminated policy being reinstated if the insured individual satisfies the necessary reinstatement criteria. Normally, insurance firms provide policyholders a grace period before a policy expires for late payments.

Replacement Cost Value (RCV):

The actual cost of purchasing a new item or items to replace the damaged or destroyed property.

Representation:

A statement made on an application for insurance that the potential insured swears is true as far as he or she knows. If the insurer signs the insurance contract based on a promise that turns out to be false at the time it was made, the insurer may legally be able to void the contract.

Renewal:

In the context of insurance, renewal refers to the continuation of coverage. For a predetermined amount of time, the policyholder extends their agreement with the insurance provider to keep their present coverage in place. Near the end of the policy’s term, the insurance provider will usually send the policyholder a renewal invitation. BriteCo will offer to renew, if not accepted, the policy will automatically terminate at the end of the current policy period. Failure to pay the required renewal premium when due shall mean that the offer was not accepted.

S

Schedule:

A list of the places or belongings of an insured, such as their laptops, mobile devices, or vehicles. In the case of jewelry insurance, this refers to the valuables you are insuring. Can also be used to describe a list of underlying or primary insurance.

Serial Number:

A serial number is a unique identification number assigned to an item. Serial numbers are commonly used for watches and online retailers. This is different from model or reference numbers because no two items can have the same serial number.

Settlement:

The compensation that an insurance provider offers to a client following a claim and the adjustment of their claim. A settlement signifies the resolution of a claim.

Special Investigative Unit (SIU):

An insurer’s unit or division that is established to investigate suspected insurance fraud.

Subrogation:

When a loss has been paid for, the insured’s rights to seek compensation against the party legally responsible for the loss are assigned to an insurer by the terms of the policy or by law.

T

Terms:

The terms of a policy dictate our financial obligation and relationship to the insured throughout the policy life cycle and through a claim.

U

Underwriter:

Any insurance professional who is charged with deciding whether a specific application is acceptable and establishing the amount, price, and conditions under which the application is admissible.

Underwriting:

Underwriting is the act of reviewing an insurance application. Many factors are considered in the underwriting process.

Underwriting Authority:

Underwriting and policy writing authority given by an insurer. This allows a company to enter into contracts of insurance on behalf of the insurer.

Underwriting Guidelines:

A collection of guidelines and specifications that an insurance company gives to its representatives and underwriters. These rules serve as the underwriter’s guide for deciding whether to accept, modify, or reject a prospective insured.

V

Valuables:

Jewelry items that are insured or that you are looking to get insured.

Source: BriteCo