Colored Gemstones Capture Trade and Consumer Attention

Background

Consumer and trade surveys were completed in the fall of 2020 by colored gemstone jewelry consumers and members of the trade. The consumer survey was completed by 1,011 US respondents. Demographics included: Male 41%, Female 59%; household income greater than $80,000 if married or $50,000 if single; ages 18-65 (with 55% in the 23-40 age range). An additional criterion was that the respondent had spent at least $200 on fine jewelry in the past 3 years. Fine jewelry was defined as: jewelry made with precious metal such as gold, sterling silver, or platinum that may contain diamonds or colored gemstones retailing for $200 or more.

The online trade survey and one-on-one interviews were completed by over 100 U.S. retailers and manufacturers. Only companies that sell mined or mined and man-made precious colored gemstones loose or jewelry completed the survey. For most respondents, mined colored gemstones were over 30% of their business.

FURA Gems, an international gemstone mining and marketing company based in Dubai, UAE was sponsor of this study; however, the sponsor was anonymous to study participants.

Sales Trends and Margins: Gemstones vs Diamonds

Sales have been trending up or the same for the period 2018 to 2019 for retailers and manufacturers in the survey for sapphires, rubies, and emeralds.

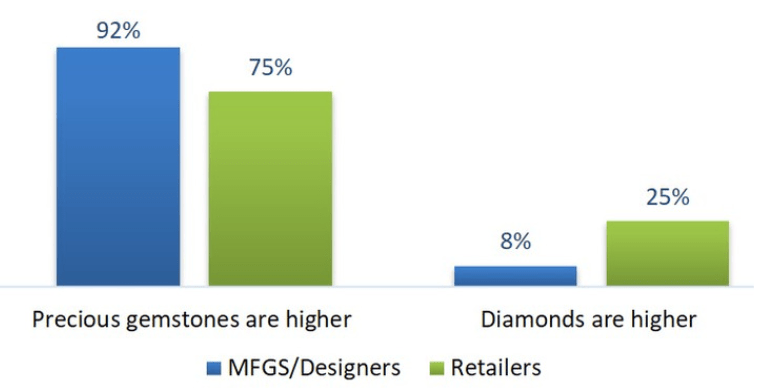

Margins are HIGHER for precious-colored gemstones for 92% of the manufacturers and 75% of the retailers in our study. This has been the trend in the industry for the past 6 to 8 years.

According to our trade respondents, typical margins are:

| Colored gemstones | Diamonds | |

| Manufacturers selling to retailers | 40% | 30% |

| Retailers selling to consumers | 65% | 33% |

Sweet Spot for selling precious colored gemstone jewelry

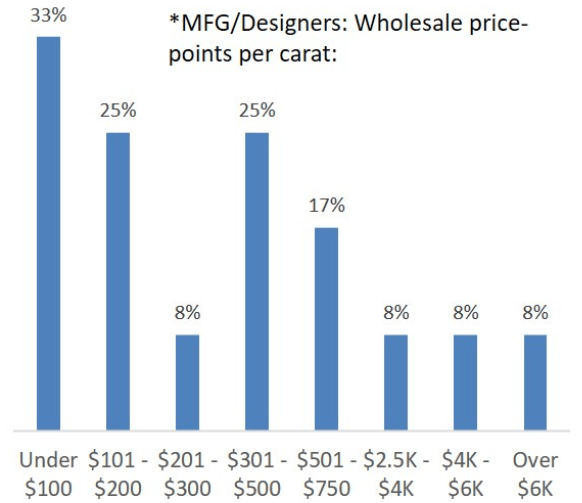

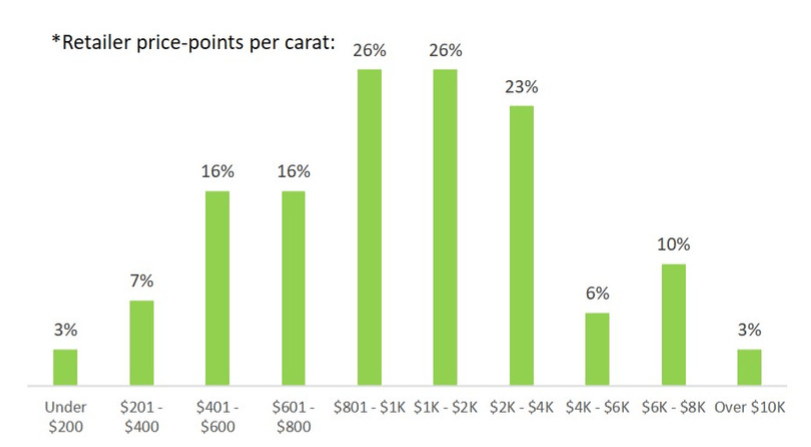

For a third of manufacturers and designers, the sweet spot per carat is under $100.For over half of retailers, the sweet spot per carat in jewelry is between $800 and $2,000.

Sapphire is King for the Consumer

While over 93% of U.S. jewelry consumers Love or Like ALL precious-colored gemstones, sapphires are the most purchased colored gemstone by 46% of consumers followed by ruby (41%) and emerald (41%) then amethyst (35%) in our study.

Forty percent of younger consumers (23-40) chose sapphire as their favorite gemstone closely followed by ruby and emerald with half of this group already having purchased sapphire jewelry.

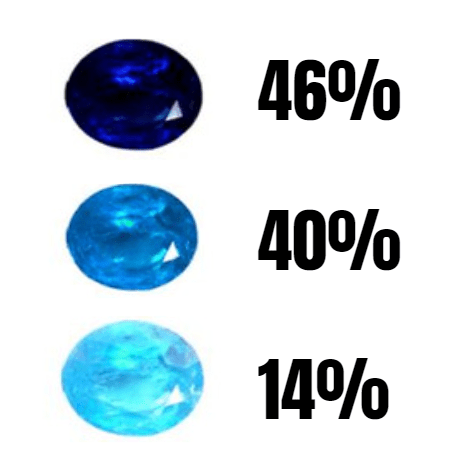

Forty-six percent of the consumers in our study had purchased fine jewelry with sapphire in the past 3 years. Consumers were asked their most preferred shade of blue sapphire. Forty-six percent said the darkest shade shown, followed by medium blue at 40% and light blue at 14%.

Most Common Colors Sold

Blue is the most purchased colored sapphire among consumers and it makes sense that 81% of manufacturers and 97% of retailers in our survey indicated blue was their most sold colored sapphires. Blue may be the first color that comes to mind, but sapphires also comes in a range of colors.

Yellow, green and multi-colored appear to be popular shades with retailers in our survey as well.

Consumers LOVE these Other Sapphire colors

Consumers were shown pictures of multi-colored sapphires called “Parti Sapphires” and were given the description: These multi-colored gems are called Parti Sapphires. They are cut from rare sapphire crystals that have two or more zones of yellow, green and blue.

Seventy-eight percent of consumers love or like these parti-sapphires. Eighteen percent of retailers and 15% of supplier say they sell them already but 64% of retailers and 46% of suppliers don’t know anything about them. While not currently well known by the trade, part-sapphires are of great interest to them.

Consumers were also shown pictures of black sapphires with the description: Black Sapphires are mainly mined in Australia. If the Black Sapphire shows star phenomena, it is called a Black Star Sapphire. Star Sapphires usually have a cabochon cut. Seventy percent of consumers love or like the black sapphires but 83% of manufacturers and 73 % of retailers say there is not much interest in them; black sapphires may suffer from lack of promotion

Consumers were then asked to rate Fancy Sapphires and were given the description: For Sapphires, blue may be the first color that comes to mind, but this gemstone also comes in a range of colors from yellow to bluish green called Fancy Sapphires. The gems shown are all natural-color Fancy Sapphires. Sixty-eight percent of consumers love or like these Fancy sapphires, while 53% of retailers already sell them Yellow is the most important color for 67% of manufacturers and 61% of retailers.

Consumers’ Favorite Shade of Ruby

Nearly half (46%) of consumers prefer dark ruby color while 88% of retailers think customers prefer medium red. Manufacturers also said dark red is more difficult to find and more expensive to source. There appears to be a between what retailers believe and what consumers prefer.

Bridal Trend = Diamonds + Gemstones

Precious gemstone has been creeping into the bridal market ever since Lady Di chose a large blue sapphire for her engagement ring. According to The Wedding Report the interest and acceptance of colored engagement rings has risen from approximately 10% to over 30% in the past 10 years.

Current data shows that retailers have increased their colored gemstone jewelry to 15% of their wedding jewelry website posted product.

Many celebrities, including Jessica Simpson, Elizabeth Hurley, Halle Berry, and Victoria Beckham have embraced non-traditional engagement rings featuring precious colored gemstones. The over 50 age group said engagement rings ‘have to be diamond’ 15% more than younger groups.

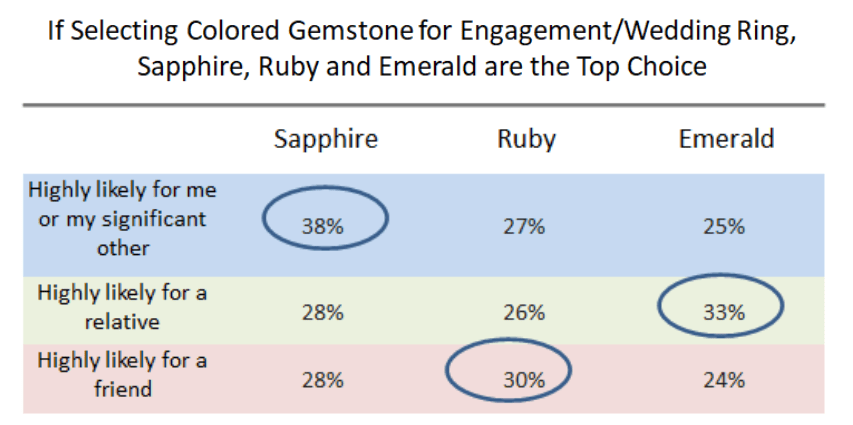

If selecting colored gemstones for an engagement or wedding ring, our consumer respondents selected sapphire as most likely for themselves or their significant other:

Country of origin importance is mixed for Trade

While 79% of consumers say country of origin is very or somewhat important, most manufacturers and retailers are concerned with VALUE but not necessarily country of origin of the gems they buy and sell. Sixty-six percent of the retailers and 50% of the manufacturers said country of origin “doesn’t matter” if the quality and price are acceptable for sapphires and 67% of retailers but only 15% of manufacturers said the same about rubies: it doesn’t matter if the quality and price are good.

Acceptable treatments

Heating appears to be the only acceptable treatment for both groups- manufacturers and retailers for both rubies and sapphires. Diffusion appears acceptable to over half the manufacturers but less than 10% of retailers. Radiation has a similar split between manufacturers and retailers.

Barriers to selling more color

Only about half of retailers say they are doing fine with colored gemstones and about a third say people don’t ask for them while 25% admitted that they don’t advertise them enough.

Forty-five percent of manufacturers blame retailers for not knowing how to sell them and about a quarter admitted that they don’t advertise much and don’t offer co-op support. Both groups appear ripe for leadership and promotion of the color category.

The future looks bright for precious colored gemstones.

This research was conducted during the retail uncertainty of the COVID 19 economy. What we found was a greater interest in not just jewelry but precious colored gemstone jewelry: rubies, emeralds and sapphires. The uniqueness that colored gemstone bring to jewelry was highlighted by consumer comments in the research denoting their search for “that special piece of jewelry,” and “I want to give her a ring that stands out.”

The research confirms how much interest in all sapphire colors especially blue sapphire, and money has been spent on precious color gemstone jewelry, with half of Millennials already purchasing.

Colored gemstone in engagement rings as the center or side stone is of interest across the U.S. by both men and women, with precious color receiving the most attention. The addition of colored gemstones has brought “life,” to retailers’ engagement ring display cases to quote a consumer from Chicago.

Consumers told us in this survey that the idea of, the look and the color of, the new Fancy and Parti sapphires that they have never seen before is exciting and they want to see more. The colors and brief origin stories that came with the questions about these sapphires quickly piqued the respondents’ interest. With the acceptance of these new sapphires by consumers and the fact that they are not available as lab-produced, may drive retailers to seek out jewelry suppliers who produce them.

Through targeted educational and sales training for precious color that retailers, manufacturers, and wholesalers all said that they want could be the key to keeping the sales growth going for all colored gemstones.

In the research, retailers and supplier both confirmed what has been evolving for a while: precious colored gemstone jewelry category is a higher margin category than diamond jewelry. Many retailers also stated that they should be spending more time and resources on promoting color and they plan to do so in 2021.

With continued high margins and new colored gemstones coming to market, retailers will happily give their customers what they are looking for — more colorful options.

Source: MVI Marketing