Gold Outlook for 2023

The global economy is at an inflection point after being hit by various shocks over the past year. The biggest was induced by central banks as they stepped up their aggressive fight against inflation.

Going forward, this interplay between inflation and central bank intervention will be key in determining the outlook for 2023 and gold’s performance.

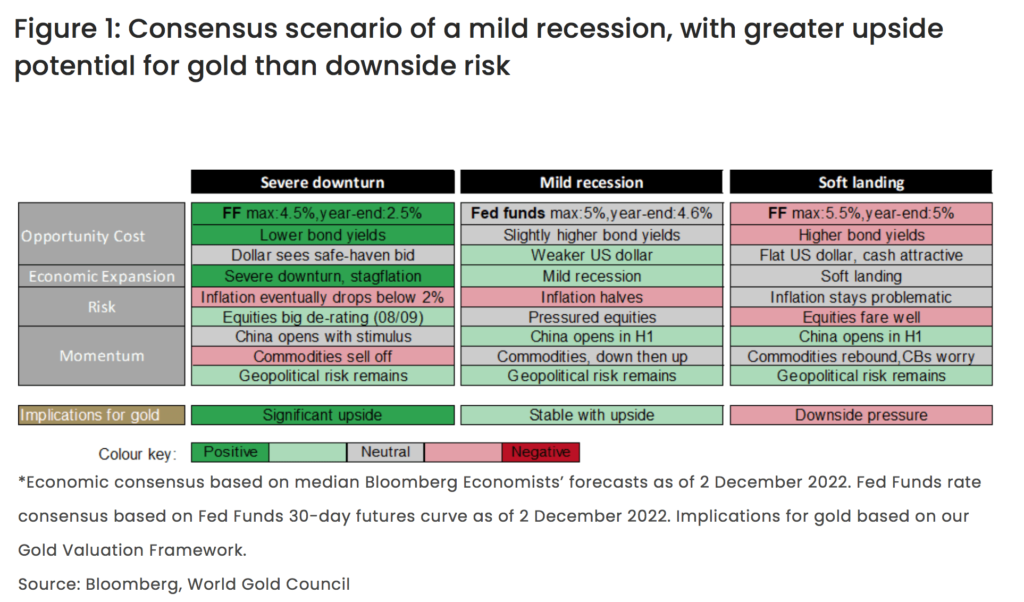

Economic consensus calls for weaker global growth akin to a short, possibly localized recession; falling – yet elevated – inflation; and the end of rate hikes in most developed markets. In this environment, which carries both headwinds and tailwinds for gold, our key takeaways are:

- A mild recession and weaker earnings have historically been gold-positive

- Further weakening of the dollar as inflation recedes could provide support for gold

- Geopolitical flare-ups should continue to make gold a valuable tail-risk hedge

- Chinese economic growth should improve next year, boosting consumer gold demand

- Long-term bond yields are likely to remain high but at levels that have not hampered gold historically

- Pressure on commodities due to a slowing economy is likely to provide headwinds to gold in H1

On balance, this mixed set of influences implies a stable but positive performance for gold (Figure 1).

That said, there is an unusually high level of uncertainty surrounding consensus expectations for 2023. For example, central banks tightening more than is necessary could result in a more severe and widespread downturn. Equally, central banks abruptly reversing course – halting or reversing hikes before inflation is controlled – could leave the global economy teetering close to stagflation. Gold has historically responded positively to these environments.

On the flip side, a less likely ‘soft landing’ that avoids recession could be detrimental to gold and benefit-risk assets.

Bumpy Road Ahead

Economic growth: short, sharp pain

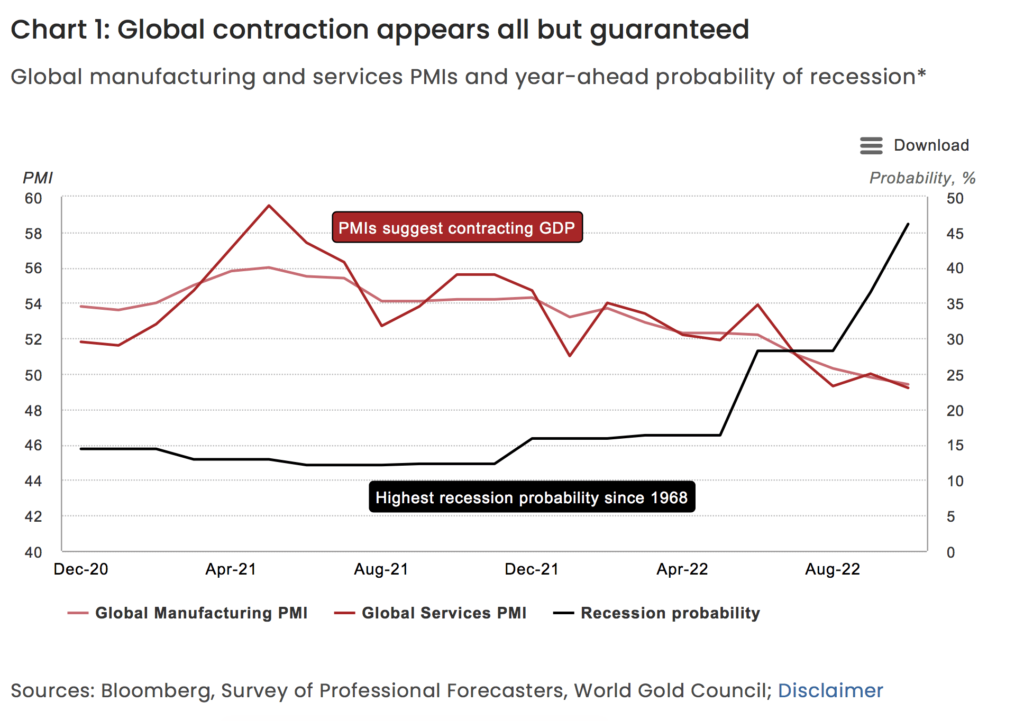

There are now many signs of weakening output due to central banks’ speed and aggressiveness in hiking moves. Global purchasing manager indices (PMI), now in contraction territory, indicate a deepening downturn across geographies, and economists are warning of a material recession risk (Chart 1).

Consensus forecasts now expect global GDP to rise by just 2.1% next year. Excluding the global financial crisis and COVID-19, this would mark the slowest pace of global growth in four decades and meet the IMF’s previous definition of a global recession – i.e., growth below 2.5%.

Policy and inflation: higher for longer

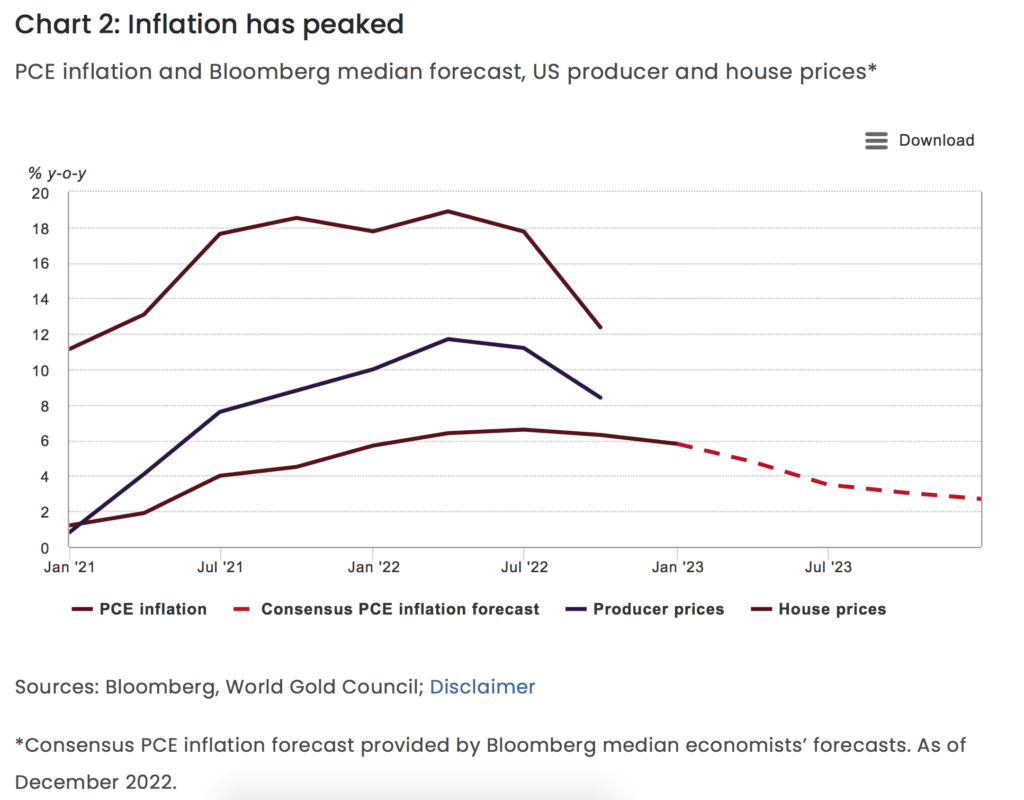

It is almost inevitable that inflation will drop next year as further declines in commodity prices and base effects drag down energy and food inflation. Furthermore, leading inflation indicators tell a consistent moderation story (Chart 2).

This brings us to the implications for monetary policy. The policy trade-off for nearly every central bank is now particularly challenging as the prospect of slower growth collides with elevated, albeit declining, inflation.

No central bank will want to lose its grip on inflationary expectations, resulting in a strong bias toward inflation fighting overgrowth preservation. As a result, we expect monetary policy to remain tight until at least mid-year.

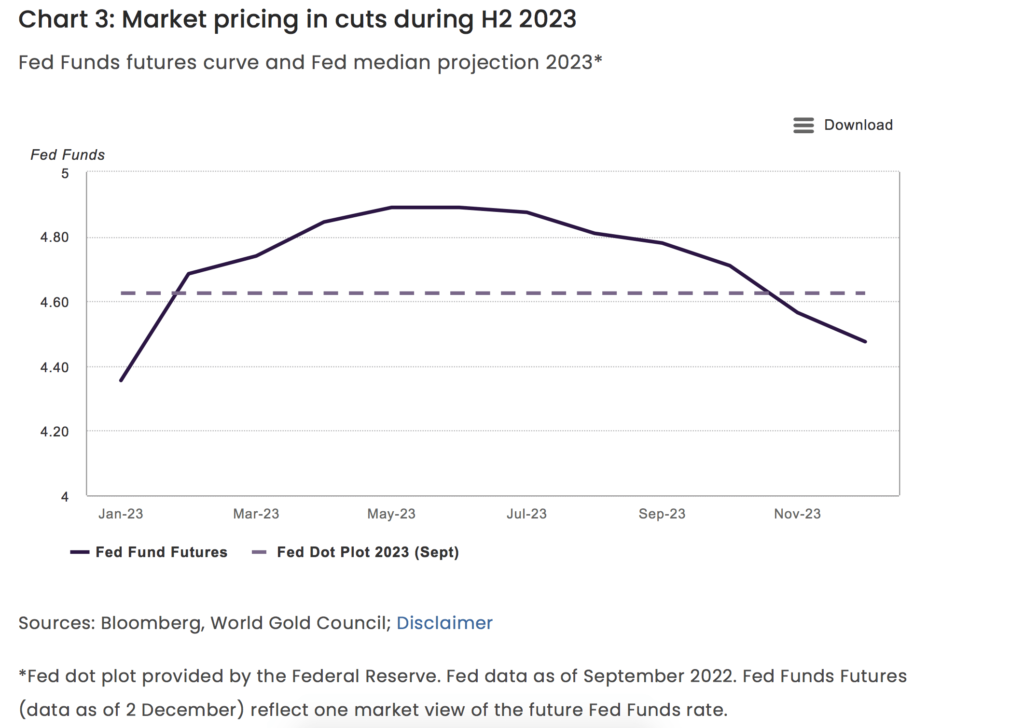

In the US, markets expect the Fed to start cutting rates in the second half of 2023 (Chart 3). Elsewhere, markets expect policy rates to decrease more slowly than in the US, but by 2024, most major central banks are expected to be in easing mode.

Macroeconomic Implications for Gold

Gold is both a consumer good and an investible asset. As such, our analysis shows that four key factors and their interactions drive its performance:

- Economic expansion – positive for consumption

- Risk and uncertainty — positive for investment

- Opportunity cost – negative for investment

- Momentum – contingent on price and positioning.

These factors, in turn, are influenced by key economic variables such as GDP, inflation, interest rates, the US dollar, and the behavior of competing financial assets.

Recession: portfolio ballast

A challenging combination of reduced but still elevated inflation and softening growth demands vigilance from investors. The likelihood of a recession in significant markets threatens to extend the poor performance of equities and corporate bonds seen in 2022.

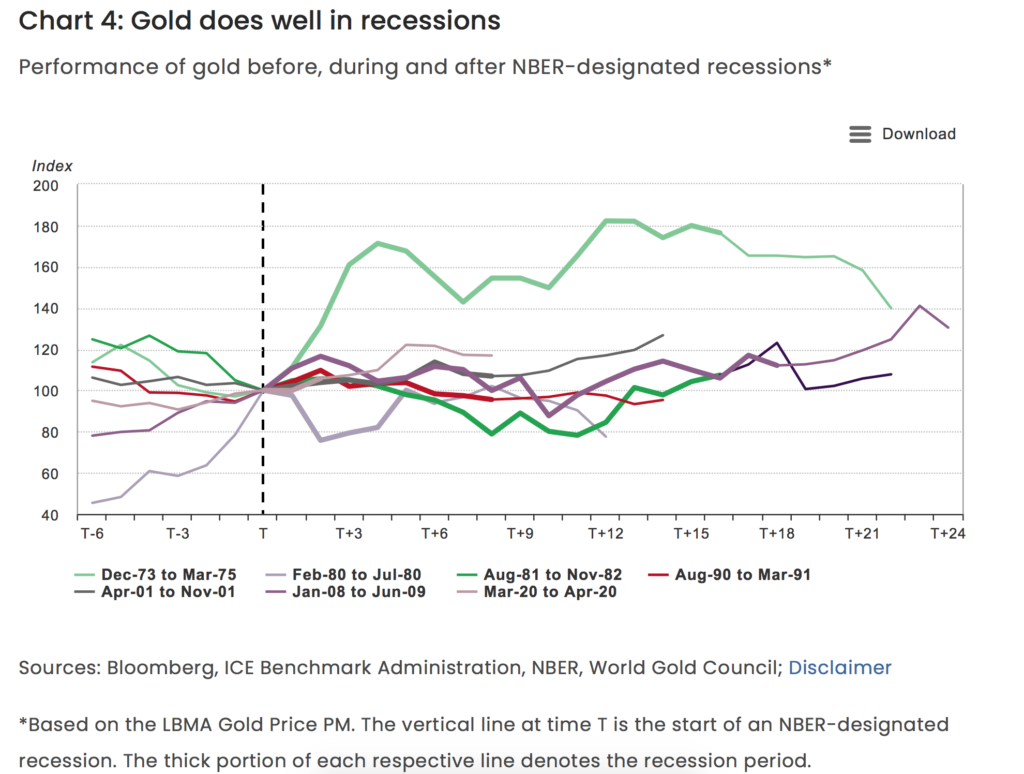

Gold, on the other hand, could provide protection as it typically fares well during recessions, delivering positive returns in five out of the last seven recessions (Chart 4). Furthermore, a recession is not a prerequisite for gold to perform. A sharp retrenchment in growth is sufficient for gold to do well, mainly if inflation is also high or rising.

Inflation: disinflation ahead

While inflation may indeed come down next year, several important considerations impact the gold market.

First, central bankers have inflation targets, and while a lower inflation rate is necessary, it is insufficient for central bankers to withdraw their hawkish policies. Inflation needs to get to target or below for that to happen. In our opinion, this raises the risk of an overshoot.

Second, our analysis suggests that the retail investor segment appears to care more about inflation than institutional investors, given lower access to inflation hedges. They also care about the price level. Even with zero inflation in 2023, prices will remain high and are likely to impact decision-making at the household level.

Lastly, institutional investors often assess their level of inflation protection. Through the lens of actual yields. These rose over the course of 2022, creating headwinds for gold.

In 2023, we could see some reversal of the dynamics at play in 2022, which were high retail investment demand but weak institutional demand. Indeed, any sign of yields moving down could encourage more institutional interest in gold. On balance, however, lower inflation should mean potentially diminished interest in gold from an inflation-hedging perspective.

Source: World Gold Council