MVI Research on Young Consumers & Lab Grown Diamonds

Lab-Grown Diamonds and the Next Gen Consumer

The power behind lab-grown diamond consumption, is the 20- to 35-year-old Millennial and Gen Z consumers. They are embracing each other and embracing lab-grown diamonds as the symbol of their love. All diamond categories are interesting to them – engagement, wedding, and fashion jewelry. Ownership is up from 10% of survey respondents in 2020 to 15% in 2022

The goal of this 2022 study was to understand current consumer awareness and ownership of the LGD category, product preferences, purchasing drivers, and how country of origin and sustainability claims impact purchasing among younger consumers and their plans for fine jewelry purchases in 2022. For the current research, 754 U.S. consumers were studied in February 2022. Respondent demographics include 59% female and 41% male, aged 20-35, with HHI greater than $50,000, or a student in college, graduate, or trade school. To show growth comparisons, we referenced our lab-grown diamond benchmark study conducted in August 2020 of 1,027 U.S. consumers.

Awareness & Ownership

A decade ago, less than 10% of jewelry consumers had even heard of lab-grown diamonds. Today, 72% of survey respondents have heard about LGDs.

In 2020 when we asked about ownership, 10% responded that they currently own LGDs, and in 2022 the number of LGD owners grew to 15%. Breaking this down by gender, men more than women have seen LGDs in a physical store (32% vs 22%).

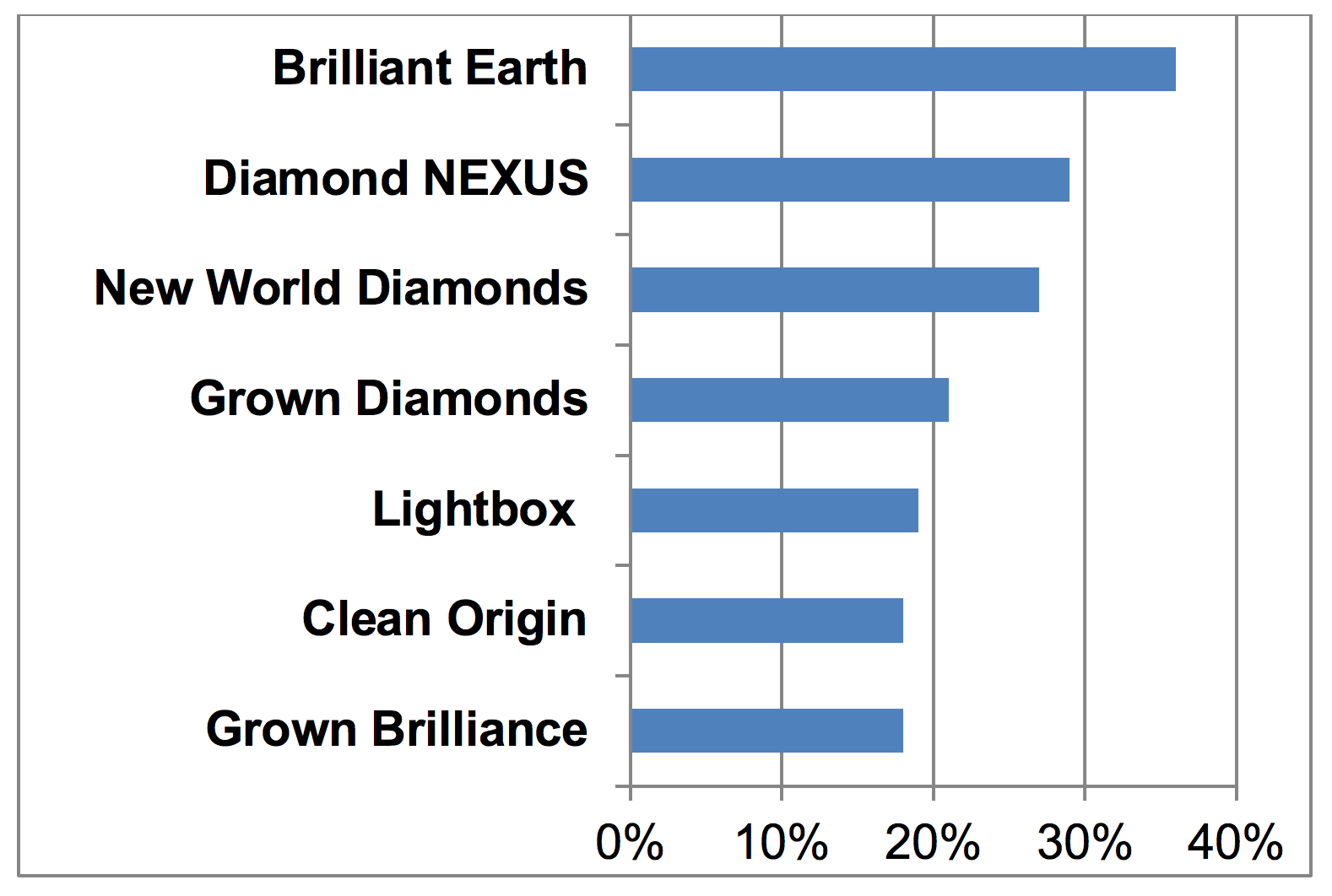

Forty-three percent of respondents recognized our list of 17 LGD brands as specifically being LGD brands, when asked “Did you know these brands were LGD brands?” The highest recognized brand was Brilliant Earth in both 2020 (36% of respondents) and 2022 (31% of respondents). Second most recognized LGD brand was Diamond NEXUS at 29% in 2022 (it was 23% in 2020). New World Diamonds came in third most recognized brands in 2022 at 27% (not on 2020 list). Grown Diamonds was 4th at 21% (not on 2020 list). Lightbox was 5th at 19% (24% in 2020). Clean Origin came in at 18% (19% in 2020) and Grown Brilliance tied at 18% (not on 2020 list).

Fifty-one percent of respondents in this survey said they have seen LGDs in person either because they or someone they know owns LGD (25%), or they saw it in a physical store (26%). Men (32%) more than women (22%) said they have seen LGDs in a physical store; while more women than men say they have never personally seen a LGD (men 33%, women 41%).

Purchasing Drivers and Preferences

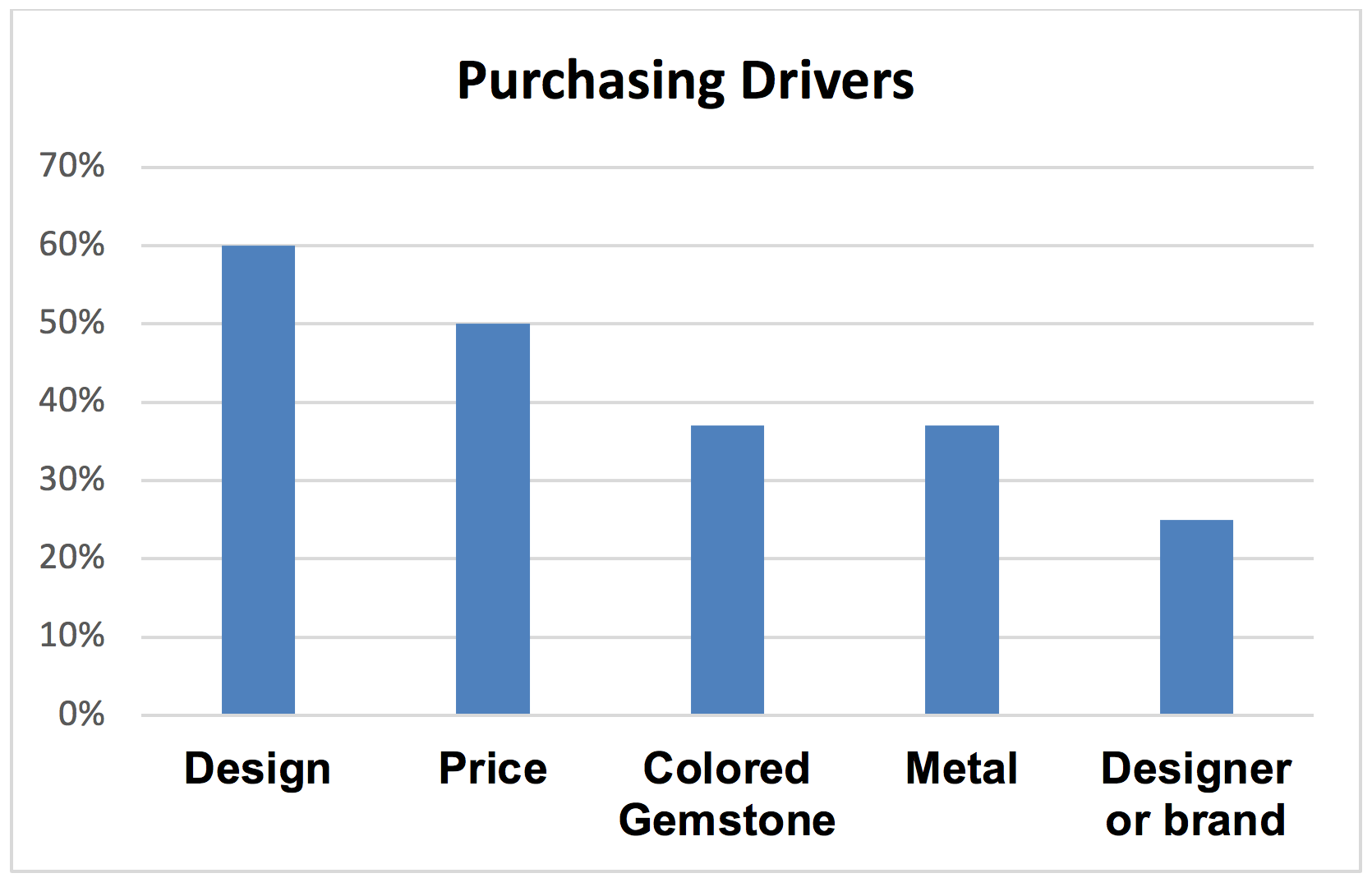

It’s no surprise that design (60%) and price (50%) are at the top of the list of drivers for what aspects affect their decision the most when buying or requesting fine jewelry for themselves or others (when asked for their top 3). The colored gemstone and the metal it’s made with tied at 37%, followed by designer or brand at 25%.

LGDs win out for this group of respondents! When asked what they would choose, given the price versus size versus quality equation previously explained to them (i.e. most LGDs sell for at least 25% less than a similar mined diamond or a buyer can get about a 25% larger diamond for the same price as a similar mined diamond) 44% said they would purchase an LGD, 32% said a mined diamond and 22% said “not sure.” Men and women were very similar on the percentage choosing LGD, but more women were “unsure”: 29%, versus men at 18% and more men would choose mined (36%) versus women (29%).

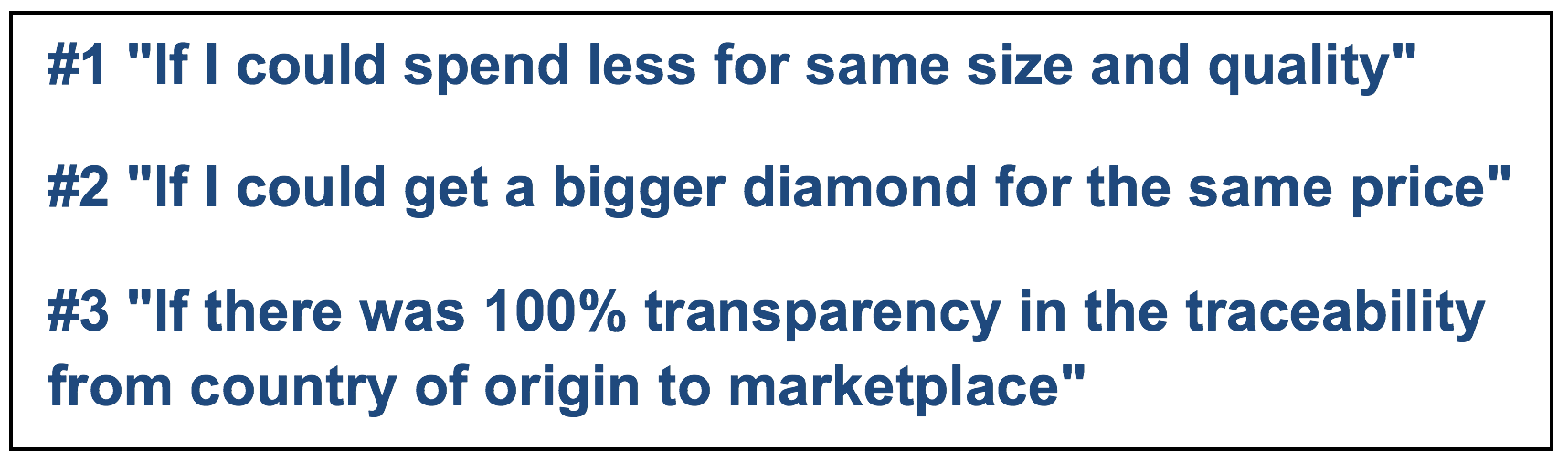

When asked to rank the situations that would lead the respondent to purchase an LGD over a mined diamond, “If I could spend less for the same size and quality” statement ranked #1, and “If I could get a bigger diamond for the same price” ranked #2 and “If there was 100% transparency in the traceability from country of origin to marketplace” ranked #3.

Next, when asked for what occasions the respondent would choose LGD jewelry, “fashion pieces (necklaces, bracelet, earrings, rings)” ranked #1 overall, followed by “gift for myself” #2, and “gift for others” being the #3 occasion that survey respondents would choose LGD. Men deviated slightly from the overall ranking in choosing gift for others as their #1 pick, fashion pieces #2, and gift for self as #3. Women ranked fashion pieces #1, gift for self #2, and engagement ring #3.

Sustainability and Country of Origin

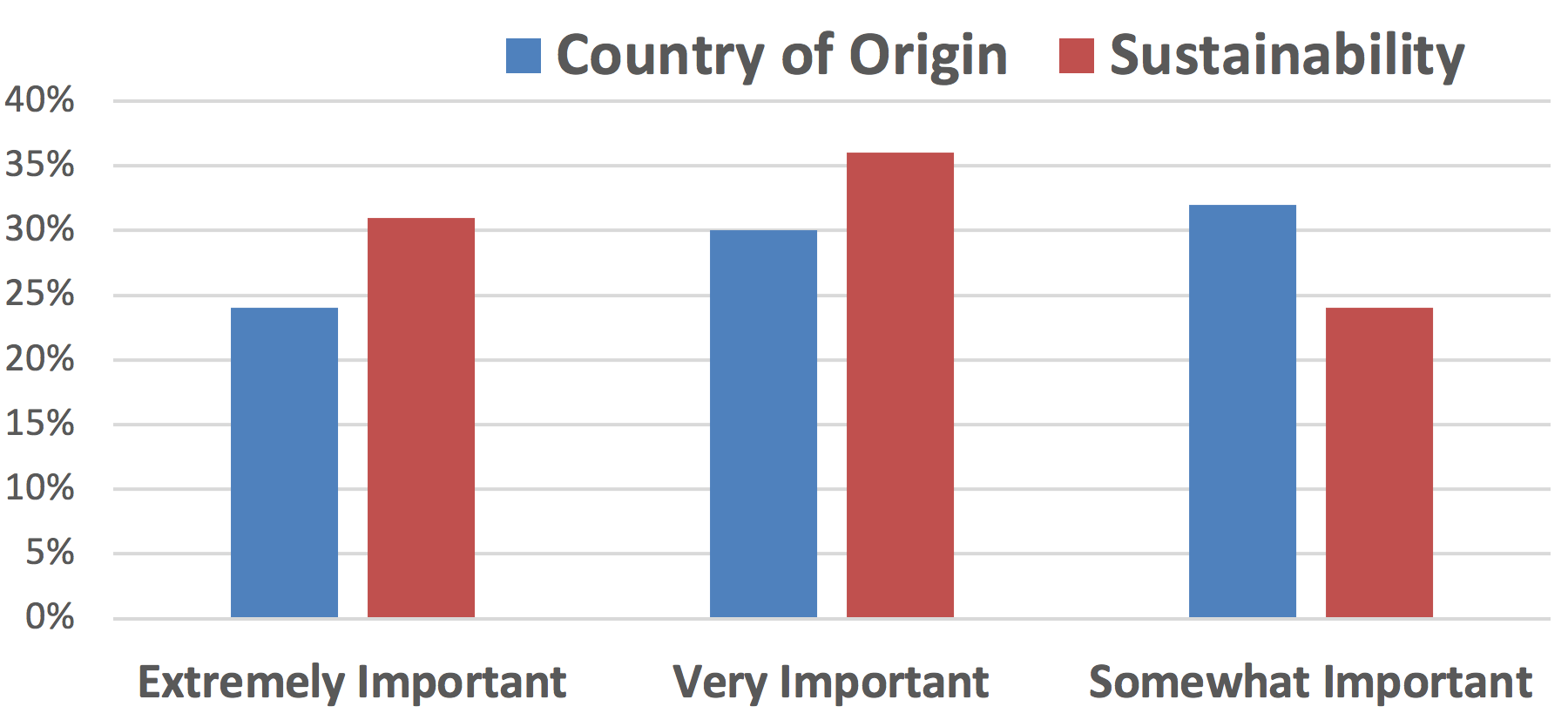

When asked about the importance of sustainability and country of origin knowledge when buying fine jewelry, 54% of study respondents believe knowing country of origin of the colored gemstones, pearls, or diamonds they buy or request is extremely or very important. Similarly, 68% of respondents believe it is extremely or very important to know the jewelry they buy was produced using sustainable and responsible manufacturing practices. Interestingly, respondents (both men and women) focus on a humane work environment (33%) to define what responsible jewelry-making means to them, followed by low environmental impact (26%).

The gender breakdown was interesting in that men ranked these concerns as more important than women. On the sustainable and responsible manufacturing practices issue, 36% of men said “extremely important”, versus 27% of women. On the country of origin question, 61% of men said “extremely or very important”, versus 50% for women with these rankings.

Furthermore, all but 11% of respondents would pay some premium for fine jewelry that was produced with minimal environmental or social impact: 21% would pay 1-4% more, 33% would pay a 5-9% premium, 24% would pay a premium of 10-15%, and 10% would pay 16% and up more.

Traceability of components (diamonds, colored gemstones, metal, pearls) back to the country of origin was similarly important. Twenty-two percent would pay 1-4%, 28% would pay a premium of 5-9%, 23% would pay a premium of 10-15% and 13% would pay a premium of 16%+ to know for certain the jewelry component’s country of origin.

Spending Habits

When asked their normal budget for diamond jewelry (excluding an engagement ring), 39% said between $200 and $1,000, while 25% said between $1,001 and $2,000, and 22% said over $2,000.

And get ready for 2022….. as 20% of respondents said they plan to spend more on fine jewelry (an average of 26% more) in 2022 versus 2021, while almost half (49%) said they plan to spend about the same as in 2021. Only 10% said less (an average of 35% less) than in 2021. Interestingly, men and women are opposite on thinking they will spend more or less, with men thinking more 24% of the time and women saying more 17% of the time. Women (12%) on the other hand, say they will spend less versus 9% of the men.

Source: MVI Marketing LLC, THEMVEYE.com